"Raising cold doesn't work"

You probably heard that sentence from a fellow founder or a well-meaning investor.

Yet, there are many examples of the opposite.

How come some founders succeed while so many others fail?

Because it's harder than you think.

It takes psychological acumen, technical knowledge, an iron-clad organization, and a great many hours of work to nail an investor outreach campaign. It's very easy to fail at it, and that's what happens with 90% of founders

Raising cold works, but you have to do it right!

That's why OpenVC joined forces with Carboncore to bring you the ultimate guide for cold fundraising - completely free.

Throughout this post, we'll unveil the exact approach we've perfected at Carboncore and OpenVC. Using this approach we've helped numerous tech startups raise capital from VC/PE funds, family offices, angel investors, and high-net-worth individuals. So... No matter who your target investor is, we're confident that our proven strategies will effectively help you grab their attention and get them on the call with you.

Before we jump into the nitty-gritty of successful outbound campaigns, let's first recognize the five fundamental pillars of cold outreach:

- Strategy: Lay out a realistic strategy for your cold outreach

- Message: Write a top 1% email that elicits a reply

-

Data: Acquire rich investor data for emailing

- Infrastructure: Optimize your emailing infra for deliverability

- Process: Run your cold outreach process like a machine

Throughout this post, we'll thoroughly explore each of these components, delving into both the technical intricacies and the strategic significance they hold.

So, shall we kick things off?

This playbook was co-written with Edwin Mik, Founder and CEO of Carboncore, a firm specializing in Outbound Marketing. Edwin's helped over a dozen start-ups and emerging fund managers successfully raise capital leveraging cold outreach strategies. Big thanks to him!

Table of Contents

1. Lay out a realistic strategy for your cold outreach

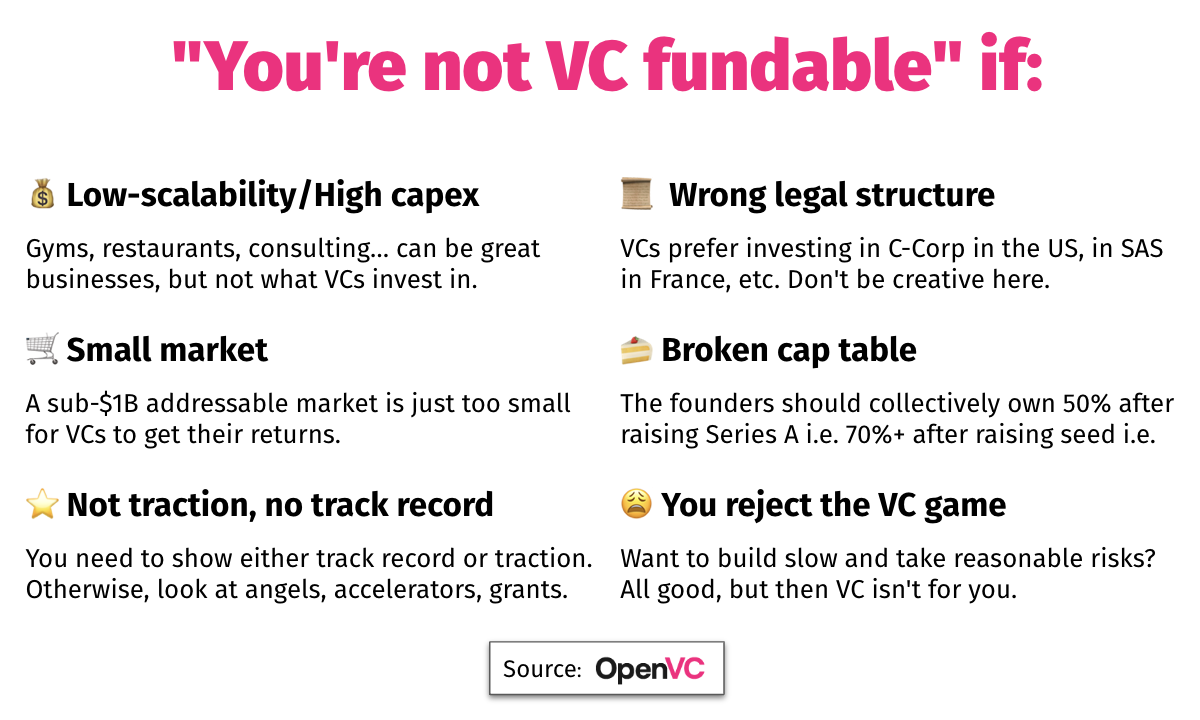

1.1 Are you VC fundable?

Not all businesses are VC fundable. VCs have precise requirements about the types of companies they fund: market size, scalability, capital efficiency, traction... Make sure you qualify before reaching out.

1.2 Make sure you have at least 1 positive signal

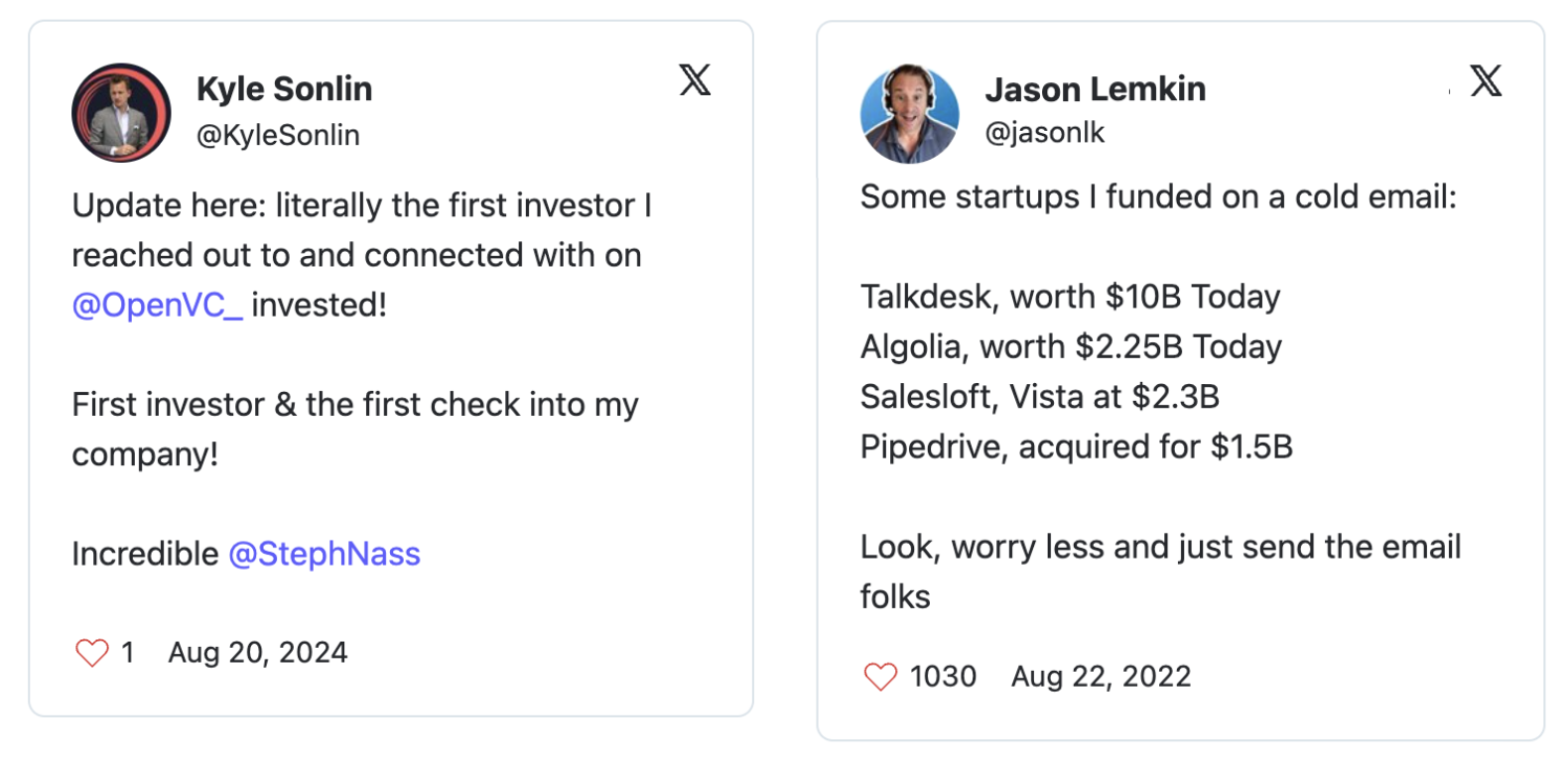

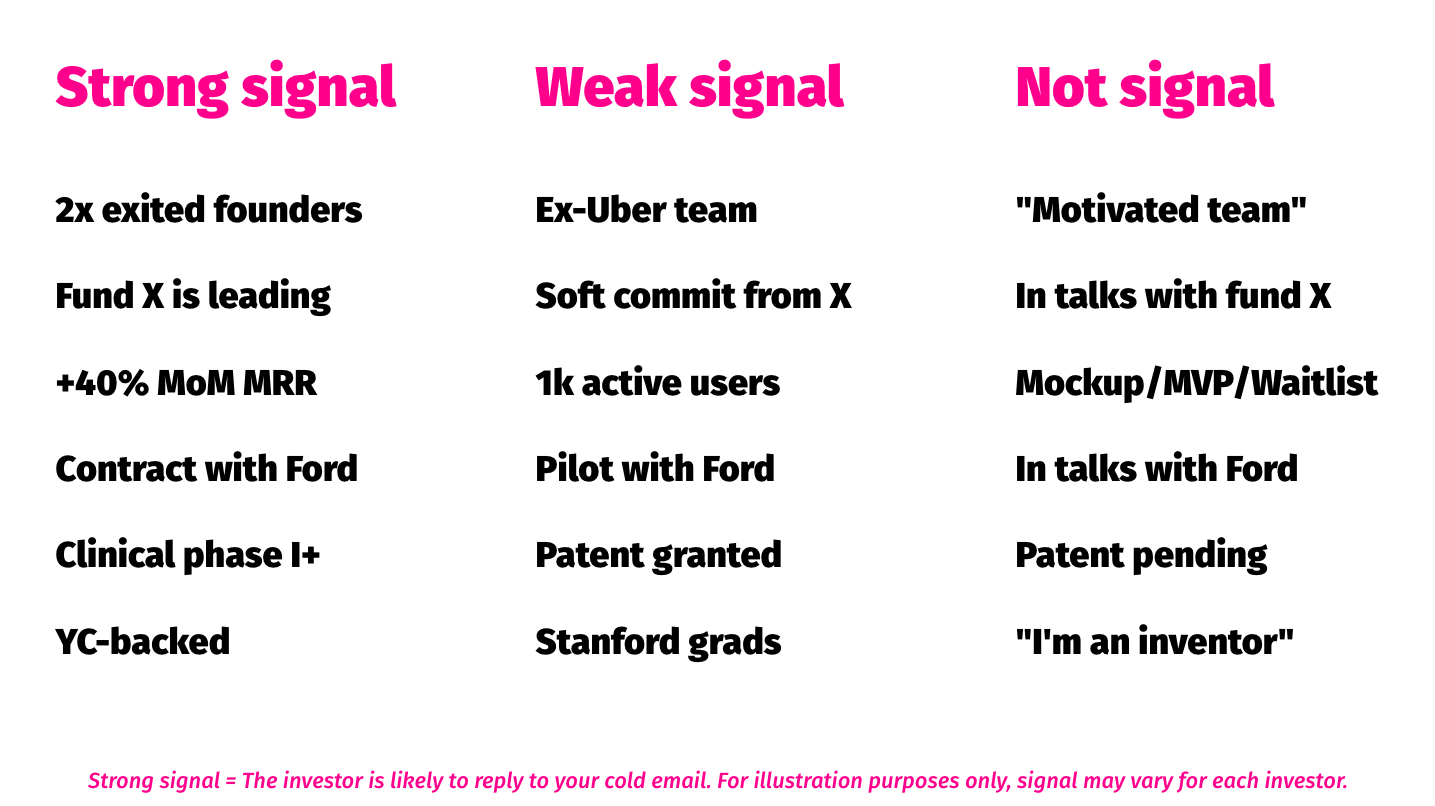

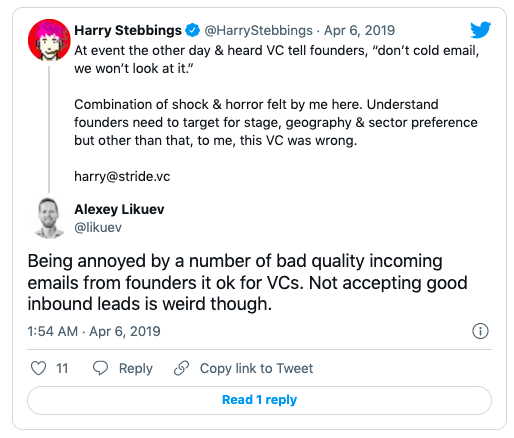

When cold emailing investors, you're competing for attention.

The best way to cut through the noise is having at least 1 positive signal: strong traction, significant IP, lead secured for your funding round, an exited founder in your team... Having a prototype or a waitlist is usually not enough.

If you're too early, consider accelerators or angels instead.

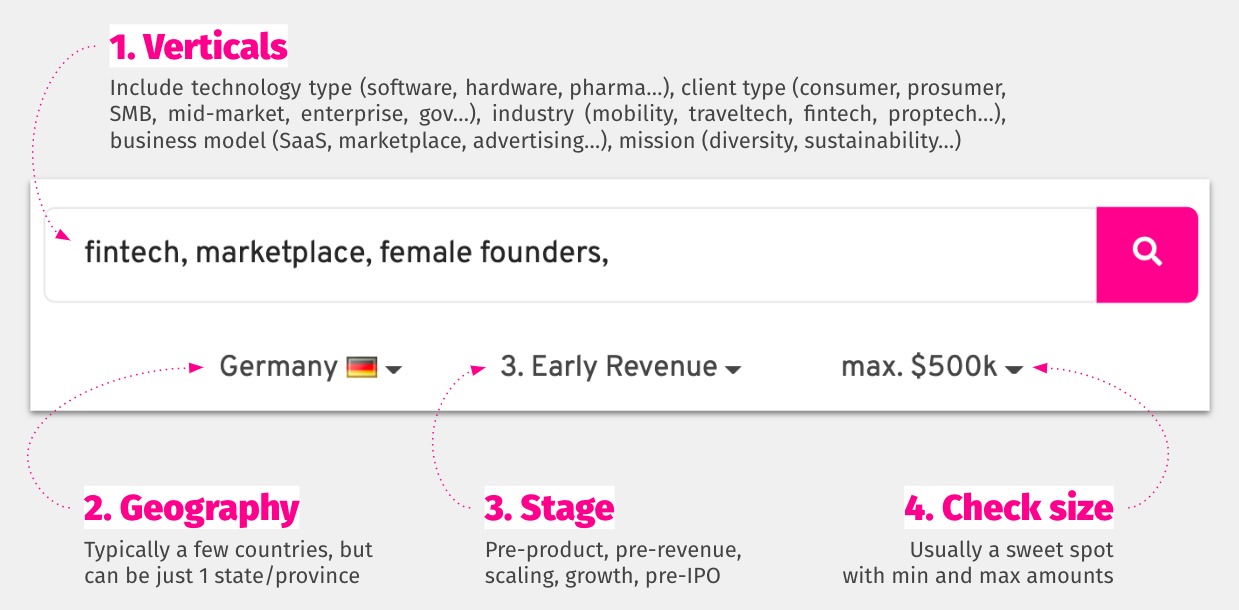

1.3 Define your ideal investor persona

Targeting the right investors is key to optimize your resource allocation.

Understanding who you want to raise from will help you build targeted lead lists and make sure you're reaching out to investors who are interested in investing in specific industries or regions. This will also help you craft messages that feel personal and have a higher likelihood of prompting responses.

Define your ideal investor persona by geography (where your company is incorporated), verticals (SaaS, biotech, web3...), maturity (MVP, PMF, growth...), and check size.

Learn how to build a targeted investor list

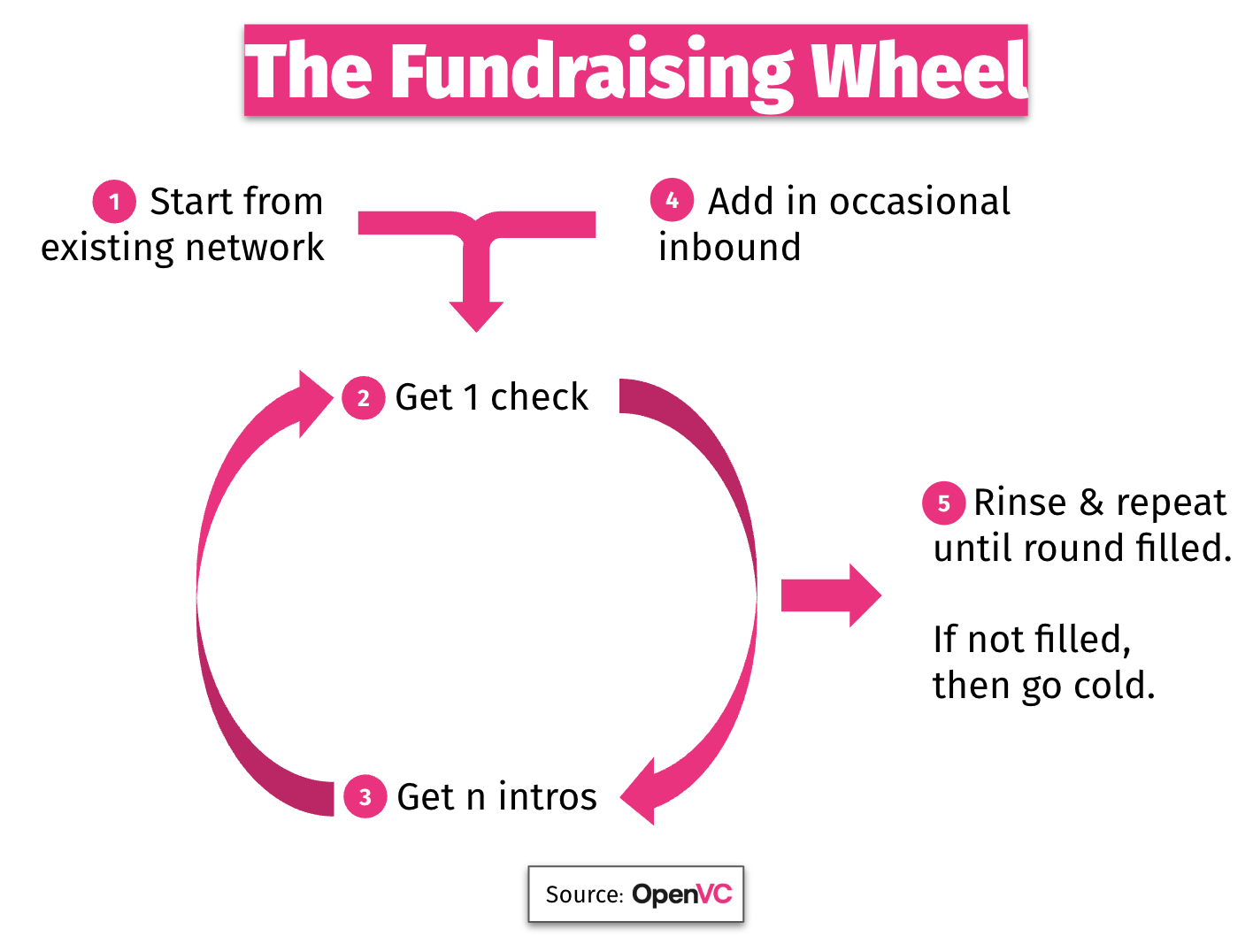

1.4 Combine cold outreach with intros, network, inbound

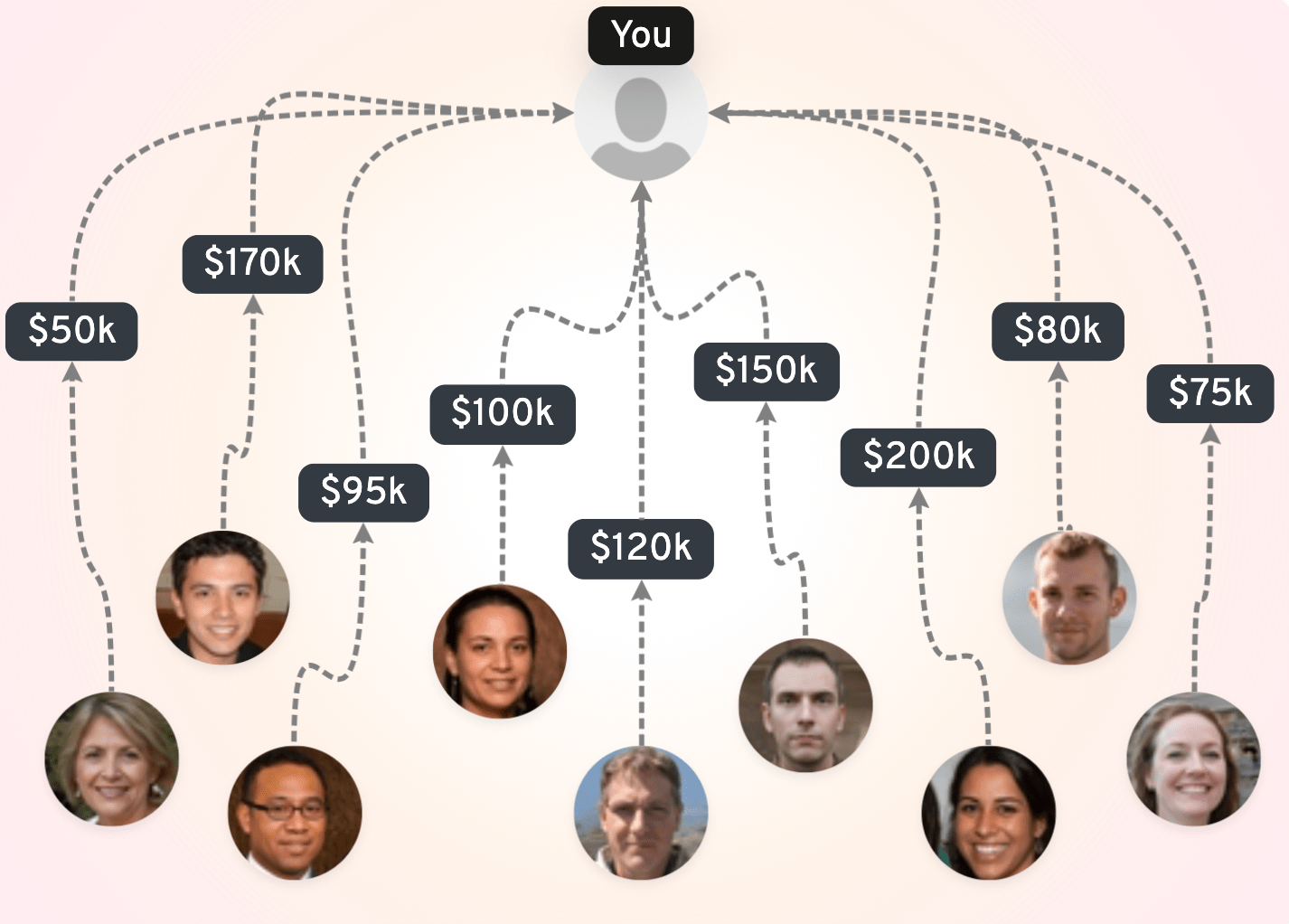

Cold outreach is one of four channels to access investors. You will usually use cold outreach in combination with warm intros, inbound fundraising, and your existing network as part of your Fundraising Wheel.

Learn how to design your Fundraising Strategy

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now

2. Write a top 1% email that elicits a reply

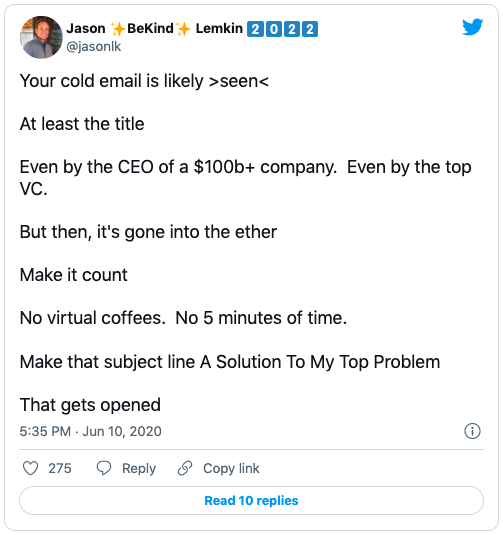

2.1 Craft a subject that gets your email opened

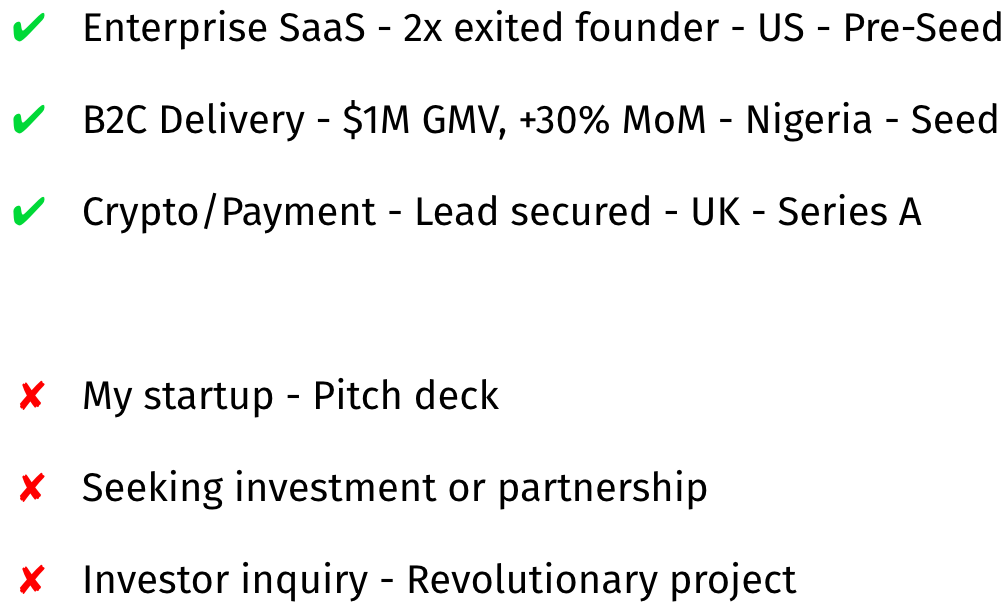

Let's dive right into the topic. See below 3 good and 3 bad email subjects. Can you see the pattern?

Now, here are six easy rules you should follow to craft your email subject:

- Keep the email subject under 60 characters. The subject must be readable in full from the notification of a mobile phone.

- Don't write "investment opportunity" or "investment idea" in the email subject. You're wasting precious space with zero-value wording.

- Include one piece of information that shows the VC a thesis fit. For a SaaS VC, "SaaS for supply chain". For a biotech VC "Scaling up gene therapies", etc.

- Include one piece of information that show the VC your project is great. It can be growth (40% MoM growth), signal (lead investor secured), the team (2x exited founder)...

- Include your funding stage. This reinforces the fact that your company may be a good fit for the investor. It also explicits the purpose of your email.

- Include your company name. Not critical, but convenient when searching old emails.

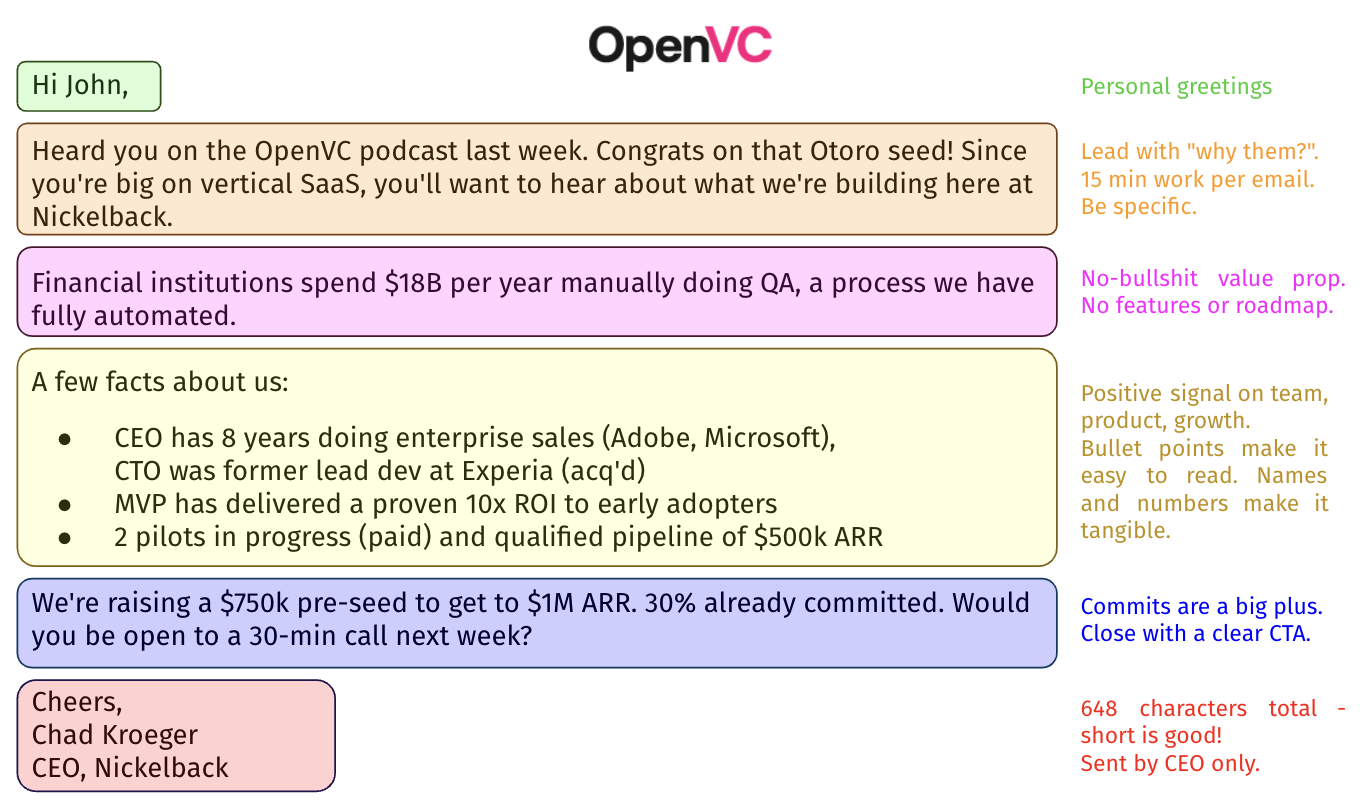

2.2 Craft an email body that gets your deck opened

See below our template for a killer cold email. We've also collected 14 examples of actual, real-life cold emails that were sent to VCs. You can check them out in this post.

Use the 15 checkpoints below to make sure your email body is optimized

- Avoid generic greetings, like "Hi there" or "Dear Sir/Madam". Use the first name of your recipient e.g. "Hi John". If you're emailing a generic address like [email protected], try something like "Hello SuperVC team".

- Don't call people Sir or Madam. In most cases, it's perfectly fine to go by first name. The only exceptions are with Dr titles (frequent in deeptech, biotech, medtech...) and in some specific geographies where social rules differ.

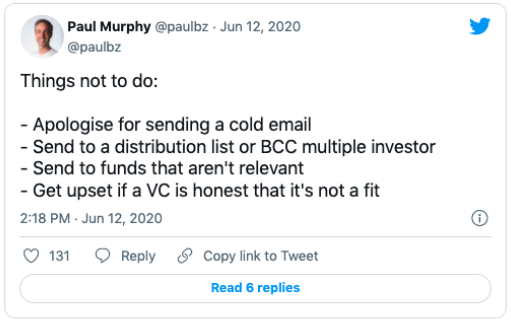

- Don't apologize for sending an email. No need for "I'm sorry to disturb you" or "I thank you in advance for reading this email". It's unnecessary. Just go straight to the point.

- Don't outsource VC outreach. Especially at early-stage, the email should come from the CEO and nobody else.

- Keep the email body under 1,000 characters. It's a universal rule: the longer the email, the less reply you get.

- Don't ask if you can send your pitch deck in the next email. Attach your pitch deck to begin with.

- Don't add legal mentions to your company name like legal structure (LLC, SAS…) or trademark (TM, C). You are the CEO of Tesla, not Tesla LLC or Tesla TM.

- Use simple words when describing what your company does. Don't say "we're a mobile technology platform that empowers travelers by allowing them to search for the best-rated cars with chauffeurs while securing the financial transaction". Instead, say "we're a mobile app that connects drivers and passengers in a safe and convenient way"

- Don't make vague statements like "the growth has been impressive" or "traction is encouraging". Instead, give numbers "MRR has grown 25% MoM over the past 12 months".

- Don't mention a 20x growth when you've just grown from 1 to 20 users. Investors won't be fooled and it's a sure way to lose your credibility.

- Never write long paragraphs. Write short paragraphs.

- Use bullet points. If you want to expand on 2-3 key points, bullet points are great because they allow the VC to quickly parse your email for them.

- Don't close with a meek CTA, like "I'd love to meet and exchange notes in the spirit of networking" or "We hope to peak your interest for the opportunity to pitch to your fund.". Instead, try a more confident "Looking forward to show you how XXX will change YYY".

- Keep your signature short. There's no need for a fax number and 5 social accounts.

- Don't stuff the email with links and images. They will distract the reader. There should be 1 link (your pitch deck) and zero images. Also, links and images trigger spam filters.

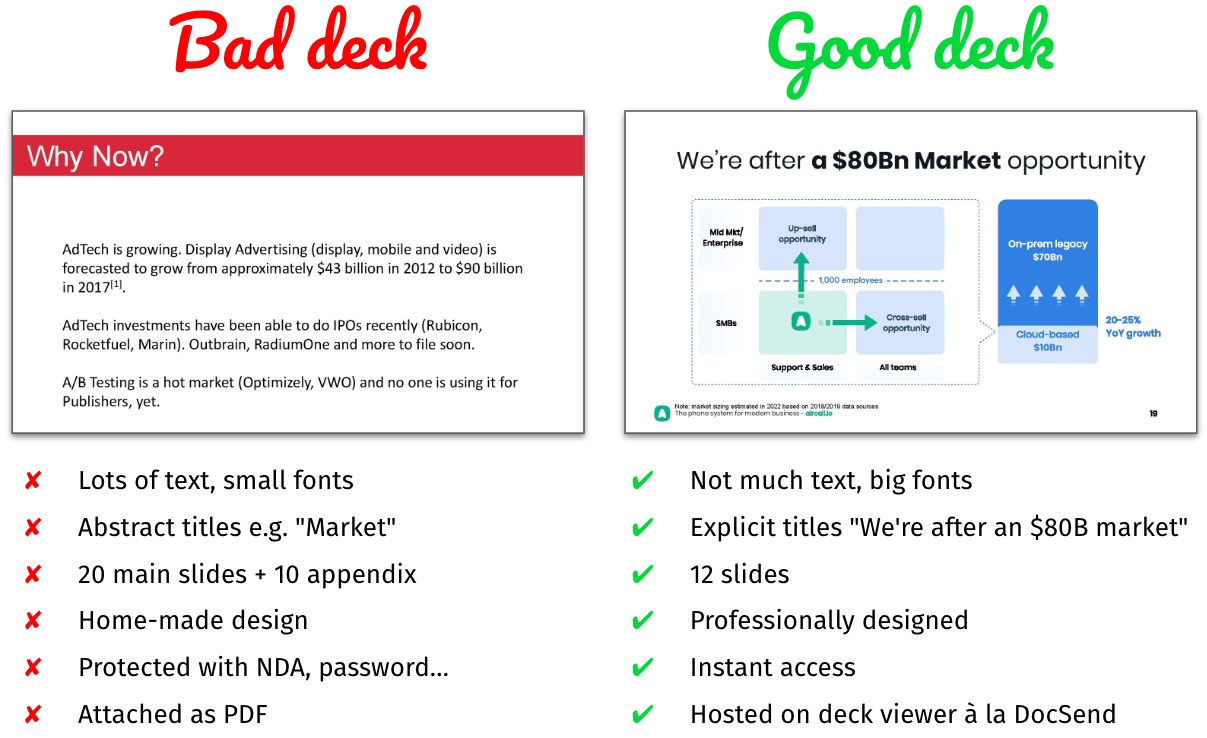

2.3 Attach a pitch deck that elicits a reply

An image is worth a thousand words, so here's visual explanation of what a good and bad deck looks like:

Here are 6 basic rules to nail your pitch deck:

- Get the basics right. A pitch deck is not a business plan. Your pitch deck should be in slides (landscape format) and in PDF.

- Keep it short. 12 slides is the maximum for a first contact. Don't go into details. Keep things high-level and focus on the key messages.

- Keep the file name clean e.g. "Tesla - Seed round", not "V6 - Pitch deck".

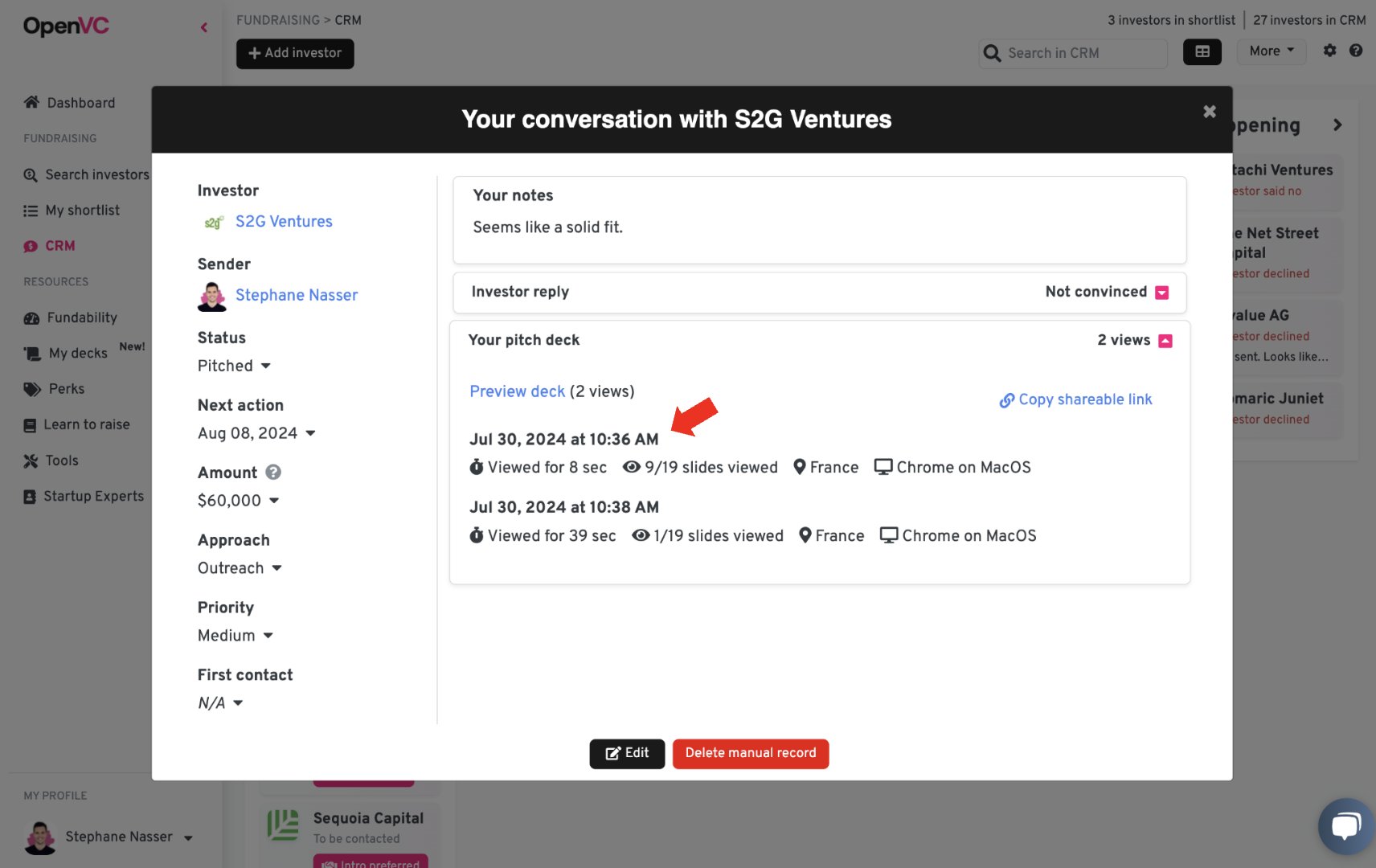

- Host your pitch deck online: OpenVC, Google Drive, DocSend, etc. That way, you can easily track metrics and update the file as needed.

- Use the following resources to build your pitch deck:

- Invest in your pitch deck. Once you have nailed the content, consider paying a professional designer to redo your deck. It may be frustrating, but it will 2x the amount of time a VC will spend on your pitch deck.

3. Acquire investor data for emailing

It's time to start building your lead lists of people that you're going to engage with.

And there isn't a definitive right or wrong approach - there are various different directories and databases as well as social media networks where you can find investors and obtain/scrape their contact details.

It would probably be impossible to cover all of the different ways to build your lead lists, however, we have tried to encapsulate the most prevalent data sources below.

3.1 Tap into investor databases

The beauty of tapping into any one of the databases mentioned above is that you are able to acquire substantial amounts of data very quickly and use effective filtering and targeting in order to launch your outbound campaigns in a matter of hours.

However, the downside is the potential for elevated costs in maintaining accurate data over longer periods of time (some tools mentioned above can get a little bit pricey), and the fact that the data you have access to is easily accessible to your competitors as well.

Linkedin Free Search

You can use LinkedIn's search feature and type an "Industry" (i.e. SaaS) - choose people and then choose 2nd or 3rd connections - choose the US or Canada or any other country that is relevant.

Next - under All Filters, Under “Keywords” and "Company" type in “Capital”, “Venture”, "Family Office" or "Investor" (Most Venture Capital firms typically incorporate these terms within their titles - whereas Angel Investors frequently employ the term "Investor.")

Click "Show results".

And now, you should have tens of pages of results - profiles of professionals that are either individual investors or people working in investment firms.

From here you can use tools, like LeadRocks, Snov.io or Findymail to scrape the data and have it in an actionable CSV.

LinkedIn Sales Navigator

LinkedIn's Sales Navigator offers a wide variety of filters to extrapolate data on both account (company) and contact (person) levels.

These features allow you to identify individual investors as well as investment firms that are specific in size and tend to invest in a specific sector.

The beauty of Sales Navigator is that, if you're going after VC funds - you can meticulously pinpoint the firms you aspire to secure as investors - make a list of, say, 50 firms - then identify the primary decision makers within each of these companies and execute highly personalized Account Based Marketing campaigns.

The only downside to Sales Navigator is that if you want to extract data into actionable CSVs you need external tools like Wiza or Krupp to be able to do that.

Crunchbase

Crunchbase is one of the largest and most popular databases of private and public companies. If you're targeting PE/VC funds Crunchbase is a perfect database to identify thousands of different investment firms and even see their previous investments.

Alternatively, you can flip the script and use Crunchbase to search for startups/companies that have previously raised funds and are relatively similar to yours. Once you've identified these companies, using Crunchbase, you can build a list of investors and firms that have invested in those businesses.

Apollo

Apollo is the most popular database amongst outbound professionals. It's one of the most up-to-date databases, with over 265 million contacts. Like Crunchbase, you can use Apollo and its filters to identify various investment firms, pinpoint key decision makers, obtain their contact details, and export all the data you need into actionable CSV.

OpenVC

You can use the OpenVC database to browse 6,000+ active investors and filter them efficiently. A nice perk of the platform is that it natively integrates with their proprietary outreach system, pitch deck links, and Fundraising CRM, so you have everything in one place.

50 more investor databases

OpenVC has already compiled a great list of 50 actionable databases you can access immediately, save yourself some time, and start your outreach campaigns in an instant: https://openvc.app/blog/vc-list.

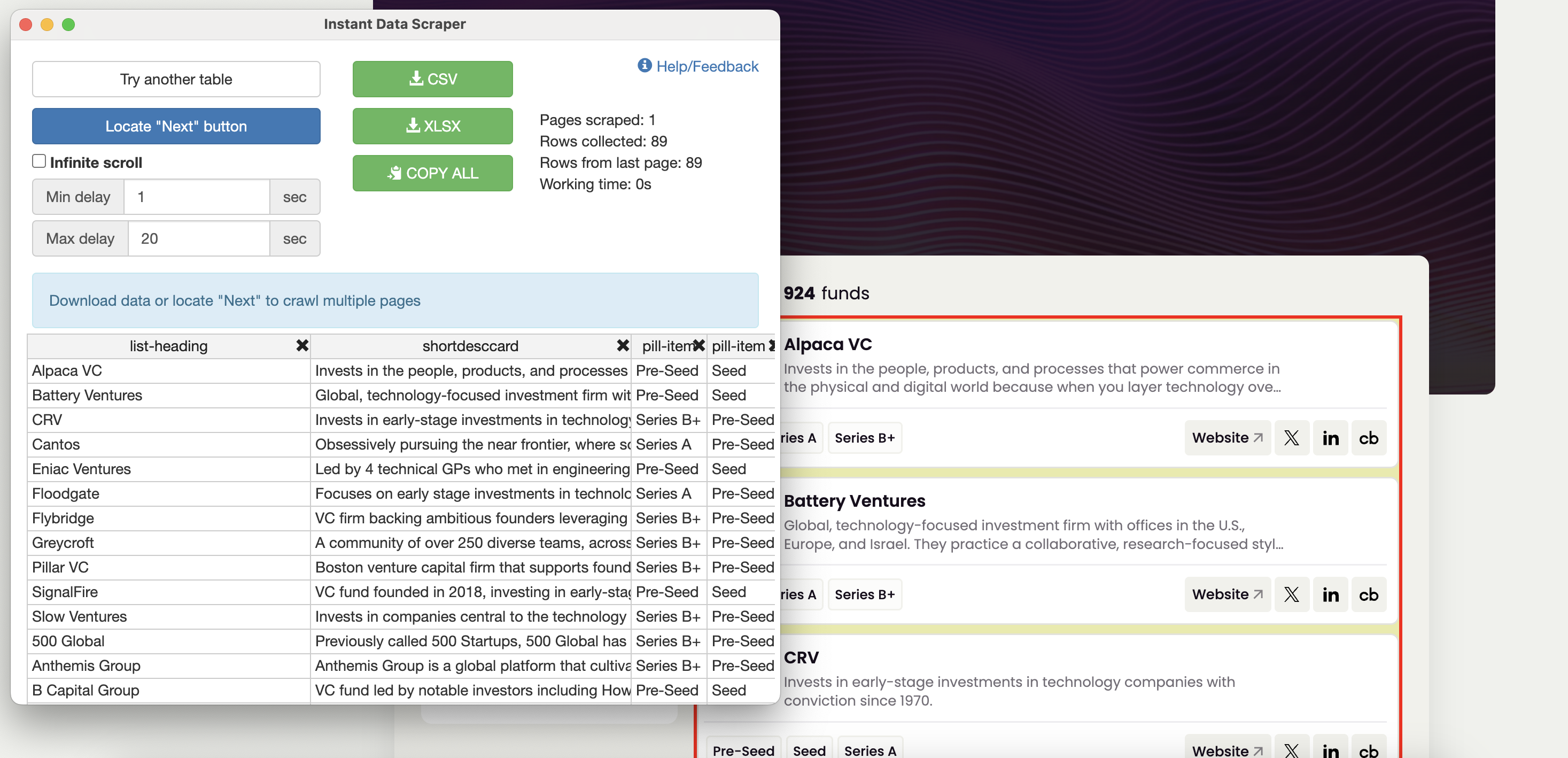

3.2 Scrape investors (advanced data acquisition)

A more advanced data acquisition strategy we use internally to acquire data that would be exclusive to us involves data scraping.

Data scraping is an automated process of extracting data from various data sources.

To scrape data from various places you can build custom scripts (requires coding) or leverage various no-code scraping tools.

Some of those tools are: Parsehub, Octoparse, and Instant Data Scraper (Chrome Extension).

When scraping data, the idea is to identify databases to scrape where you can access compiled data with as much information as possible. Still, as a minimum, a website URL - as URLs are always our starting point.

As long as we have a website URL of a specific investment firm we can always use data enrichment tools to obtain contact details of decision makers and other relevant data.

We can use tools like Instant Data Scraper to scrape all of this data and the output will be a CSV file that will include the Fund Name, Description, and a website URL.

Depending on the data source, you might get some or all of the following data points:

- Company name and website URL

- Prospect name and position fitting your perfect investor persona

- Prospect contact details

- Any other relevant information for your campaign

The more data points you extract from your chosen data source the easier the process will be but sometimes you might end up just getting a website URL of the target firm you want to approach, and that’s perfectly fine because at the end of the day it’s all you really need.

As long as you have the website URL, you can use tools like findyemail, anymailfinder, or snov.io to enrich the data that you already have.

And since the most commonly used channel is email; making email enrichment is the easiest.

Tools like Snov.IO allow you to upload domains in bulk, choose the job title of the person you are after and it spits out the contact details of that specific person for you.

However, it’s important to note that it won’t work 100% of the time and there will be a percentage of your list that you might have to enrich manually.

You can do that, again, using the Snov.io Chrome extension on the page of the specific company.

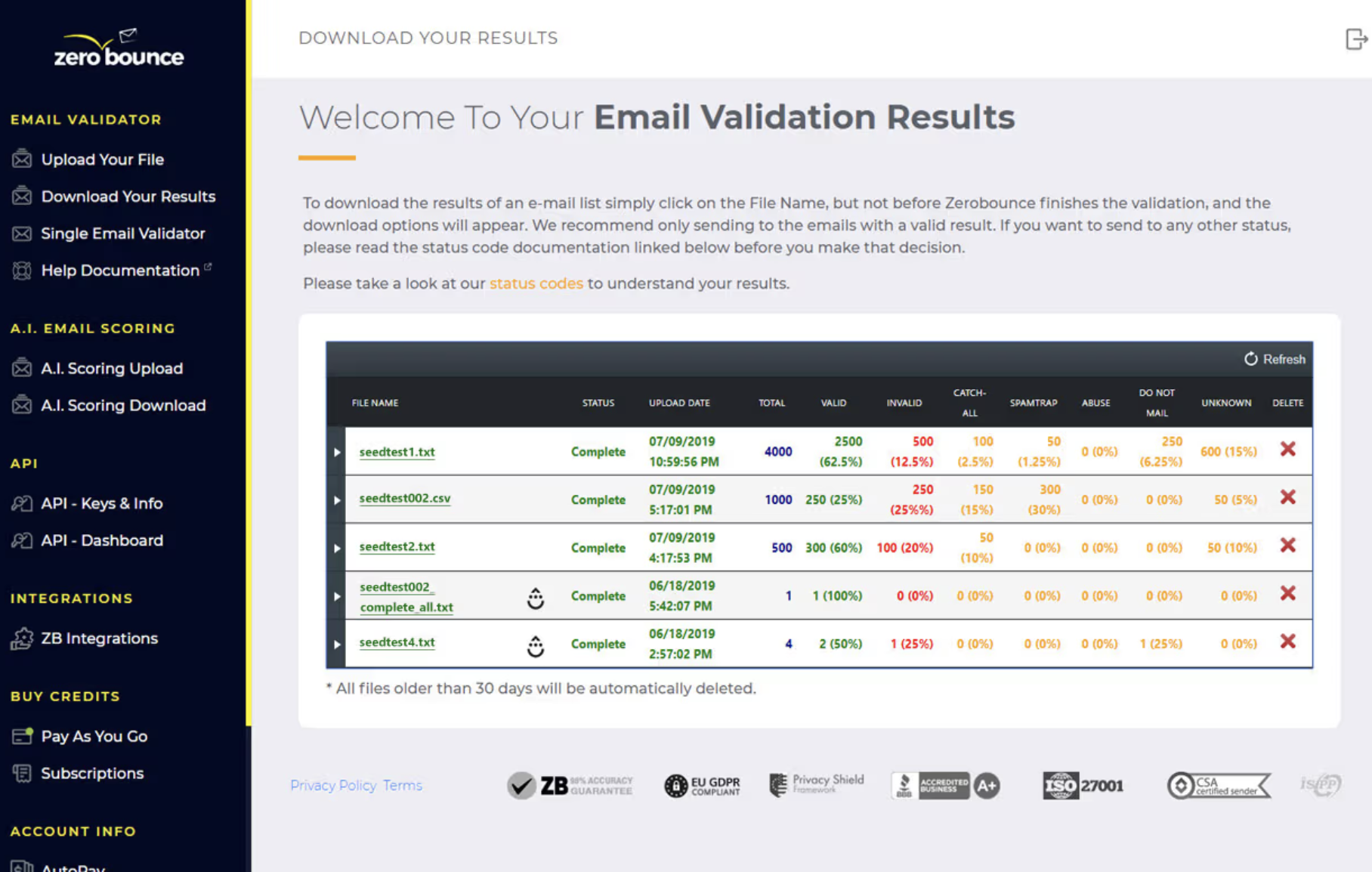

3.3 Clean up the data

Now that we've identified our ideal potential investors and have their contact details and other relevant data in actionable CSV files, we need to make sure that our data is, in fact, accurate.

It's extremely important to clean and verify your data using tools like ZeroBounce or MillionVerifier before you start sending emails. You only want to send to valid addresses that you know with certainty will not bounce.

Having low bounce rates is crucial to the success of your campaigns, and as a general rule of thumb, you should aim to keep your email bounce rate below 1%.

Both ZeroBounce and MillionVerifier are extremely effective and make it very easy to verify your data. All you have to do is drag and drop your CSV file into one of these tools and they'll take care of the rest for you.

And now that we have our investor lead list built out and verified It's time to focus on building the cold email infrastructure we're going to use to connect with them.

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now

4. Optimize your emailing infrastructure for deliverability

if you're using OpenVC, you can safely skip that section - it's all done for you. However, if you want to build your own emailing infra, follow the steps below.

4.1 Getting Domains and Creating Email Accounts

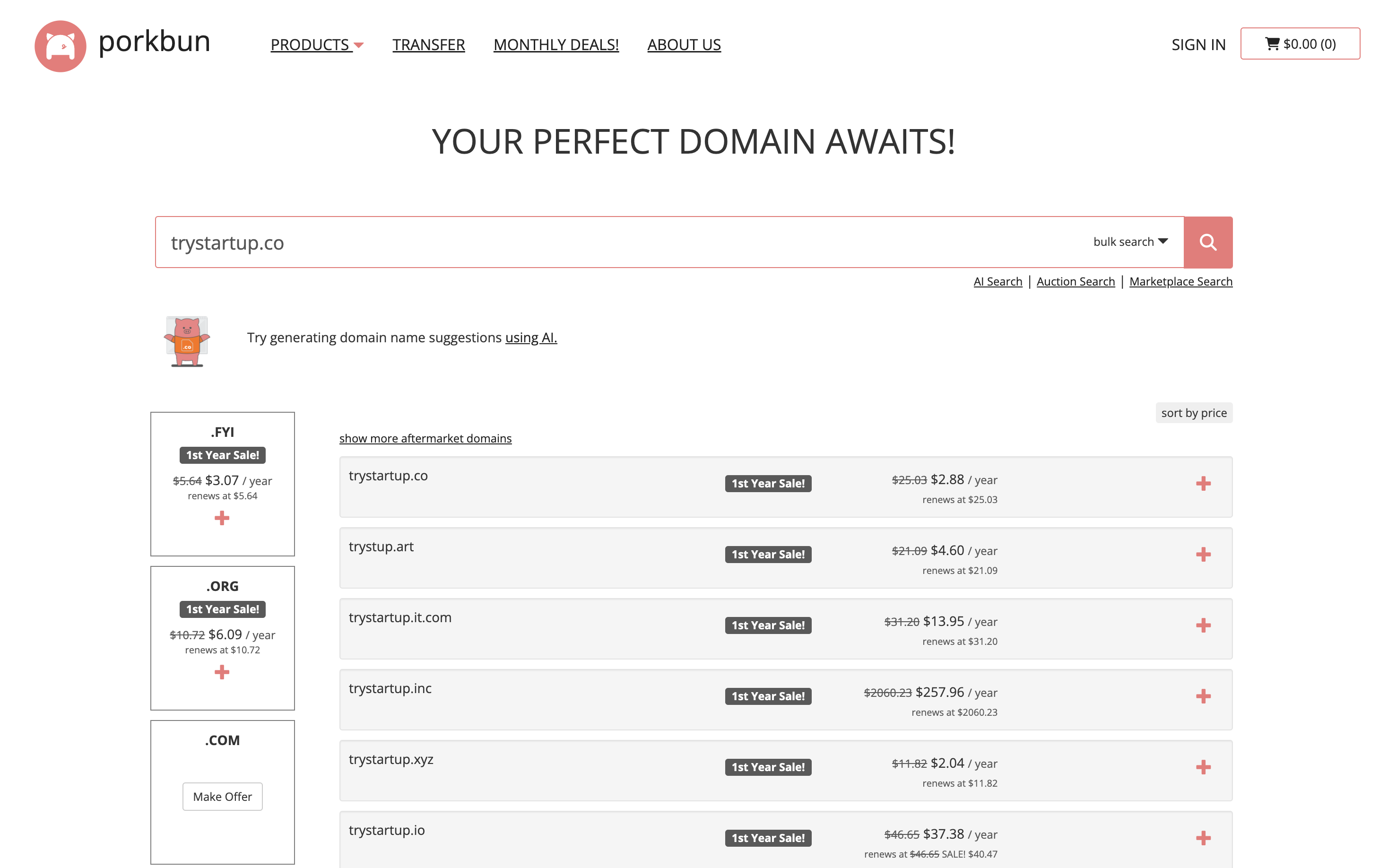

The first step in the process of setting up your infrastructure is to get yourself some brand-new domains that will be specifically dedicated to your cold email campaigns.

While technically you can use your main company domain to send out cold emails, by doing that you're running the risk of getting it blacklisted, especially if you're going to be sending out a high volume of emails on a daily basis.

I highly recommend purchasing your domains from Porkbun or GoDaddy and setting up your email inboxes on either Google Workspace or Office365. We consistently see the least amount of issues using these providers.

It is, however, always a good idea to have half of your inboxes setup on Microsoft Office365 and the other half on Google Workspace. This approach allows you to protect your infrastructure in a scenario where one of the ESPs makes updates to their filtering algorithms which can impact your deliverability.

We’ve seen this happen very recently and having your infrastructure setup in this way allows you to keep your campaigns running instead of having to completely kill them off while you pinpoint what exactly is causing issues.

Besides, a lot of cold email platforms have ESP matching feature which optimizes your email delivery by aligning your sending ESP with your recipient's Email ESPs.

Meaning your emails are sent from Gmail to Gmail and from Outlook to Outlook.

Now, when it comes to choosing domain names, the approach is relatively simple.

Assuming your company currently operates under company.com, for sending cold emails, you can simply acquire additional domain extensions. Among our personal preferred choices are: company.co and.net.

Alternatively, you can also make some changes to your company name and get domains like investincompany.com, companygroup.com, trycompany.com, getcompany.com, etc.

This part really boils down to your creativity, but as long as you keep your domains short and clear, everything's going to be just fine.

Now the next step is to estimate how many domains and mailboxes you need. To figure that out you can use the reverse engineering approach based on the daily volumes of emails that you're planning to send.

Here's how we internally determine the number of domains and mailboxes needed to send 500 new cold emails each day:Using these guidelines, we typically require between 25 mailboxes and 13 domains to be able to efficiently send out 500 emails per day.

- We aim to send out 20 cold emails daily for each mailbox.

- For each domain, we create 2 mailboxes.

This is a fairly conservative approach - technically you can send more emails per mailbox but we've found that using these guidelines, over a longer period of time we burn fewer mailboxes and see significantly better KPIs.

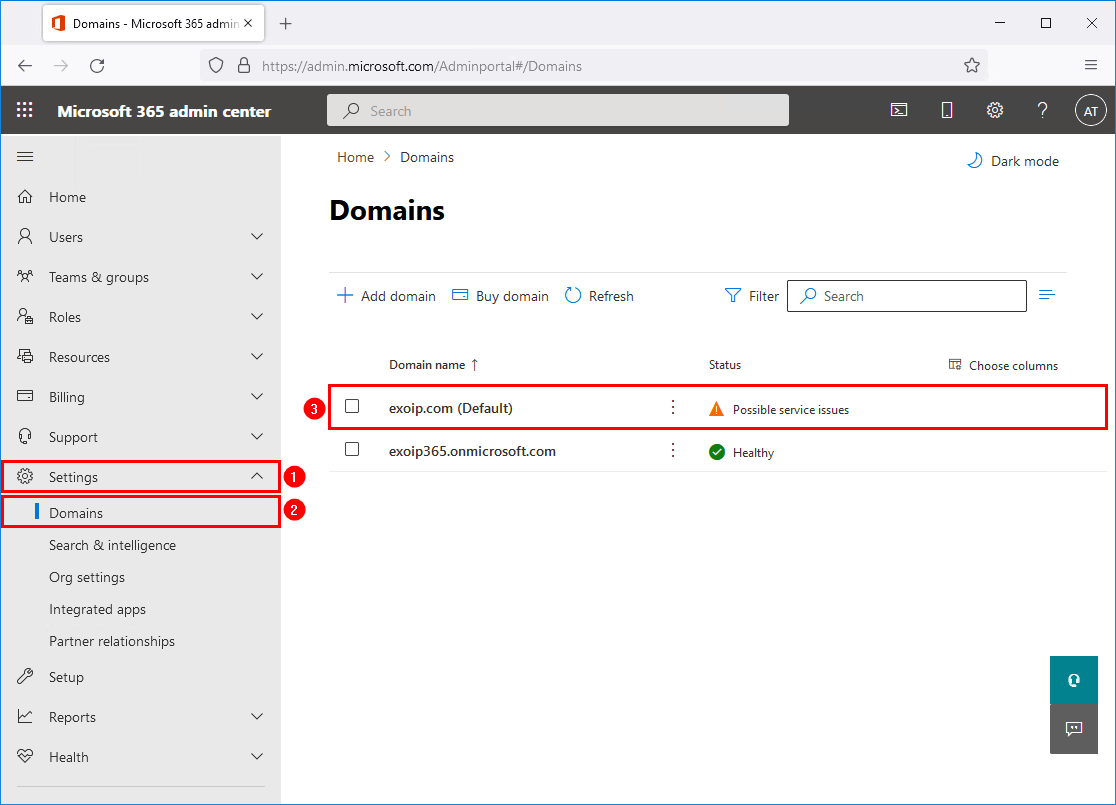

4.2 Configure your domain: SPF, DKIM, DMARC

In order to make sure the emails you send land in the primary folder and your email deliverability is pristine you have to authenticate your domains and set up the following parameters: SPF, DKIM, and DMARC.

SPF stands for "Sender Policy Framework" and it is used to specify which servers are allowed to send emails on your domain’s behalf. It is simply an entry in your domain provider’s DNS records.

DKIM stands for "Domain Keys Identified Mail" and it's another DNS record that serves the purpose of confirming that an email has been sent and authorized by your domain.

If you're using Google Workspace as your ESP, configuring Google's SPF records for your domain will signal that Google's servers are authorized to send emails on your domain's behalf.

This assures other email servers that messages sent from your domain through Google's servers are legitimate.

DMARC stands for "Domain-based Message Authentication, Reporting & Conformance". A DMARC record provides a sender with the ability to affirm that their emails are safeguarded by both SPF and DKIM.

Having all three of the mentioned records is vital for the optimal performance of your email accounts. In fact, it's worth noting that email providers, such as Google, might hurt your deliverability if these records aren't properly set up.

Below you can find the instructions on how to set up the records mentioned above for Google Workspace and Office365.

Google Workspace:Office365:

- For SPF configuration, refer to this guide for step-by-step instructions.

- For DKIM configuration, refer to this guide for step-by-step instructions.

- For DMARC configuration, refer to this guide for step-by-step instructions.

- For SPF configuration, refer to this guide for step-by-step instructions.

- For DKIM configuration, refer to this guide for step-by-step instructions.

- For DMARC configuration, refer to this guide for step-by-step instructions.

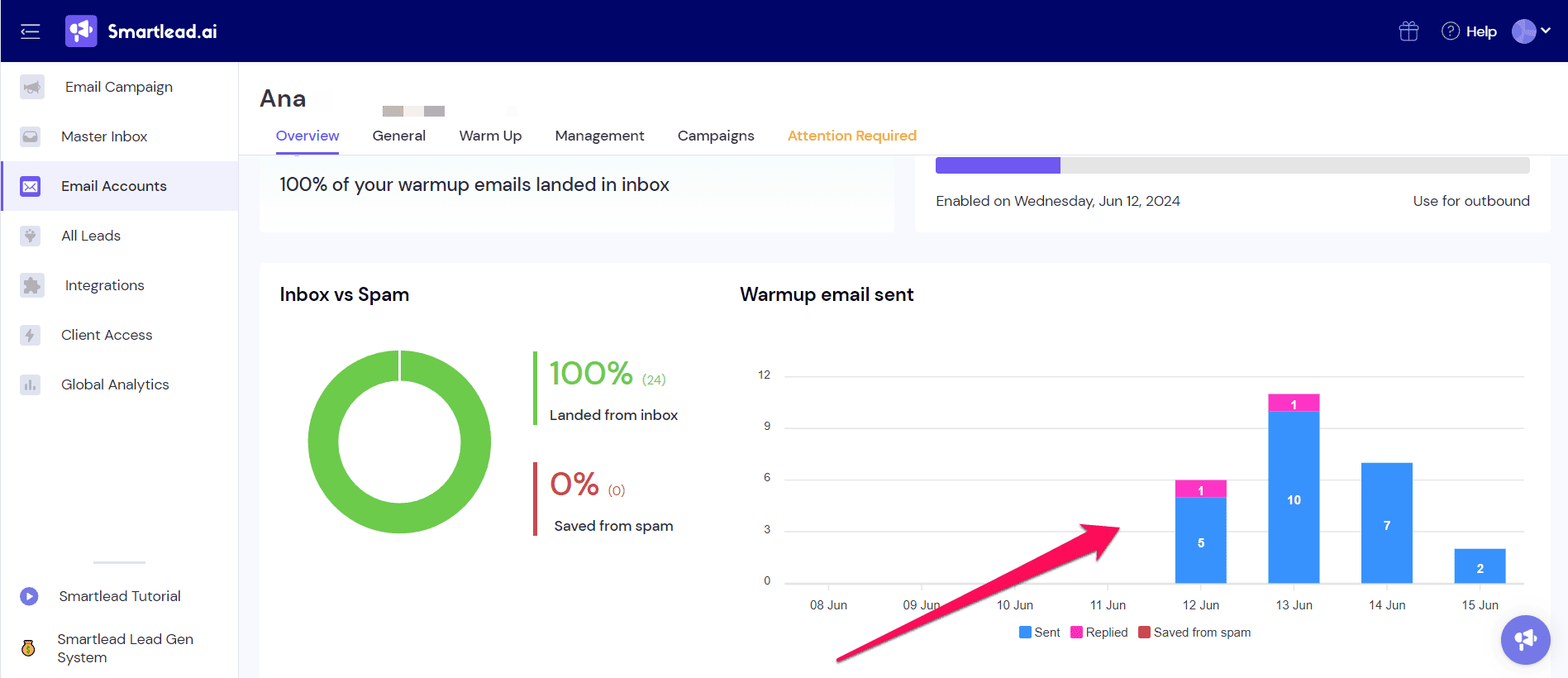

4.3 Warm up your email address

Once you have your domains fully set up and configured, before you start initiating your actual cold email campaigns, it's extremely important to first warm up your email inboxes to build up your sender reputation.

By doing that you increase the chances of your emails being delivered to the primary inbox rather than getting flagged as spam.

The concept behind the email warmup process is to foster meaningful engagement with your emails, such as opens, and replies, and marking them as not spam. By doing so, you signal to your email service provider that you're a credible sender, which in turn enhances your sender's reputation.

To warm up your inboxes you can use dedicated software (i.e. Mailflow.io, SmartLead.ai) which automatically sends, opens, and replies to emails while also making sure they're removed from spam folders.

The beauty of these software is that they work seamlessly in the background and are entirely automated so you can set them up and let them run.

As a standard practice, we typically recommend warming up your email accounts for a minimum of 2 weeks before beginning to send cold emails.

However, it's important to ensure that you keep the warmup feature active at all times, even when you start engaging with your target audience.

You can think of email warmup and cold emailing as two opposing forces: warmup builds and guards your sender's reputation, while emailing has the potential to harm it due to potential bounces and spam complaints.

4.4 Pick The Right Cold Emailing Tool

When running cold email campaigns it's extremely important to choose the right tools that will make your life as easy as possible.

Since we're dealing with multiple domains and multiple inboxes, we want to be able to manage everything from one place.

Therefore the ideal cold email tool should have features that would allow you to connect and rotate multiple email accounts so you could send your emails from one place without having to log into different email accounts, but also so you could distribute the workload between multiple domains and multiple mailboxes.

Additionally, you want your cold email tool to have advanced reporting features that would allow you to see and track your overall campaign performance as well as the performance of individual domains and email accounts so that you would be able to replace or remove unhealthy accounts when needed.

Moreover, having a built-in email warmup feature within the cold email tool you're using offers added convenience.

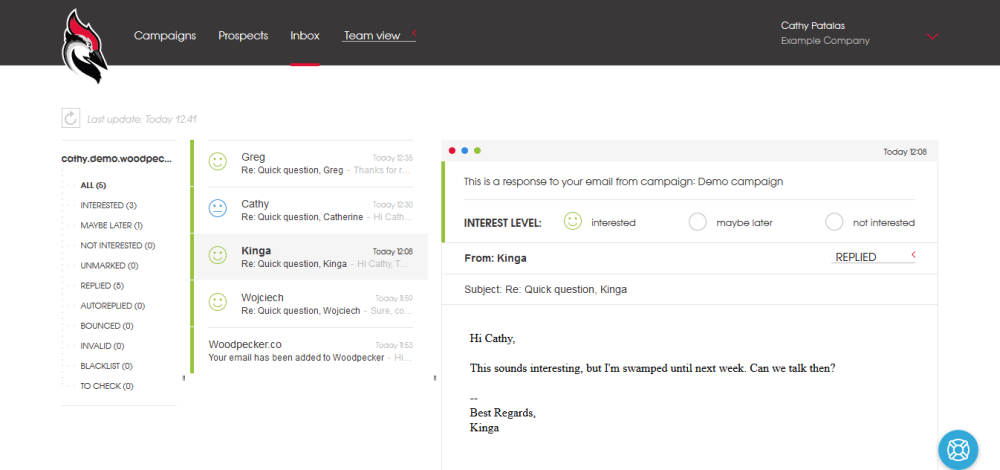

While internally, we use a couple of different cold email tools, my personal favorite ones are SmartLead.ai and Woodpecker.

Both of these tools have all of the features mentioned above, are extremely easy to use and we’ve never had any issues with them unlike most other software we’ve used in the past.

5. Run your cold outreach process like a machine

So we have solid content, data, and infrastructure. Now, we want a robust process to maximize the impact of our hard work.

1. Send your emails at the right time

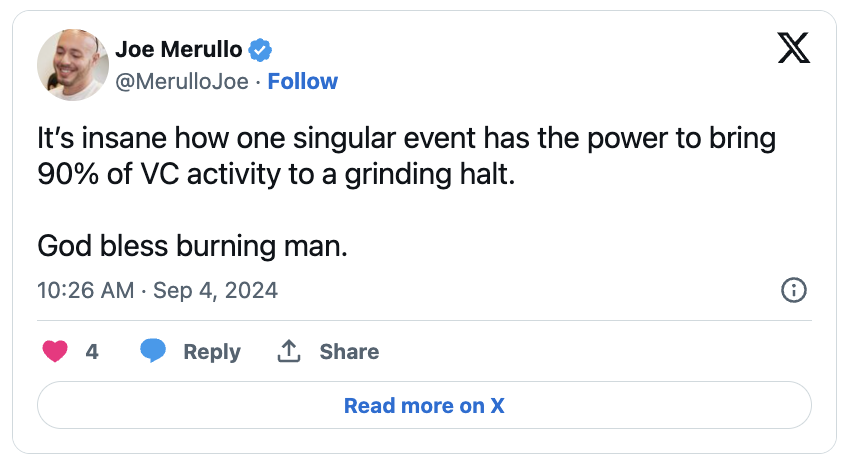

Email VCs on weekdays and during working hours to maximize exposure. Make sure to fit their time zones, not yours. Angel investors may also be responsive on weekends or in the evening.

Also, take seasonality in consideration. For example, US investors tend to be AFK during Thanksgiving or Burning Man.

2. Follow-up based on deck tracking

After sending your email, track it.

If your deck was opened and no reply, take the L and move on. It's a no. You can still follow up once, just for the sake of it.

If your deck wasn't opened, follow up once, then twice. Give 3-7 days between each email.

No reply after that? Then it's a pass.

Don't get frustrated - not replying is protocol for VCs. That's their way of declining.

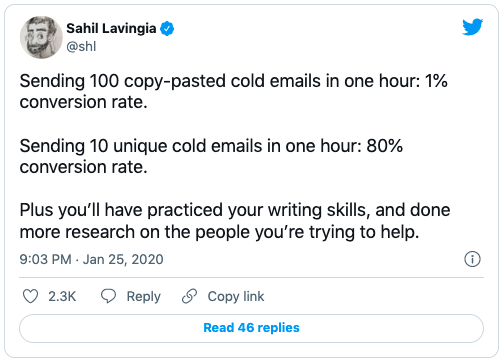

3. Secure plenty of time for cold emailing

It takes 10 to 15 min to craft one customized, high-quality email.

If you're emailing 100 VCs, that's 16 hours of boring work.

Secure a recurring time slot in your calendar and stick to it religiously.

Conclusion: If you do it, do it right

Fact: Warm intros are always better than cold emails.

An intro will guarantee you at least 5 minutes of attention - versus 2 seconds for a cold email.

Having said that, even well-connected founders eventually resort to cold emailing: one cannot just get a personal intro to hundreds of VC firms out there.

The benefit of cold outreach is that it's extremely scalable and it doesn't rely on any outside factors that you can't necessarily control in order to secure meetings with investors. With this playbook, you can literally fill your calendar with a steady flow of meetings.

And that's the beauty of cold outreach.

There's no shame in cold emailing VCs.

Just do it the right way 😊

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started