Should you use an external advisor to help raise funds for your startup? This is one of the most heavily debated topics amongst founders and VCs, and for good reasons.

On the one hand, founders are expected to own the fundraising process and cut costs rather than spending $$$ on professional services - and in many cases, getting burnt by so-called "advisors" who oversell their networks or straightforward abuse their trust.

On the other hand, founders cannot be expected to do everything themselves. Wouldn't that time be better spent building product and growing your business? After all, VCs themselves pay for intros to their LPs…

I'm Jonathan Hollis from Mountside Ventures and I've spent the last 10 years raising $300M+ for startups. In this post, I want to give you the playbook for working with a fundraising advisor: is it a good idea for you, how to pick the right one, and what you should expect?

Table of Contents

I. Why founders choose to work with a fundraising advisor

1. Closing the power imbalance with investors

There is an inherent imbalance of knowledge between founders and investors.

Between them, it’s likely that partners at the investment firm will have entered into 100+ deals, whereas the founder will have made 1, 2 or a couple more if they’re lucky. Not only does this mean that there may be a lack of understanding of the key investment terms, but there will also be a lack of awareness of whether the terms are market standard.

Founders should also be wary if investors dissuade them from using experienced advisors to review their ‘market’ terms — their interests are not aligned!

2. Benefiting from the support late-stage founders receive

It is more widely accepted that later-stage founders should benefit from working with advisors (or brokers), than those at the pre-seed or seed stage.

This makes little sense — anyone with experience working with founders will agree that the earlier the stage of the founder, the more guidance they need across all aspects of the raise. Sadly, this view is due to the plethora of low-quality advisor options (and a minority of ‘self-serving investors’ - see power imbalance above.) If the majority of early-stage advisors are suspect, it makes sense that generic advice is to dissuade founders from using one, reinforcing the mantra of some investors that ‘founders should do everything themselves’ (Terrible advice).

3. Comparing it with the alternative

Founders could consider comparing it with paying a significant amount upfront to a Finance Director, CFO or equivalent internally. However, it’s hard to find someone who has cultivated investor relationships for the profile of your business, a finger on the pulse on what is market standard, experience in building financial models that pass investors’ due diligence, and experience running a fundraising process.

4. Getting investor access from day 1

There is a diversity problem in venture. Take female founders, for example, approximately a third of founders are women, yet funding only goes to 1%. This is partly due to a large part of the market investing in their primary or secondary network. Therefore, warm intros from introducers are solving a key problem to level the playing field.

There are other considerations when thinking about leveraging an advisor’s VC access:

- People often change jobs — most junior VCs move on average every 3 years. If you’re not maintaining your network, it soon goes out of date.

- VC strategies change every 2 to 3 years — even if you have built trusted relationships, many VCs will change their thesis as future funds are raised.

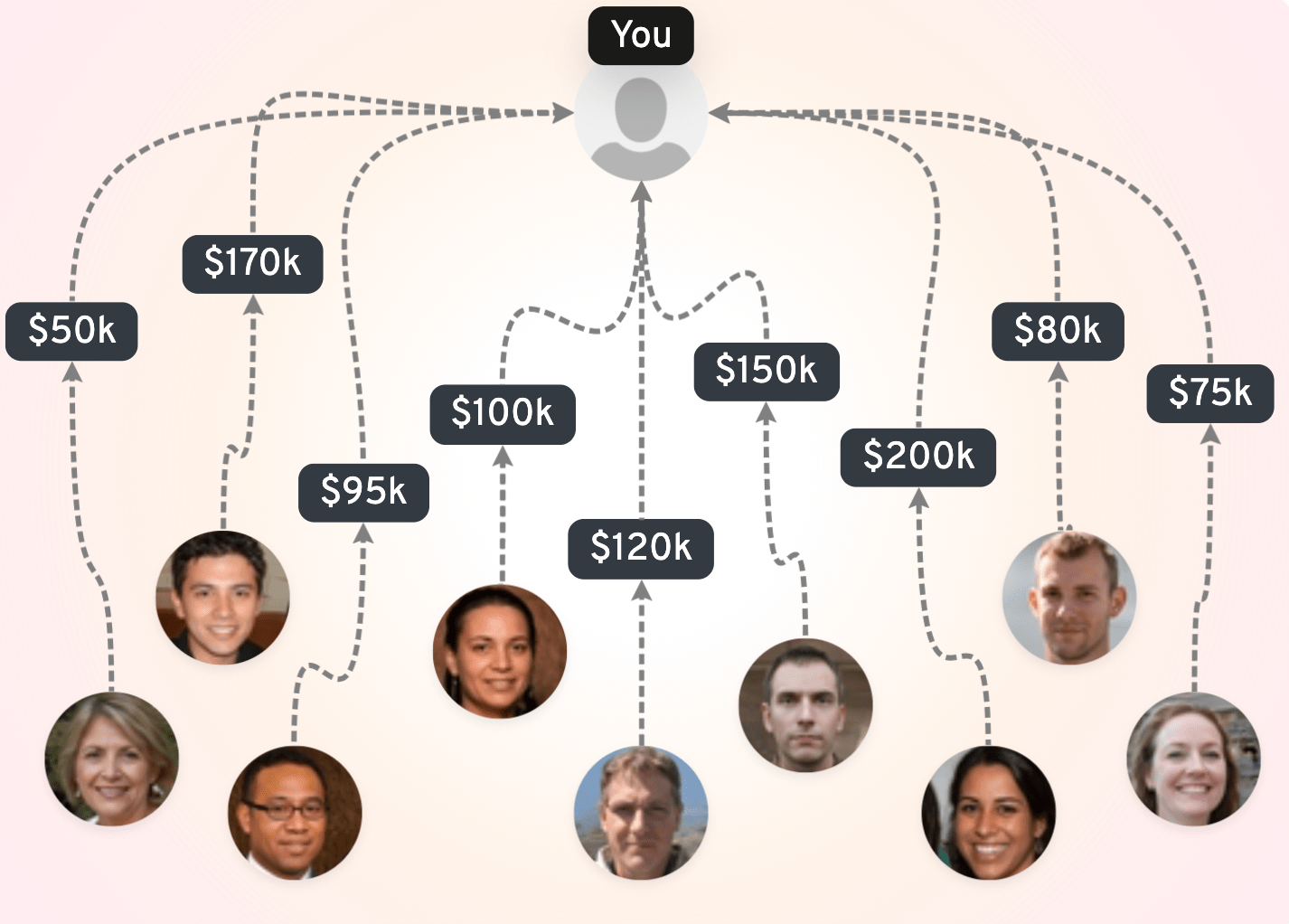

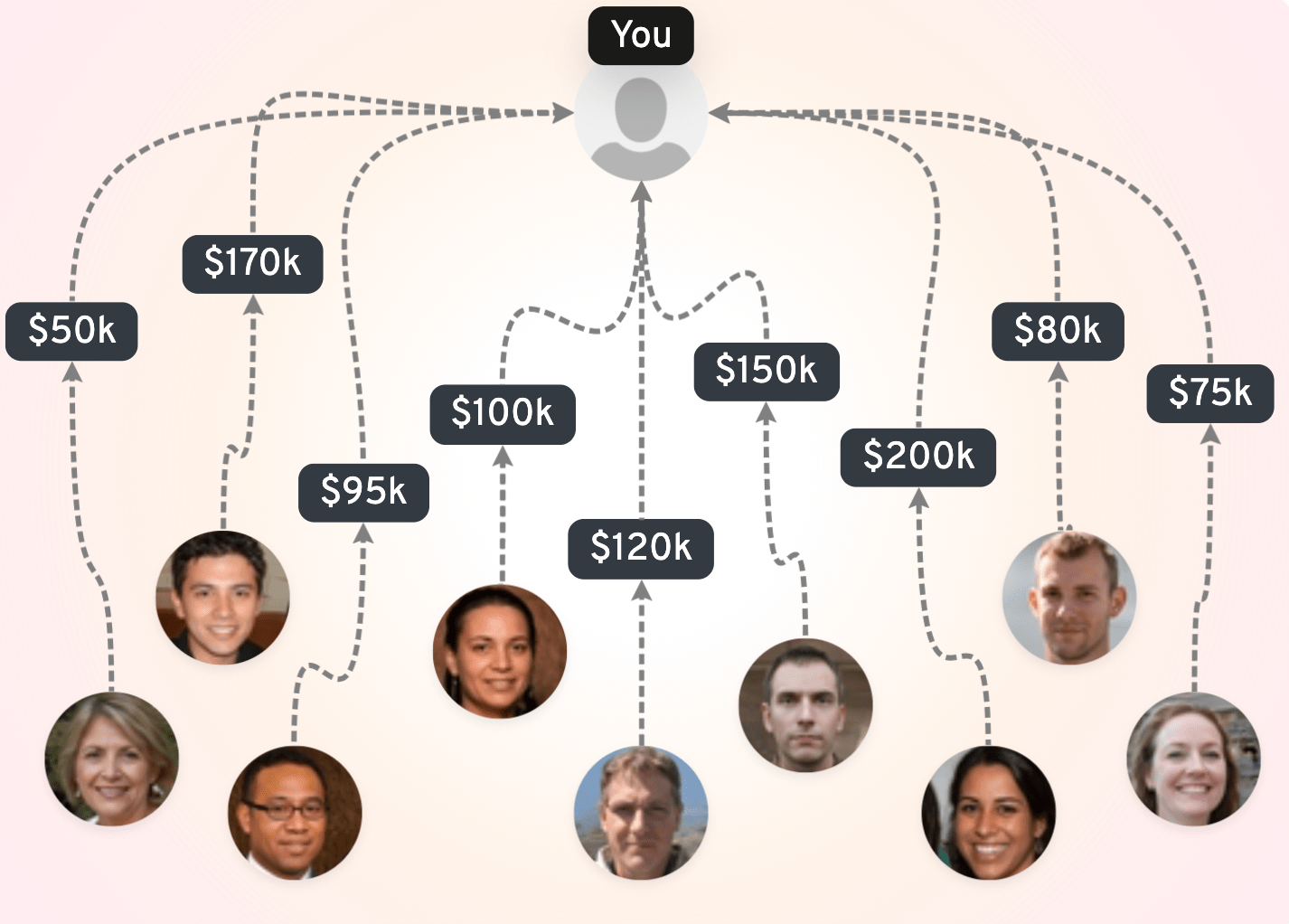

- Cold emails can work, but the average reply rate is 5%. There are plenty of investor lists online which can be used to build an ideal investor target list, but according to the British Business Bank, warm introductions are 13 times more likely to reach IC than cold outreach.

- Building VC relationships has a one-time use for most founders. As a founder, you may end up working with only one or two of the 100 investors you might approach, many of whom you find out are not relevant, after taking the first meeting.

- Family offices have no public profiles, so an introducer may have spent decades building trusted relationships.

It amuses me when investors warn founders never to pay for an intro because almost all VCs (I don’t use ‘all’ lightly) pay for introductions themselves. I know this, because I receive dozens of requests each day from VCs wanting to pay us for introductions to our investor network. I imagine this is because we introduce VCs to prospective investors at our conferences and workshops. We do not charge for these and we are not placement agents. We run these initiatives in order to build stronger investor relationships at all levels, and better support the founders we work with.

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started

II. How to choose a fundraising advisor

1. Filter fundraising advisor by track record

Review the advisor’s deals page to ensure they have completed multiple recent transactions in a similar space and stage. For example, if you are a UK B2B company raising your Series A, make sure that any advisor you work with has completed at least a dozen transactions in the past in this sector.

Your fundraising advisor doesn’t have a deal page and/or is unwilling to share recent transactions completed in the last 6 months? Move on to the next one.

2. Confirm they are regulated in your geography

Founders should ensure any advisor they instruct is regulated. In the UK, the FCA exists to protect founders (and consumers) against harmful advice and ensure strict ethical standards. The penalties are severe - an unlimited fine and up to two years imprisonment! In the US, the SEC is there to protect that community, and the penalties and enforcement mechanisms are even more severe(!)

There are two regulated activities:

- Investor introductions — when introducing a company to an equity investor, if the advisors’ fee is dependent on the transaction completing, the introduction is regulated. (Note: this is not relevant for family or friends as there is no commercial relationship)

- Investment advice — advising a company on the merits of investment terms, where the advice goes further than ‘’generic guidance’ and is payable, is a regulated activity.

The way to think about it is that if you pay someone to help you with a transaction, then that person needs to ensure they have your best interest at heart, and to ensure they have the appropriate experience and ethical standards to be advising you on the transaction. This is becoming especially important in an industry with so many charlatans.

3. Reflect on your interaction with the fundraising advisor

So you just got off the phone with a potential fundraising advisor for your startup.

Have they taken the time to understand your business? Have you challenged them on the spot to name the top 10 investors that would be relevant for your company, and when was the last time their team interacted with them? Do you feel confident they will dedicate sufficient time to maximizing your success?

4. Clarify the scope of work, milestones, and deliverables

Be clear in what is expected on both sides, how long the process is likely to take and what support you will receive once offers are in.

Advisors should NOT be involved in founder-investor meetings so if they expect to sit in the first few meetings, that should be an instant red flag. Nor should they use automated email campaigns to pepper hundreds of investors, which will do a disservice to your raise.

The number of automated emails I get from randoms claiming to be ‘representing a company’ spamming my inbox makes me sad for the founders.

5. Pay attention to their business model

Are they taking an upfront payment, or deferring their fee until close?

Some founders prefer the alignment of working with an advisor who shares in their success. If that’s the case, you will be paying a fee out of the investment and I recommend you gross up the ask at the outset to ensure you are unaffected on a net basis.

Be careful of the incentives of advisors who take an equity position - they may run the risk of negotiating against themselves when advising you on valuation and terms if they are benefiting from more investor-friendly terms.

Personally, I want to work only with best-in-class founders, and they are more reluctant to pay anything upfront (hustlers at heart!) and I also like being aligned with their success.

6. Consider the value:cost multiple

It’s difficult to quantify an average marginal value provided when supporting an entrepreneur’s raise by comparing the time, expense and terms they would have had without an advisor. However, you can ask for specific examples of recent value-add and compare it against the fee.

For example, recently our support led to a value:cost multiple of 15x based on an increase in valuation of 30%, without factoring in any of the other improvements in terms and time efficiency. Note — this assumes a cost to the founder of 1% of the final valuation, based on an incoming 20% stake and a deferred fee of 5% of the investment amount

7. Negotiate the payment terms and conditions

It is likely that deferred fees paid upon a successful raise will be greater than an upfront fee paid for the equivalent work. This is because there is a premium for a process that can take up to 9 months for working at risk. If founders pay a retainer or hefty upfront fee, any success fee should be significantly reduced.

It may also be that the total fee paid is higher for higher amounts raised. This question shouldn’t only be asked to advisors, but is especially relevant for VCs themselves, who take an uncapped 2% a year of the total fund size from their investors. Does their sourcing and diligence work increase materially if they invest £5m instead of £2m? What about £100m?

Fee percentages, rightly or wrongly, are a function of the industry. You can address this by ensuring that the advisor lowers the success fee for larger raises to reduce the total amount paid and ensure it continues to be reasonable for the value gained and the risk taken.

8. Check their founder + investor references

The best way of assessing value is through testimonials and feedback from other founders.

Before committing to a fundraising advisor, reach out to a few founders they've worked with on Linkedin and ask how their experience was. Yes, it's a bit of work, but that's the best way to get direct, unbiased insights about the fundraising advisor.

Similarly, ask multiple investors in your network their opinion of the advisor before engaging to ensure they are credible in the market. Investors will be quick to tell you whether a particular advisor will send a positive or a negative signal, which will be a function of their credibility in the market, and the strength of their relationship.

Advisors with positive signals select a highly curated list of companies to work with and take them to market only once they are happy attributing their brand to the company, and have spent time building strong relationships with the investor community

Working with an advisor who is not well respected, which may be due to a poor track record, negative founder references or charging hefty upfront fees, will send a negative signal, and therefore harm your chances of fundraising.

III. How to find a fundraising advisor

When choosing a fundraising advisor, knowing where to look is just as important as understanding the qualities to seek. Advisors can bring valuable networks, insights, and industry expertise that help refine your fundraising strategy and connect you with the right investors. However, finding someone with the right experience and fit for your startup’s needs can be challenging.

Here are some of the most effective ways to meet startup fundraising advisors.

Platforms like Upwork offer a wide range of experienced advisors who can help with fundraising, from pitch preparation to investor outreach. Startups can filter candidates by experience, hourly rate, and expertise, making it easy to find someone who aligns with specific needs and budgets. Be sure to review profiles, client feedback, and ratings to choose a reputable advisor.

Startup Communities and Networking Events

Many fundraising advisors connect with early-stage companies through startup hubs and communities. Events like Startup Grind, Web Summit, or even local incubators often feature seasoned advisors looking for promising startups to mentor. Attend these events to meet potential advisors face-to-face, or join online communities like Indie Hackers or Slack groups focused on startup growth, where advisors may offer insights and connect with founders.

Referrals from Fellow Founders

Other startup founders can be a valuable source of trusted advisor recommendations. If a founder in your network has worked with a fundraising advisor and seen positive results, ask for an introduction. Advisors with proven success are more likely to come recommended by peers in your industry, increasing your chances of finding the right match.

LinkedIn and Professional Networks

LinkedIn is a powerful tool for finding fundraising advisors with relevant industry experience. Search for advisors with backgrounds in venture capital or specific experience raising funds for startups. Use keywords like “fundraising advisor” or “startup advisor” and filter by industry or location. Don’t hesitate to reach out directly—many advisors are open to exploratory conversations about their approach and expertise.

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started

IV. When not to work with a fundraising advisor

While a fundraising advisor can provide valuable expertise and connections, there are times when you might not need one.

1. You're a top-performing portfolio company of a top-tier operational VC

That's if your company has been invested by a branded ‘top-tier’ or ‘operational’ VC with significant follow-on capital, a well-resourced portfolio team dedicated to future fundraisers and is performing within the top 20% of their portfolio. There are about 10 VCs in Europe with the resources to do your next raise justice, which means c. 40 founders are in this fortunate position each year.

Be mindful that incentives may not be aligned between existing investors and their views on incoming investors. They will have their own objectives on board compositions, investor consents and exit strategy.

2. Your CEO is a repeat founder with fundraising experience

Your CEO is a second or third-time founder who has gone through a fundraising journey in a similar industry and stage. Mistakes will have been learnt, and trusted relationships already developed.

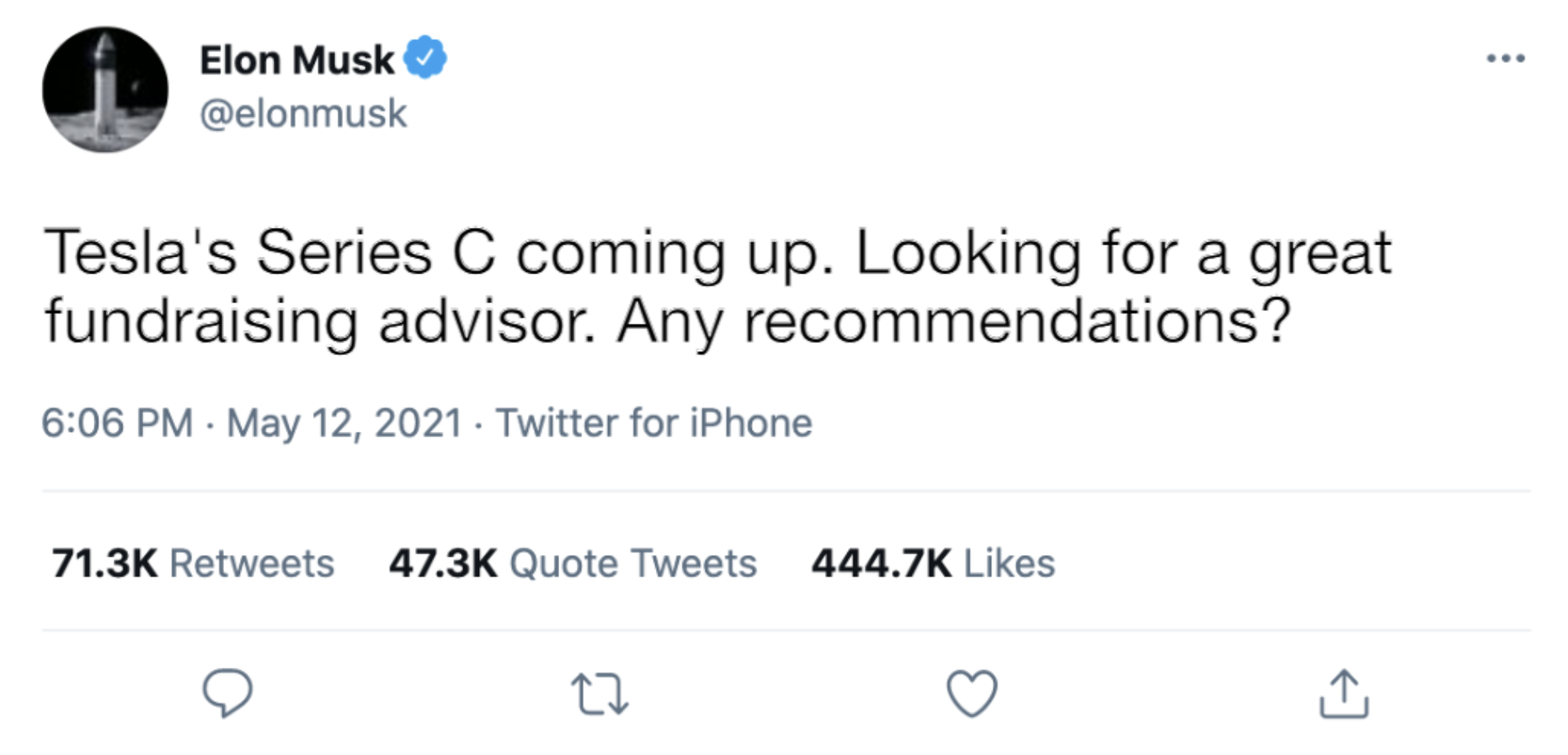

Put it another way, the tweet below probably never happened.

3. Your board can (seriously) take care of fundraising

There is an all-star board of directors with significant fundraising experience who are happy to commit at least 3 months to open up their (relevant) network, dive into your fundraising materials and can leverage other recent similar deals they’ve been involved in to understand market term sheets.

At the early stage, this is rare.

4. You're raising from US investors only

For companies raising exclusively from US investors, external advisors may be less impactful for earlier rounds of funding given that the market is much more mature; investors are more likely to be ex-entrepreneurs themselves, thereby investing with their gut rather than placing as much reliance on fundraising materials like a 5-year financial model, and well-crafted cold investor emails tend to receive much higher conversion rates.

Conclusion: work with a great one - or nobody

It should be clear now that fundraising advisors are not a one-size-fits-all situation.

Founders are responsible for fundraising, but should not be expected to do everything themselves. Companies that are built to last are built as a team, and the best founders have the highest opportunity cost of dedicating six months away from sales and becoming professional fundraisers.

Working with a reputable and regulated external advisor with a successful track record can improve the chances of raising with preferential terms, and reduce the overall time spent on fundraising.

About the author

Jonathan Hollis is the Managing Partner of Mountside Ventures, a fundraising advisory firm that partners with founders raising their next round of funding (Series A and B, equity and debt raises) as well as Limited Partners and Family Offices to identify the next generation of VCs.

Jonathan can be contacted at [email protected].

Find ideal VCs for your startup today 🚀