Blog > Startup Valuation

Jonathan Hakakian: From Building Startups at University to Backing 50+ Startups & $200M+ Exits

This is episode 20 of The OpenVC Podcast. In this episode, Jonathan Hakakian, Managing Partner at SoundBoard Venture Fund, shares his journey from entrepreneur to VC and how he’s backed 50+ startups, including Jump (acquired by Uber for $200M+). He dives into how he identifies overlooked investment opportunities, the importance of strong investor-founder relationships, and key lessons from scaling high-growth startup

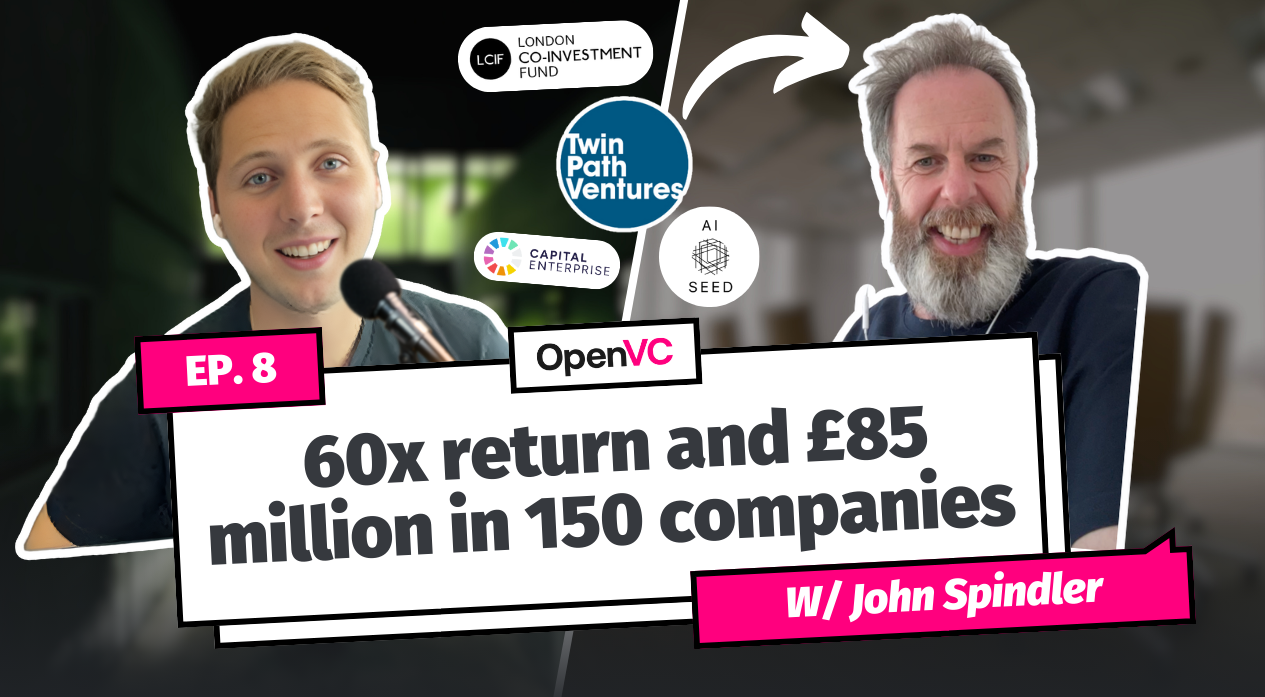

Co-founder at Twin Path Ventures: John Spindler (& ex co-founder of London Co-Investment Fund)

This is Episode 8 of The OpenVC Podcast. In this episode, John Spindler shares his journey from founder to investor, overseeing £85M+ in investments across 150 startups. With a 60x angel investment win, he breaks down AI startup evaluation, frontier AI opportunities, and key investment strategies.