"What is my startup valuation?"

Founders ask us this question all the time at OpenVC!

This guide will answer your questions about startup valuation. In a few minutes, you will be able to determine a valuation that makes sense for you and your future investors.

- Part 0 gives you the key answers you want on valuation & round size

- Part I gives you key definitions and the right mindset to approach valuations

- Part II gives you the step-by-step method to value your startup

- Part III gives you 18 benchmarks to adjust your valuation

- Part IV gives you 9 advanced valuation methods just for fun

Ready? Let's do it! 💪

Table of Contents

0. Key answers on valuation and round size

No time for a long post? Just check out the two graphs below.

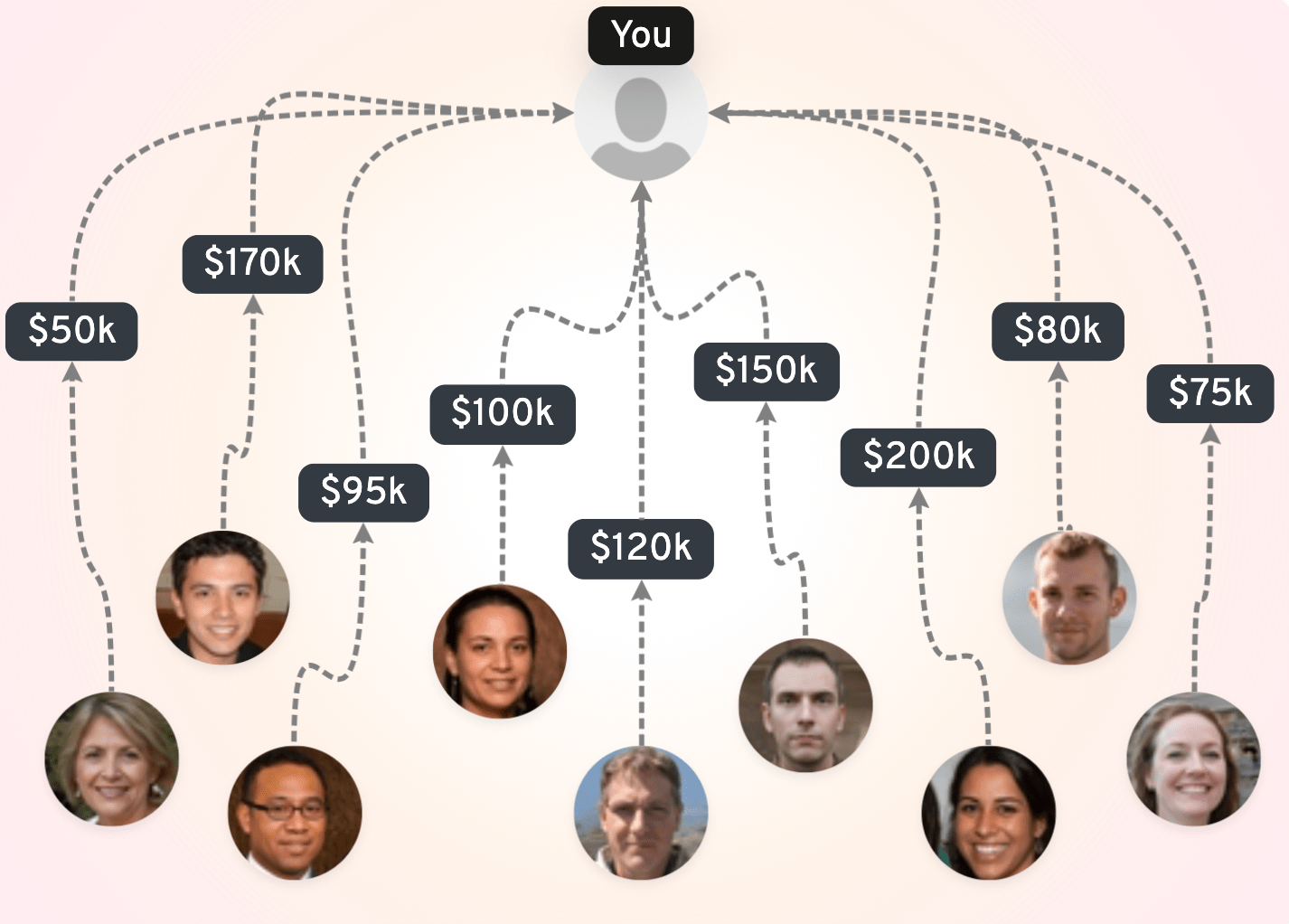

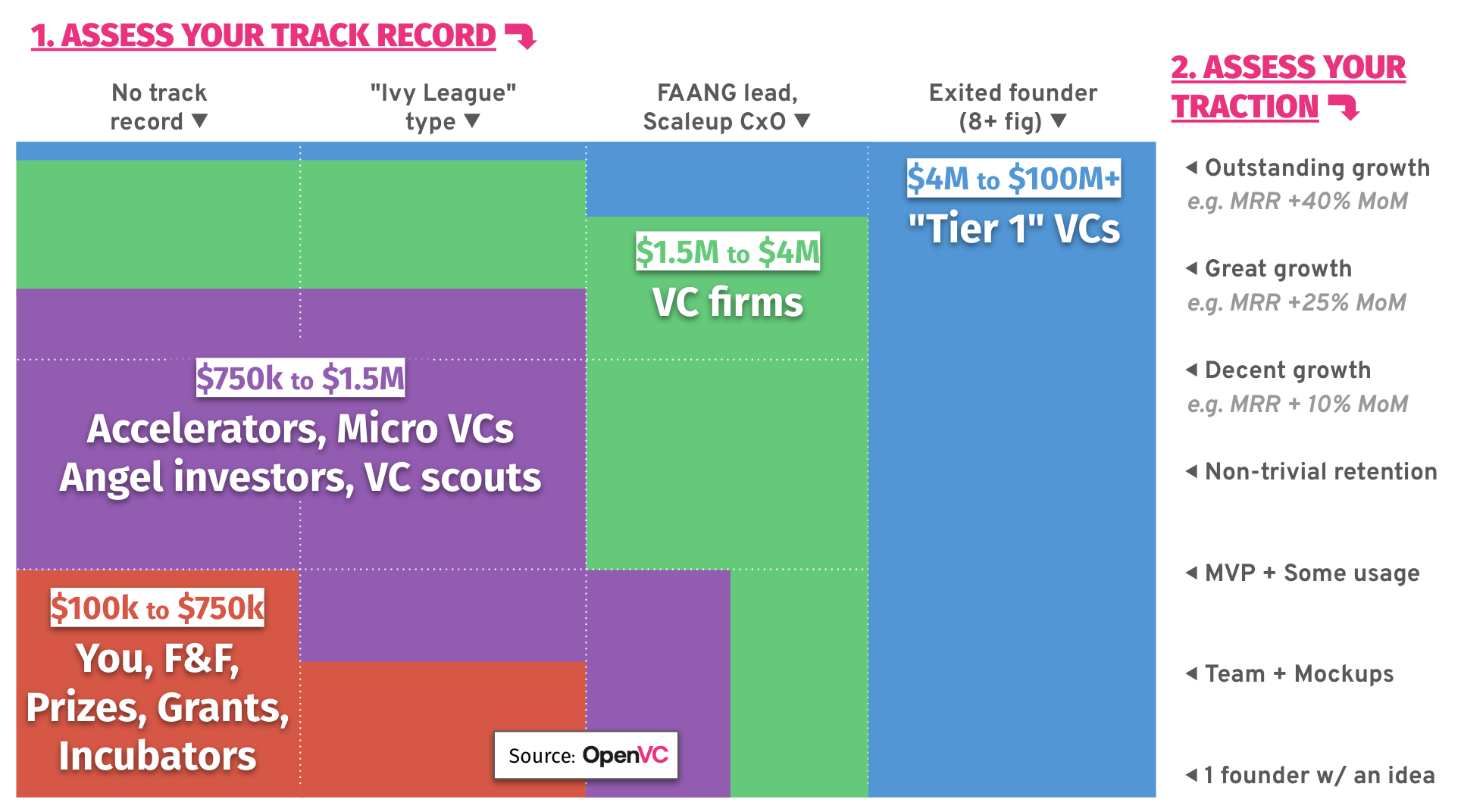

First, here's how much you can raise and from whom based on your track record and traction.

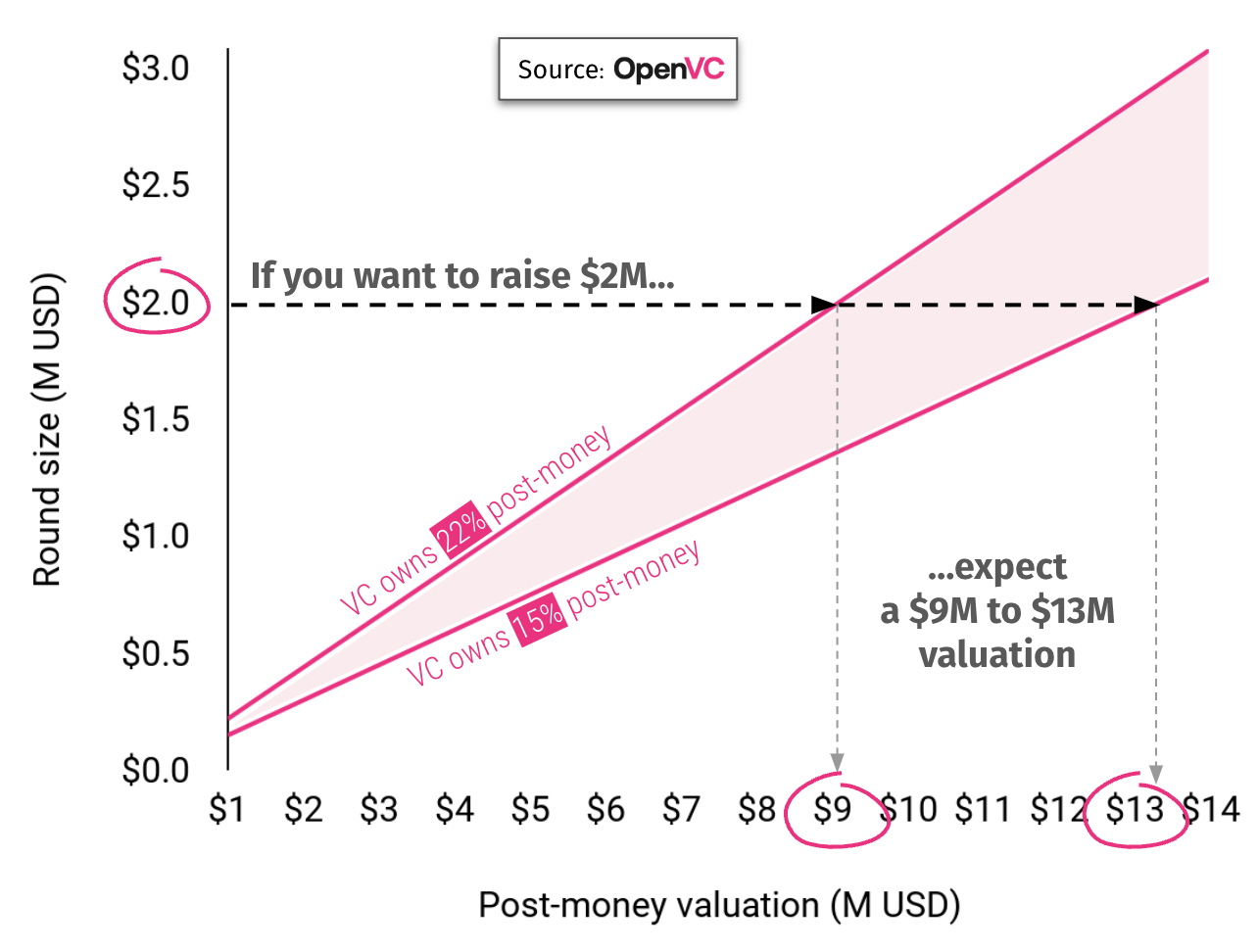

Second, here's how you can determine your valuation based on how much you want to raise and how much equity you're giving away.

Now, if you want to dive deeper into startup valuation, keep on reading. 😊

I. The basics of startup valuation

1. Startup valuation for dummies

A startup is like a box. A very special box.

The box has a value. The more things you put in the box, the more its value increases. Add a patent in the box, the value increases. Add a kick-ass management team in the box, the value increases. Easy, right?

The box is also magic. When you put $1 inside, it will return you $2, $3, or even $10! Amazing!

However, building such a box is risky and expensive. So you need to go and see people with money — let’s call them investors — and offer them a deal that sounds a bit like this:

“Give me $X to build a box, and you'll get Y% of it in return”

How do you define define the value of the box when it hasn't been built yet? That's what we're going to see right now.

2. Some definitions

Yes, it's boring, but let's define a few concepts first:

- Valuation: It's the dollar value of your startup based on the most recent investment terms.

- Round size: It's the amount of investment your company receive at a given round (seed, Series A, etc). For example, a seed round may be $2M.

- Pre-money valuation: It's the value of your company right before the investment.

- Post-money valuation: It's the value of your company right after the investment - basically the pre-money valuation + the investment amount.

- Ownership target: That's how much investors want to own of your company. Typically, seed investors want to own 20% of your company.

Keep in mind that startup valuations are paper money. You're only worth $X because an investor agreed to pay a given price per share. You could be a billionaire on paper, and the company would still be worth zero in the real world (example here).

Those numbers only make sense in a long-term vision where equity appreciates all the way to an exit - acquisition or IPO.

3. Don't obsess over valuation

Unexperienced founders sometimes obsess over valuation.

Some founders try to go for the highest possible number. They feel that valuation is the sum of all their hard work, efforts, and vision. If the company ends up being worth billions, then they want to "take" as much as possible.

This is the wrong way to think about it. The real risk is not a low valuation, but no fundraise at all. What matters in the short-term is raising funds at standard terms so you can get back to building and growing your business ASAP.

What's more, if you get a super high valuation, you may be unable to deliver, then have to take a down round, and eventually lose your business. Not fun.

On the other hand, some founders feel they could just "lower the price" to get more investors on board. But valuations don't really matter at early-stage. If investors like your business, they will invest at a reasonable valuation for everyone involved. If they don't, they won't invest no matter the price. You have to convince first, and discuss valuation second.

By the way, at early-stage, it is common to raise with SAFE notes (in the US) or their local equivalent (e.g. BSA Air in France). These financial instruments allow founders and investors to determine the valuation at the next round, therefore postponing that discussion until you have enough data points.

Watch out for the terms!

Valuation doesn't matter as much as the terms of the round. Liquidation preferences, voting rights, board seats... Make sure you get fair terms, be it a SAFE round or a priced round.

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now

II. Define your startup valuation in 5 steps

1. Determine how much you need to raise

First, let's determine how much you need to raise.

In a perfect world, you would just raise funds once, reach profitability, and never raise again. This is what Y Combinator recommends and that's ideal: less dilution, less defocus.

However, multiple funding rounds may be necessary, especially if you're building a business that is capital intensive (hardware, biotech...) or that requires scale (marketplace, social media...). In that case, you will engage in the typical 18-month fundraising cycle:

- Raise an angel round ($100k to $750k), grow for 18 months

- Raise pre-seed ($750k to $1.5M), grow for 18 months

- Raise seed (1.5M to $4M), grow for 18 months

- Raise Series A ($4M to $10M), grow for 18 months

-

Rinse & repeat (B, C, D...) until you get acquired or IPO

What's really important to understand: there are typical milestones at each stage.

For example, a SaaS company is expected to have at least $1M in ARR and grow at least 2x year-over-year to raise a Series A. Failure to hit those milestones will make it difficult to raise the next round, which could be a death sentence for your company.

Therefore, if you're raising a seed round, you should raise enough money to make sure you hit Series A milestones in the next 12 to 18 months.

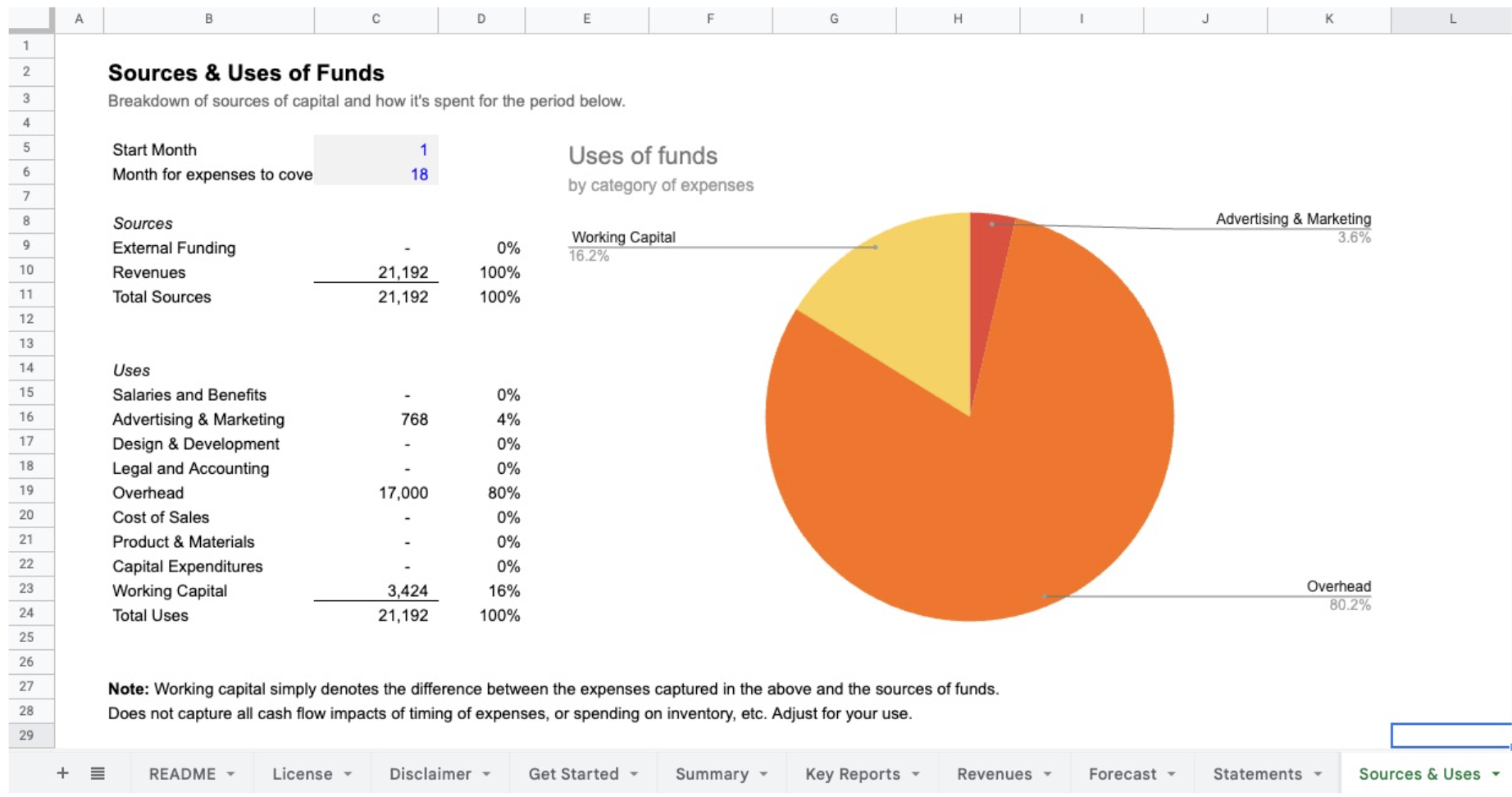

So open up a spreadsheet, define your revenue and growth target, and work backwards from there to budget the resources you need for the next 18 months. You may need a financial model for that.

Let's say you need $1.5M to hit your Series A milestones. Add an extra 30% of burn, just to be safe. That's $1.95M in investment amount. Round it up to $2M for simplicity.

That's it. That's your round size: $2M.

2. Calculate your post-money valuation

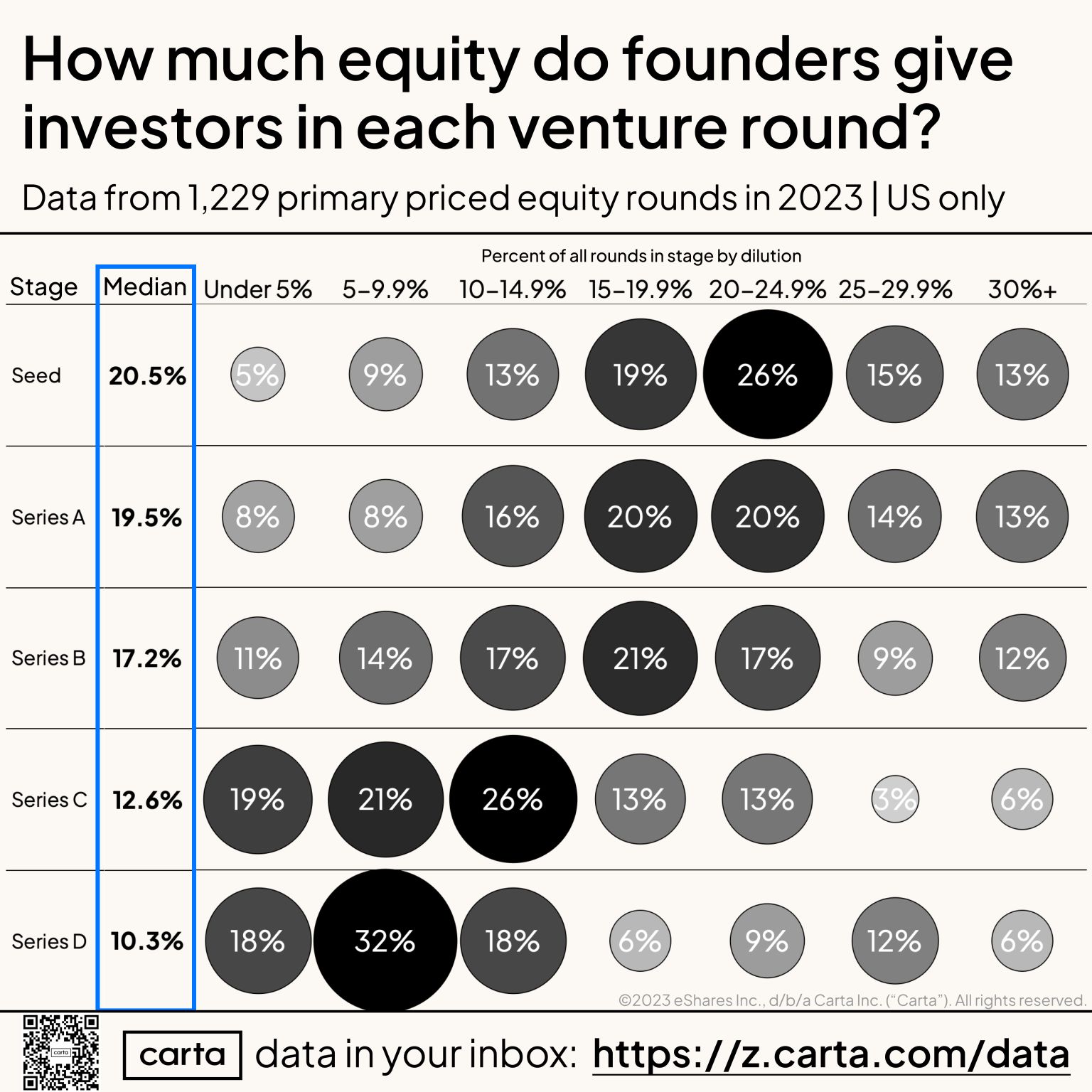

Professional investors have "ownership targets". At seed round, they want to own around 20% of your company in order to have enough upside if you're a winner.

That's an important information and we can use that to determine your valuation:

Post-money valuation = Round size / Ownership target

Since you're raising $2M, you need to be valued at $10M so the investor hits their ownership target of 20%.

Ownership target varies based on stage and investor. Here's a breakdown for the US, courtesy of the good people at Carta:

This approach might feel "fake" because we are not looking at the actual value of the company. Yet, that's how it's done in the real world.

3. Calculate your pre-money valuation

There are actually two types of valuation: pre-money and post-money.

"Pre-money" means "before the investment". "Post-money" means "after the investment".

Indeed, after the investment, the company has received cash from the investor, so its value has increased from the same amount. Therefore:

Post-money valuation = Pre-money valuation + Round size

⇣

Pre-money valuation = Post-money valuation - Round size

In our example, you raised $2M (round size) at $10M (post-money valuation). So your pre-money valuation is $8M. Easy peasy.

As a general rule, when discussing valuation with investors, always specify "$10M pre" or "$10M post" so there is no confusion on either side.

NB: Please note that this is a simplified scenario. We didn't take into accounts factors like pre-existing notes and/or an employee stock option pool, which are both fairly common. More on this soon.

4. Control your valuation against founder ownership

You should always make sure that you retain enough ownership in your company.

It is widely admitted that the founders should collectively own at least 50% of the company after Series A, hence they should own at least 70% of the company after seed - and preferably more.

It's not just about greed. Anything under that and you have a "broken cap table" that makes you un-investable for future rounds.

Do a quick sanity check and make sure that your chosen valuation leaves you with enough ownership.

What if I don't have enough ownership?

In that case, you can play with a few levers: lower the round size, increase the valuation, postpone the raise, and/or renegotiate ownership with existing investors.

Indeed, if an existing investor bought 50% of your company for $200k, well, you screwed up. But it's not great for them either because the company is dead in the water. So it would be in everyone's interest to reach a sensible agreement.

5. Adjust your valuation with comparables

Finally, look at the market and adjust your valuation accordingly.

If you're a marketplace startup in the UK, find similar startups that have raised recently and compare their valuation to yours. Ideally, compare their key metrics against yours - do you have higher GMV? Stronger growth? Better margins? Use this information to adjust and defend your valuation when negotiating with investors.

Obviously, this information is hard to come by. That's why we listed a bunch of valuation comparables and benchmark in the next section. You're welcome! 😇

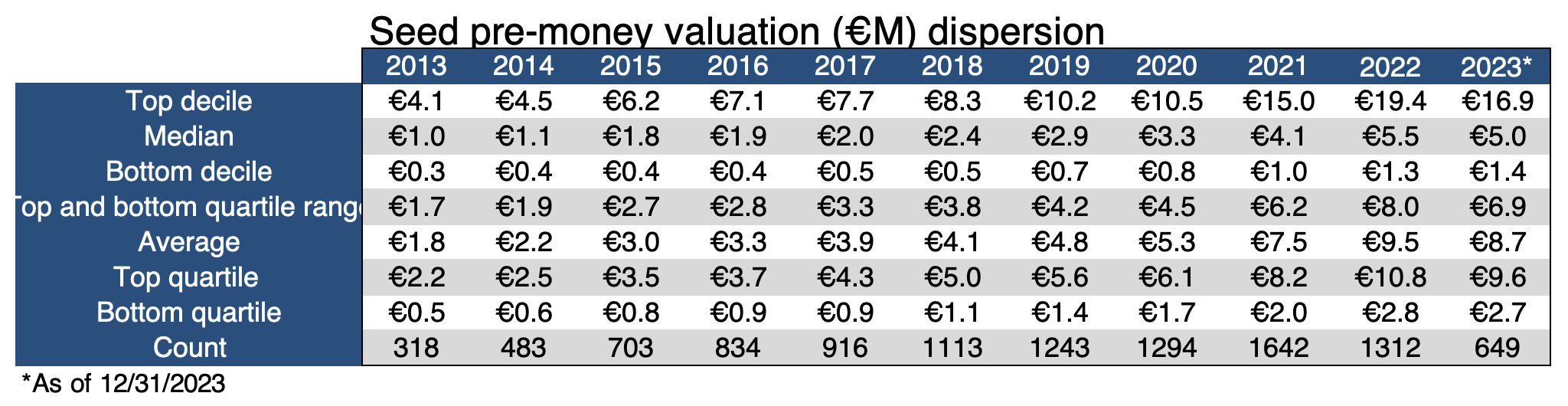

III. Benchmarks for startup valuations

Finding comparables for startup valuations is difficult.

But OpenVC delivers yet again!

We have listed a bunch of recent valuation benchmarks for your entrepreneurial pleasure. Make sure to select recent data that fits your business model (SaaS, marketplace...) and your geography (US, EU...).

If you have access to data we missed, please email us at [email protected]!

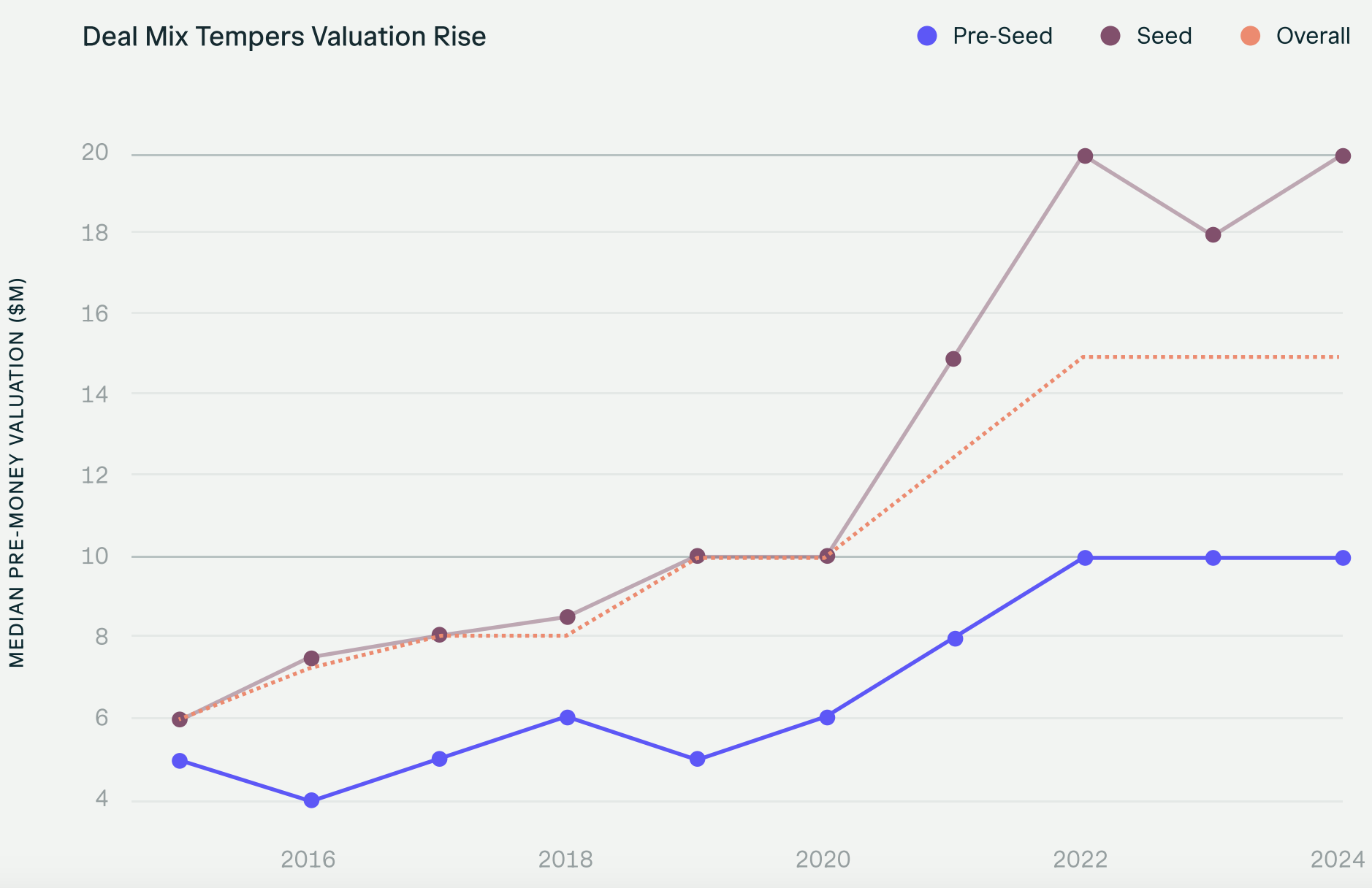

1. Pre-seed and Seed valuations in the US by AngelList (2024)

https://www.angellist.com/data-center/the-state-of-venture-2024

According to AngelList data for the year 2024, the media pre-money valuation is fairly stable at $10M for pre-seed rounds and $20M for seed rounds.

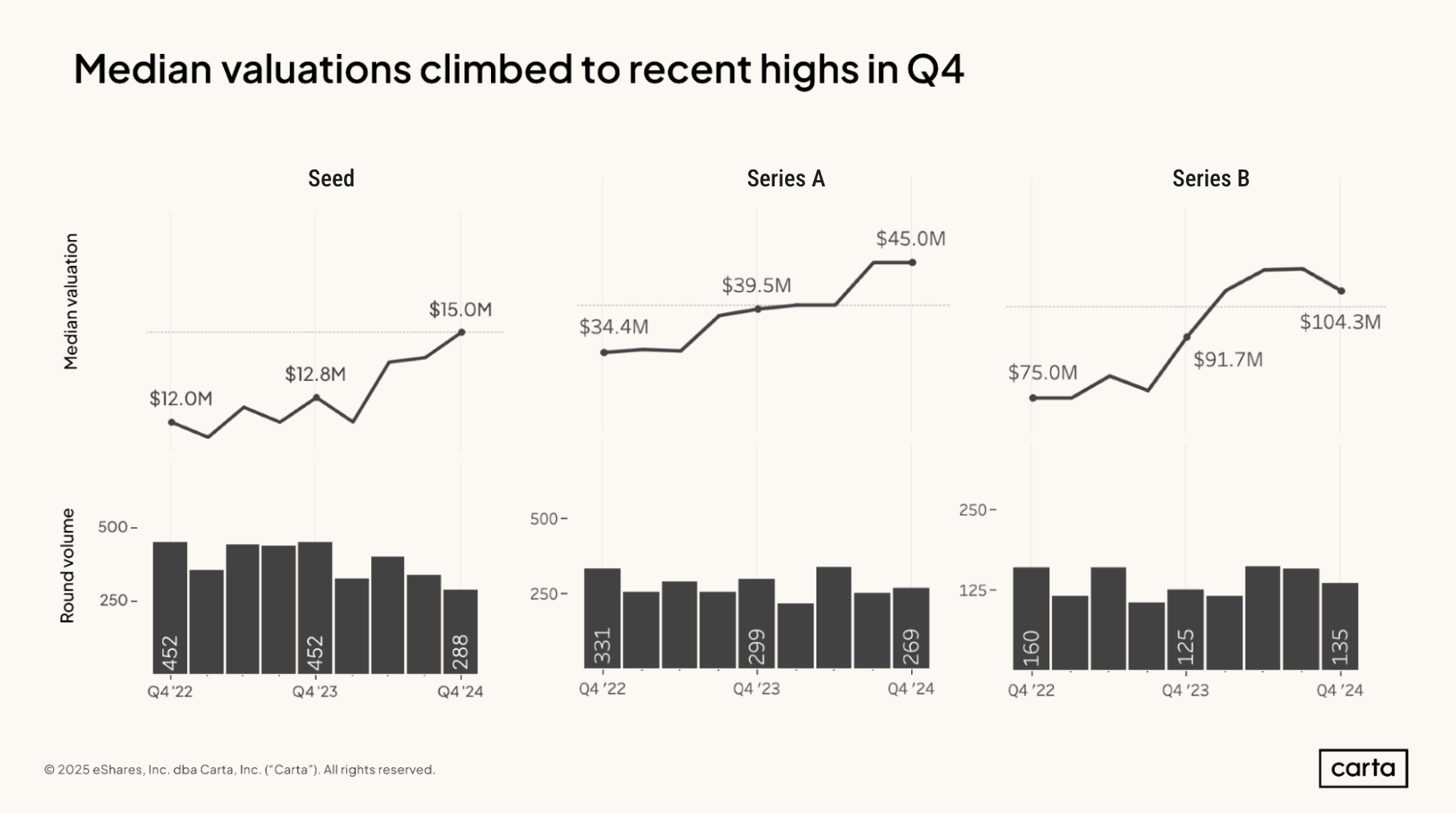

2. Seed, Series A, Series B pre-money valuations by Carta (2024)

https://carta.com/sg/en/data/state-of-private-markets-q4-2024/

Carta released their numbers for media pre-money valuation at seed, Series A, and Series B, showing an uptick in Q4 2024.

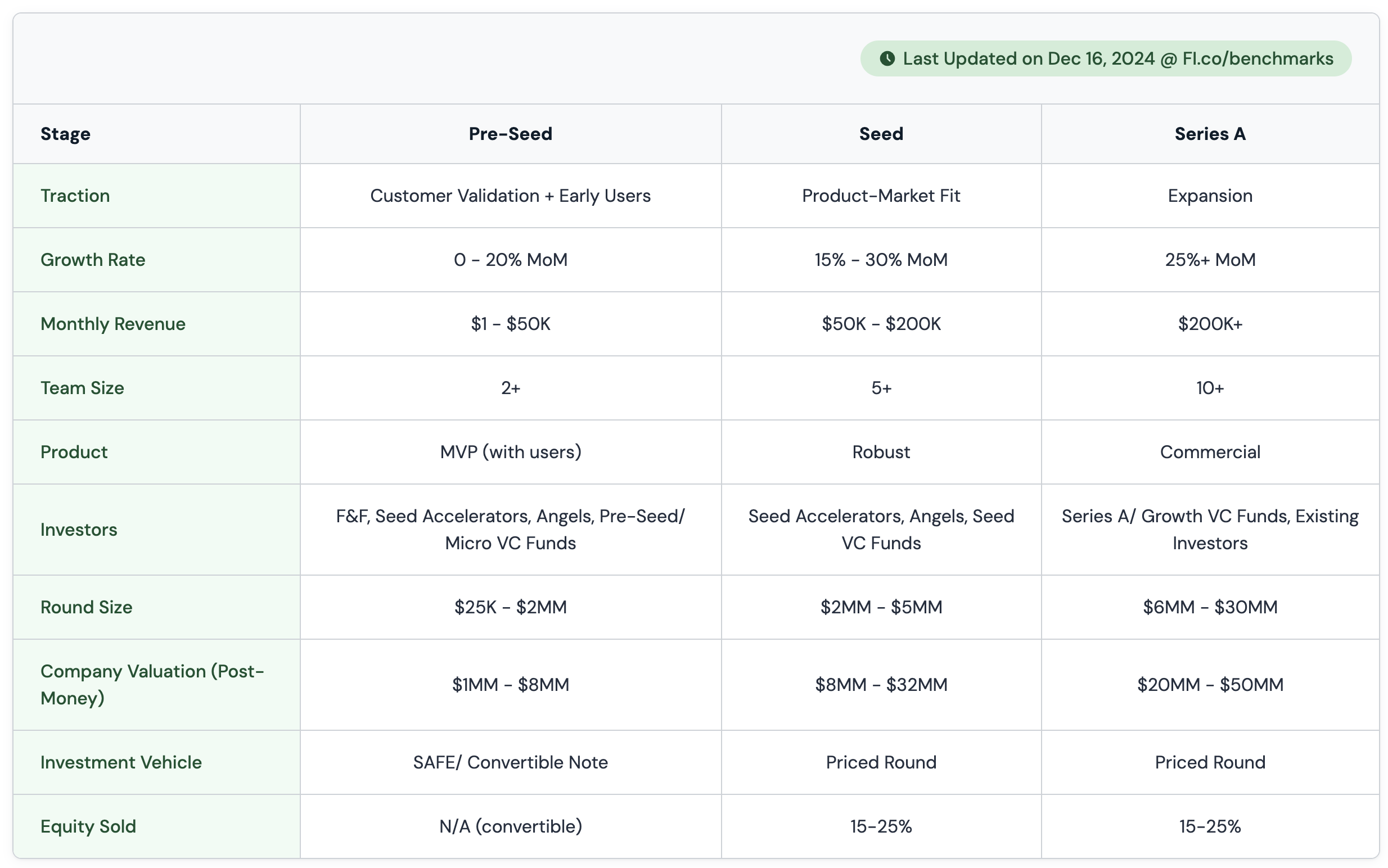

3. Funding Benchmarks from pre-seed to Series A by FI (2024)

The Founder Institute provides a wealth of knowledge for founders. This includes everything from traction to the investment vehicle used. The chart below is extremely handy and frequently updated, so don't hesitate to check out the original version in the link above.

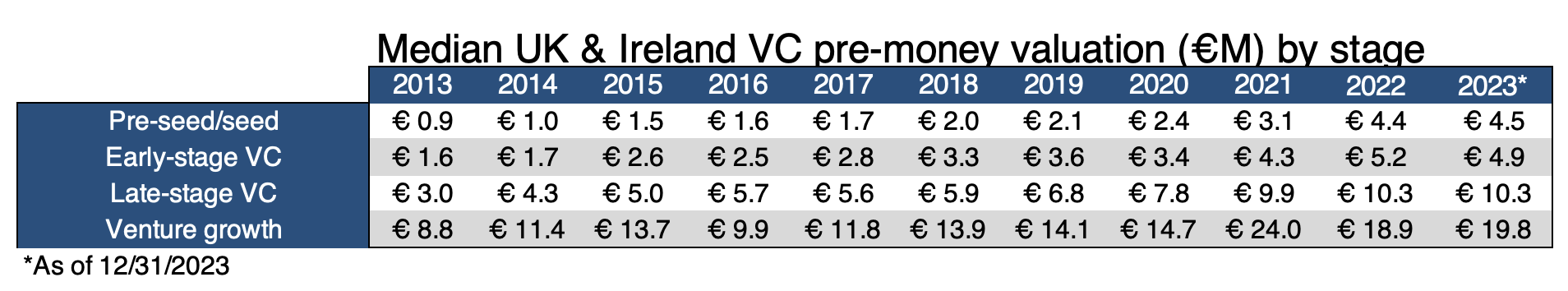

4. Median valuations by region and by stage by Pitchbook (2023)

https://pitchbook.com/news/reports/2023-annual-european-vc-valuations-report (EU)

https://pitchbook.com/news/reports/2023-annual-us-vc-valuations-report (US)

Every year, Pitchbook published an extensive dataset of valuations in the EU and the US. This is a goldmine: the data is broken down by stage (pre-seed, seed, etc) and by region (UK & Ireland, DACH, France & Benelux...). Even better: you can download the Excel dataset for free. Kudos to Pitchbook, great job!

5. Median valuations of early-stage startups by AngelList (2023)

https://angellist.com/data-center

Every quarter, AngelList releases a report with rich data on the US ventrue scene. The screenshot below is from their most 23Q2 report, available for free at the link above.

6. Pre-seed/seed valuations for NYC/SF SaaS by Ihar Mahaniok (2023)

https://www.linkedin.com/posts/mahaniok_what-i-see

Nothing beats first-hand knowledge. Here, Ihar Mahaniok shares valuation estimates for software founders based in NYC/SF. Surprisingly, LinkedIn is a good place to get a pulse on current valuations.

7. (Pre-)seed valuations for LatAm startups by Brian Requarth (2023)

https://x.com/brianrequarth/status/1720282499350446447

Valuations vary a lot based on geography. Here's a sneak peek into LatAm valuations, courtesy of Brian Requarth on Twitter - and yes, Twitter is also a great place for VC data.

8. Median valuations in France (2023)

https://avolta.io/vc-exit-multiples-2023-france/

Avolta is a French fundraising boutique that published robust data every year. The report is very extensive, covering valuations but also exit multiples.

9. SaaS valuations from pre-seed to Series B by Chris Janz (2023)

https://medium.com/point-nine-news/what-does-it-take

The SaaS fundraising napkin has become mandatory reading for those in the industry. Essentially it outlines what it takes to raise funding for a SaaS company and should fit on the back of a napkin. Kudos to Christoph Janz for this beauty.

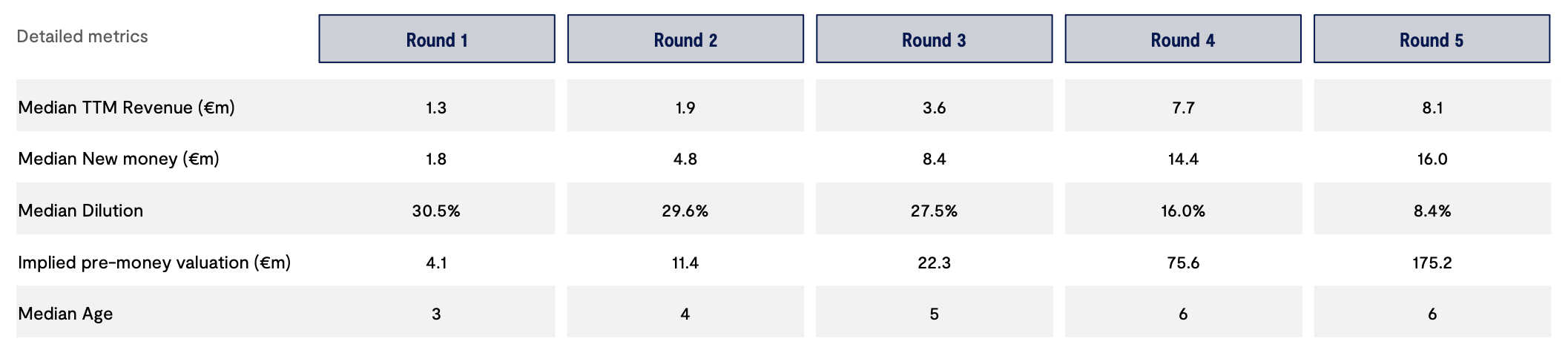

10. Median valuations & dilutions from Seed to growth by Carta (2023)

https://carta.com/blog/state-of-private-markets-q3-2023/

Just like AngelList, Carta produces quartely reports that are available to the general public. Here, you can see median valuations and dilutions for seed+ startups.

11. Growth metrics benchmark for Enterprise SaaS by A16Z (2022)

https://a16z.com/growth/guide-growth-metrics

Andreessen Horowitz has an interactive dashboard that provides founders in the B2B space based on their data and investing team experience. This covers a number of key metrics including growth, retention, margin, etc but doesn't include valuations.

12. SaaS Growth & Burn Benchmark by ScaleVP (2022)

https://www.scalevp.com/insights/benchmarking-saas-growth-and-burn/

Scale provides data and methodology behind SaaS growth and burn benchmarks. This is a detailed post that all SaaS founders should put on their reading lists. No valuation data, though.

13. Github benchmark for open-source startups by RunaCap (2022)

The Ross Index is updated every quarter. They select top 50 open-source startups based on their AGR i.e their Annual Growth Rate of GitHub star, a relevant metric for open-source projects.

14. B2B Marketplace Funding Napkin by Alex George (2022)

https://medium.com/point-nine-news/the-b2b-marketplace

Building on Christoph Janz’s napkin, Alex George created a B2B marketplace funding napkin. Additionally, his post includes a wealth of knowledge for those operating in the space and some significant data points and findings.

15. SaaS Benchmark Report by OpenView (2022)

https://openviewpartners.com/2022-saas-benchmarks-report/

OpenView Partners provides an in-depth look at SaaS benchmarks for 2022. Their key analysis covers company size and growth, financial metrics (margin, burn...), SaaS metrics (CAC payback, NDR...) and diversity. It doesn't include valuations, but still a good reference point to gauge your own fundability.

16. GTM & Financial Benchmarks to raise Series B by BVP (2022)

https://www.bvp.com/atlas/scaling-from-1-to-10-million-arr

Bessemer provides a great playbook for companies looking to make effective decisions to reach $10 million ARR.

17. Valuations & round sizes across industries & stages by Carta (2021)

Carta again, but this time with a gorgeous interactive dashboard that lets you visualize valuations and round size by industry, stage and country. However, the data seem to stop in 2021 and doesn't include pre-seed rounds.

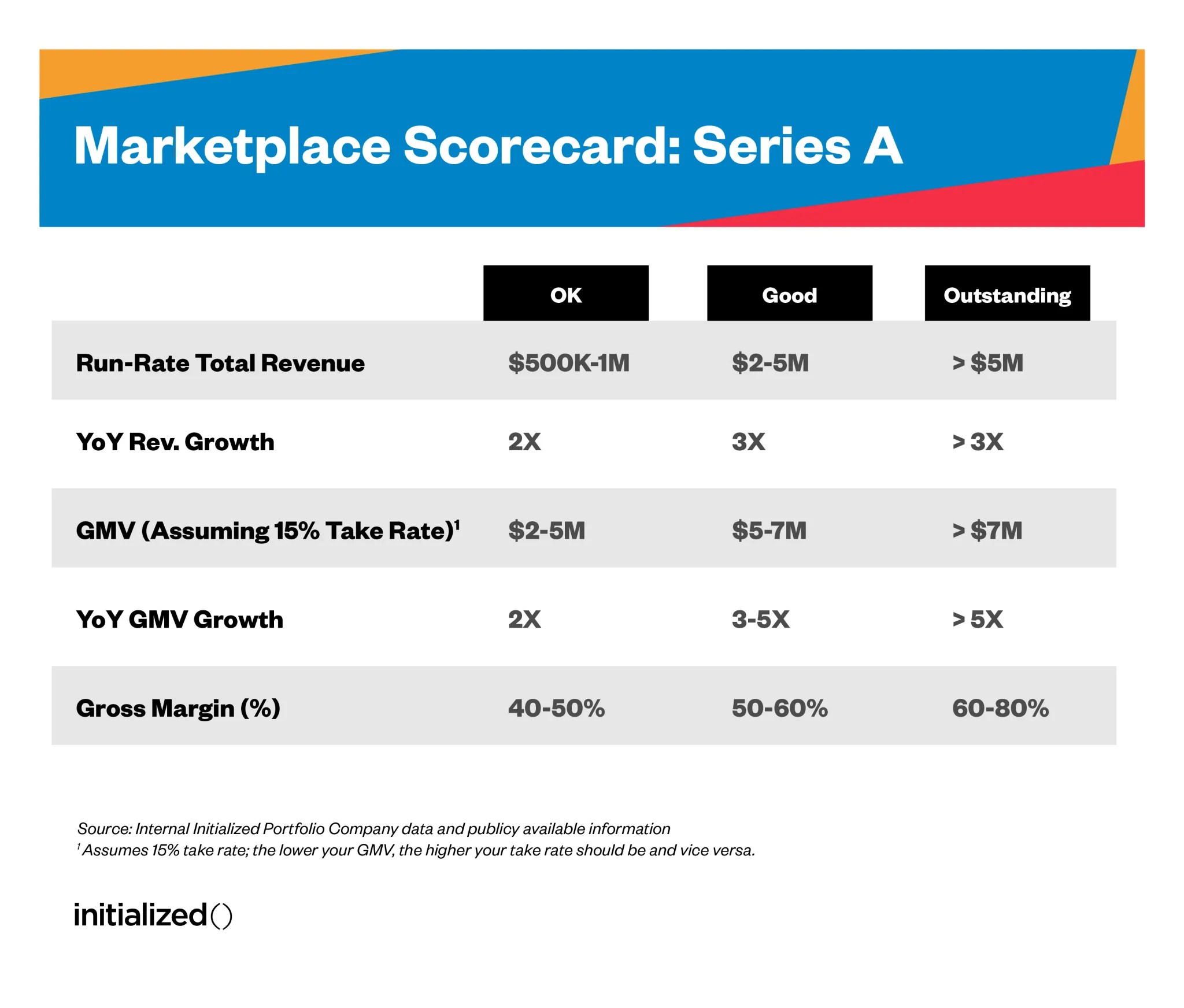

18. Series A in SaaS, D2C, marketplaces by Initialized (2021)

https://blog.initialized.com/2021/06/the-metrics-you-need-to-raise-a-series-a/

For those ready for a Series A, Initialized provides an overview of their companies in the SAAS, D2C and marketplaces and what exactly allowed them to successfully close their Series A rounds.

19. Marketplace valuations by FJ Labs (2020)

https://fabricegrinda.com/fj-labs-marketplace-matrix

FJ Labs created a very useful matrix that provides clear expectations to founders on where they need to be when they attempt to raise their next round of funding.

It should be noted that this matrix does not consider outliers.

20. Retention for social, SaaS, ecommerce by Lenny Rachitsky (2020)

https://www.lennysnewsletter.com/p/what-is-good-retention-issue-29?s=r

Lenny’s Newsletter provides a wealth of information to founders. In this issue (which is free to everyone), he illustrates the differences between good and great retention for different types of business models: social media, SaaS, ecommerce, etc.

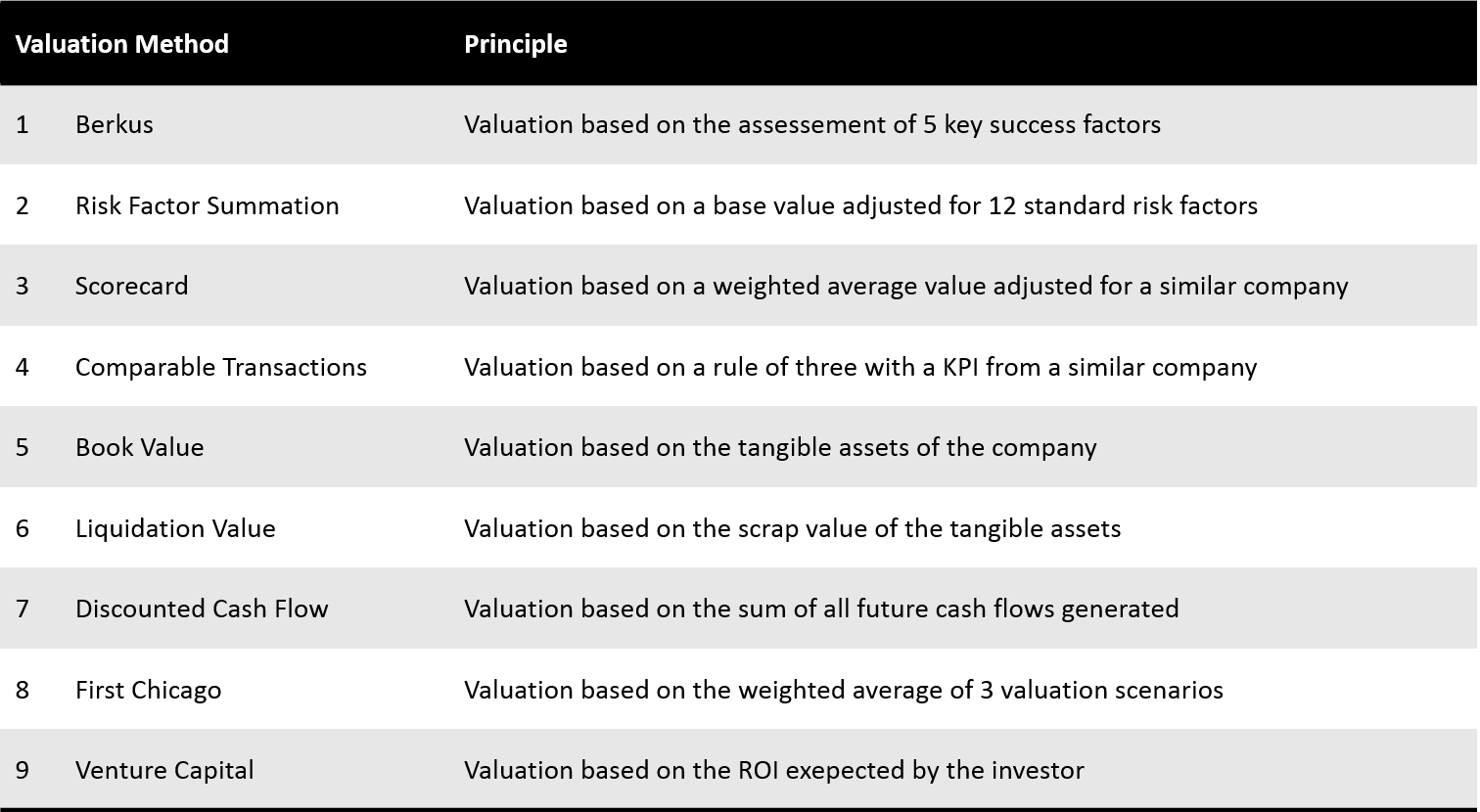

IV. Advanced methods for company valuation

Wanna go deeper into the valuation rabbit hole? Here are 9 advanced methods with additional valuation frameworks.

Bear in mind some of them are not relevant for early-stage startups!

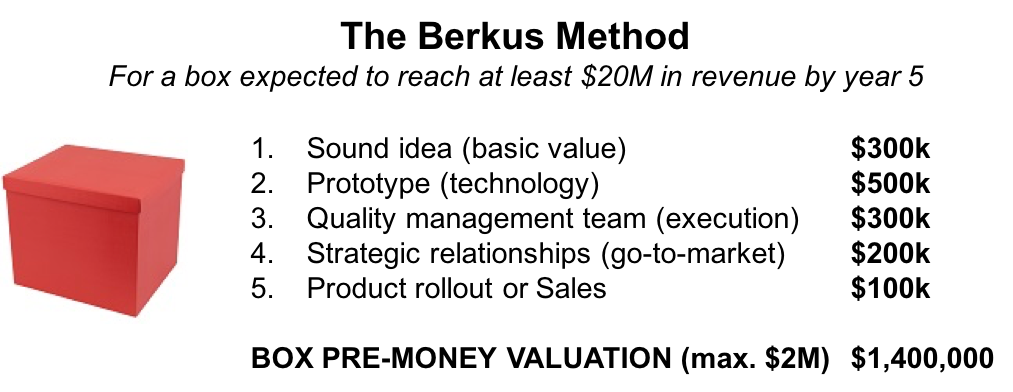

1. Value your startup with the Berkus Method

The Berkus Method is a simple and convenient rule of thumb to estimate the value of your box. It was designed by Dave Berkus, a renowned author and business angel investor. The starting point is: do you believe that the box can reach $20M in revenue by the fifth year of business? If the answer is yes, then you can assess your box against the 5 key criteria for building boxes.

This will give you a rough idea of how much your box is worth (AKA pre-money valuation) and more importantly, what you should improve. Note that according to Berkus, the pre-money valuation should not be more than $2M (which is probably too low by today's standards).

The Berkus Method is meant for pre-revenue startups. To read more about the Berkus Method, click here

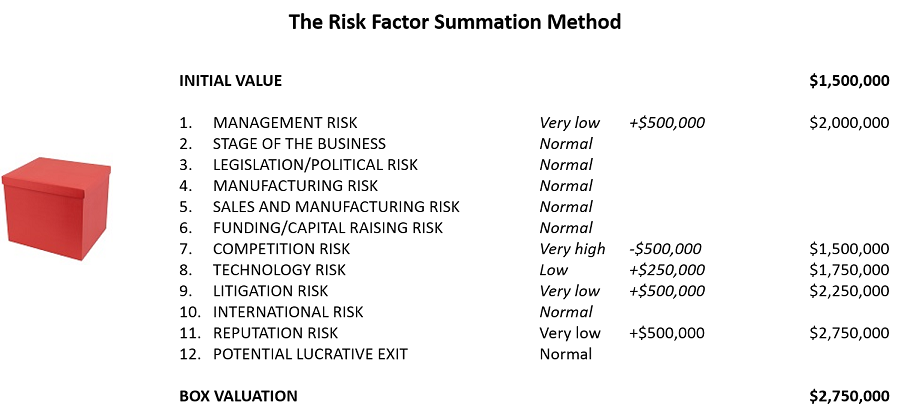

2. Value your startup with the Risk Factor Summation Method

The Risk Factor Summation Method or RFS Method is a slightly more evolved version of the Berkus Method. First, you determine an initial value for your box. Then you adjust said value for 12 risk factors inherent to box-building.

The initial value is determined as the average value for a similar box in your area, and risk factors are modeled as multiples of $250k, ranging from $500k for a very low risk, to -$500k for a very high risk. The most difficult part here, and in most valuation methods, is actually finding data about similar boxes.

The Risk Factor Summation Method is meant for pre-revenue startups. To read more about the Risk Factor Summation Method, click here

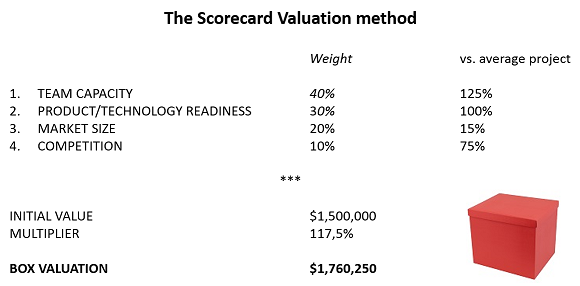

3. Value your startup with the Scorecard Valuation Method

The Scorecard Valuation Method is a more elaborate approach to the box valuation problem. It starts the same way as the RFS method i.e. you determine a base valuation for your box, then you adjust the value for a certain set of criteria. Nothing new, except that those criteria are themselves weighed up based on their impact on the overall success of the project.

This method can also be found under the name of Bill Payne Method

The Scorecard Valuation Method is meant for pre-revenue startups. To read more about the Scorecard Valuation Method, click here

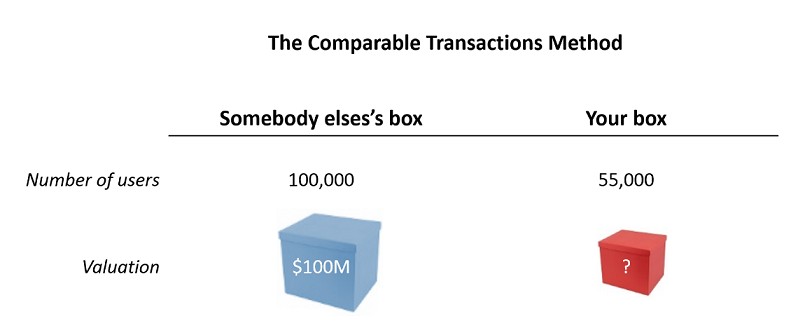

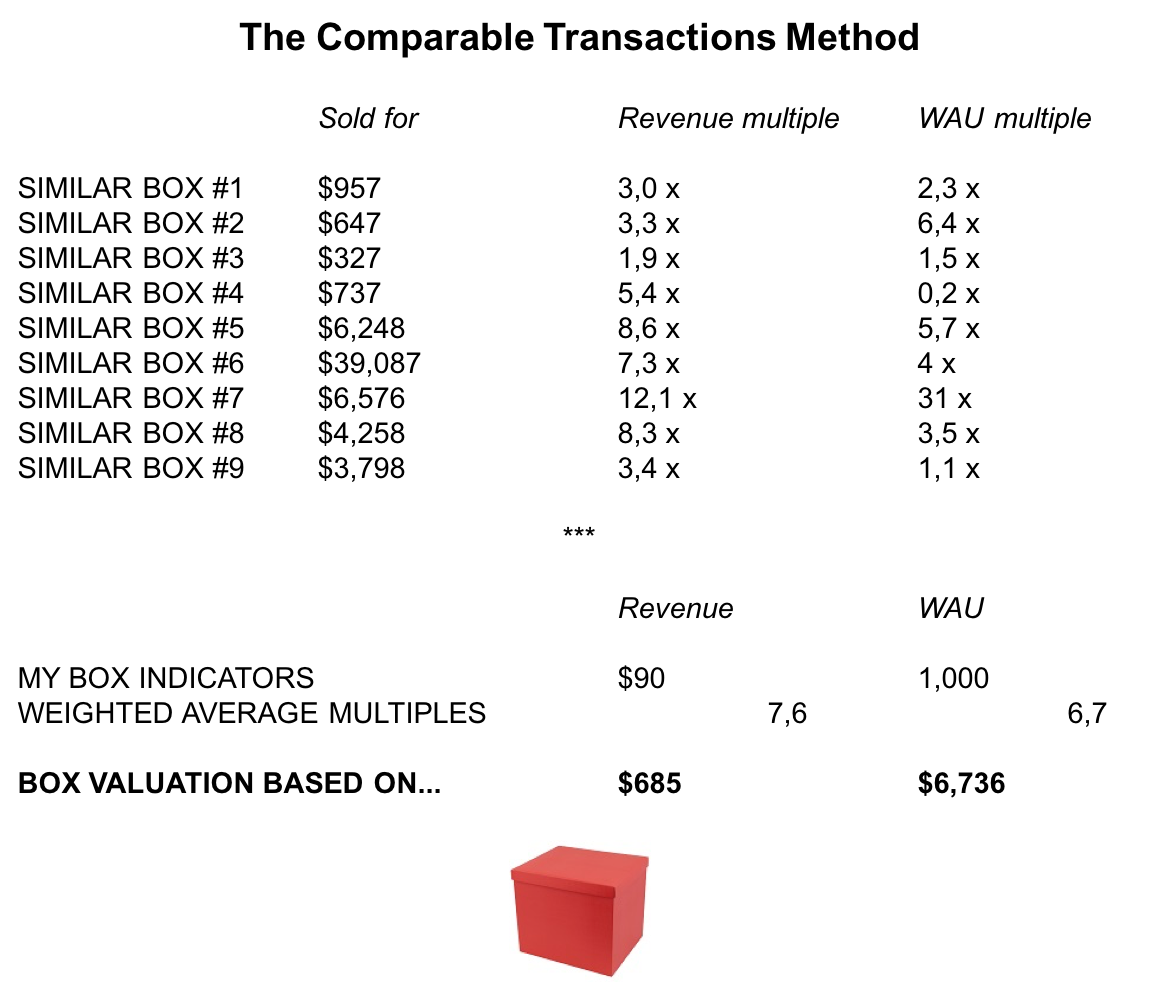

4. Value your startup with the Comparable Transactions Method

The Comparable Transactions Method is really just a rule of three.

Depending on the type of box you are building, you want to find an indicator that will be a good proxy for the value of your box. This indicator can be specific to your industry: Monthly Recurring Revenue (Saas), HR headcount (Interim), Number of outlets (Retail), Patent filed (Medtech/Biotech), Weekly Active Users or WAU (Messengers). Most of the time, you can just take lines from the P&L: sales, gross margin, EBITDA, etc.

The Comparables Transactions Method is meant for pre- and post-revenue startups. To read more about the Comparable Transactions Method, click here

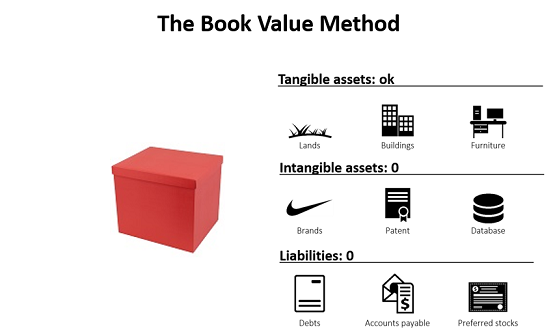

5. Value your startup with the Book Value Method

Forget about how magical the box is, and see how much 1 pound of cardboard is worth.

The book value refers to the net worth of the company i.e. the tangible assets of the box i.e. the “hard parts” of the box.

The Book Value Method is particularly irrelevant for startups as it is focused on the “tangible” value of the company, while most startups focus on intangible assets: R&D (for a biotech startup), user base and software development (for a software startup), etc. To read more about the Book Value method, click here

6. Value your startup with the Liquidation Value Method

Rarely good from a seller perspective, the liquidation value implies that your company is going out of business.

Things that count for a liquidation value estimation are all the tangible assets: Real Estate, Equipment, Inventory… Everything you can find a buyer for in a short span of time. The mindset is: if I sell whatever the company can in less than two months, how much money does that make? All the intangibles, on the other hand, are considered worthless in a liquidation process (the underlying assumption is that if it was worth something, it would have already been sold at the time you enter in liquidation): patents, copyright, and any other intellectual property.

Practically, the liquidation value is the sum of the scrap value of all the tangible assets of the company.

For an investor, the liquidation value is useful as a parameter to evaluate the risk of the investment: a higher potential liquidation value means a lower risk. For example, all other things equal, it is preferable to invest in a company that owns its equipment compared to one that leases it. If everything goes wrong and you go out of business, at least you can get some money selling the equipment, whereas nothing if you lease it.

So, what is the difference between book value and liquidation value? If a startup really had to sell its assets in the case of a bankruptcy, the value it would get from the sale would likely be below its book value, due to the adverse conditions of the sales.

So liquidation value < book value. Although they both account for tangible assets, the context in which those assets are valued differs. See Ben Graham on this.

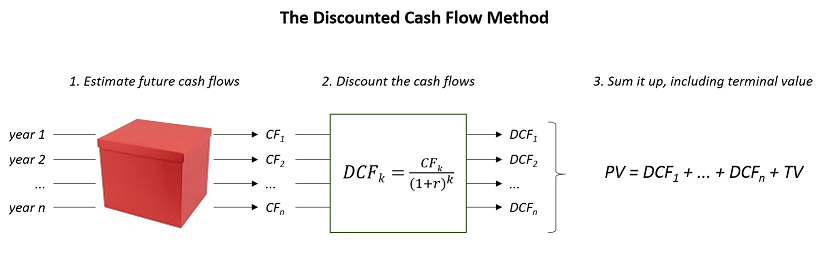

7. Value your startup with the Discounted Cash Flow method

If your box works well, it brings in a certain amount of cash every year. Consequently, you could say that the current value of the box is the sum of all the future cash flows over the next years. And that is exactly the reasoning behind the DCF method.

Let’s say you are projecting cash flows over n years. What happens after that? This is the question addressed by the Terminal Value (TV)

Option 1: you consider the business will keep growing at a steady pace, and keep generating indefinite cash flows after the n years period. You can then apply the formula for Terminal Value: TV = CFn+1/(r- g) with “r” being the discount rate and “g” being the expected growth rate.

Option 2: you consider an exit after the n year period. First, you want to estimate the future value of the acquisition, for example with the comparable method transaction (see above). Then, you have to discount this future value to get its net present value. TV = exit value/(1+r)^n

Although technically, you could use it for post-revenue startups, it is just not meant for startup valuation but for mature company. To read more about the DCF method, click here

8. Value your startup with the First Chicago Method

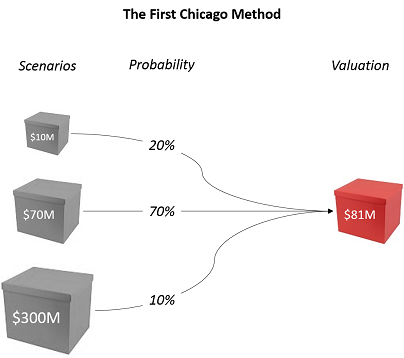

The First Chicago Method answers to a specific situation: what if your box has a small chance of becoming huge? How to assess this potential?

The First Chicago Method (named after the late First Chicago Bank — if you ask) deals with this issue by making three valuations: a worst-case scenario (tiny box), a normal case scenario (normal box), a best-case scenario (big box).

Each valuation is made with the DCF Method (or, if not possible, with the internal rate of return formula or with multiples). You then decide on a percentage reflecting the probability of each scenario to happen. Your valuation according to the First Chicago Method is the weighted average of each case.

The First Chicago Method is meant for more mature companies. You can read more about the First Chicago Method here

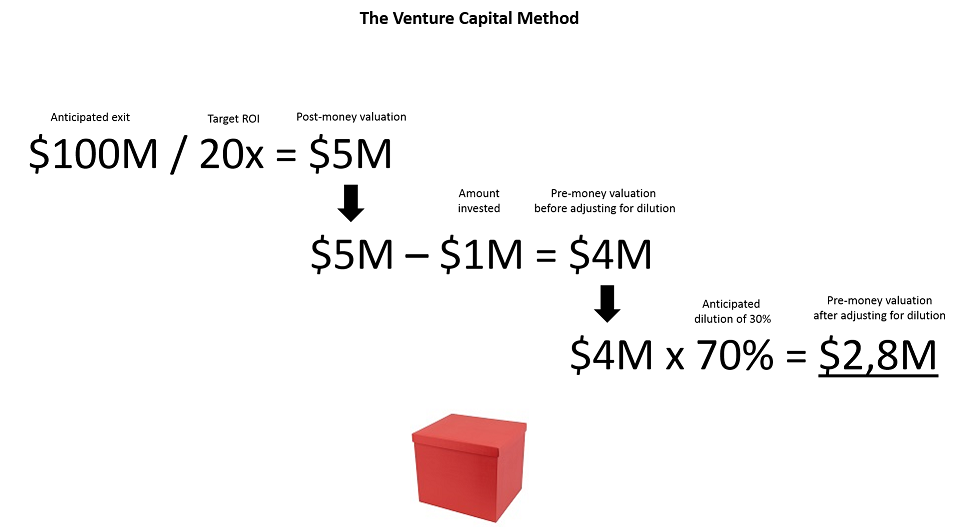

9. Value your startup with the Venture Capital Method

As its name indicate, the Venture Capital Method stands from the viewpoint of the investor.

An investor is always looking for a specific return on investment, let’s say 20x. Besides, according to industry standards, the investor thinks that your box could be sold for $100M in 8 years. Based on those two elements, the investor can easily determine the maximum price he or she is willing to pay for investing in your box, after adjusting for dilution.

The Venture Capital Method is meant for pre- and post-revenue startups. To read more about the Venture Capital Method, click here

Final thoughts on startup valuation

Congratulations if you made it this far.

At the end of the day, valuations are nothing but semi-formalized guesstimates driven by supply and demand. Always take them with a grain of salt.

As a parting thought, I'd like to quote a word of wisdom by Pierre Entremont, Partner at Frst.vc:

"The optimal amount raised is the maximal amount which, in a given period, allows the last dollar raised to be more useful to the company than it is harmful to the entrepreneur."

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started