Fundraising cannot be entirely planned.

That doesn't mean you should go unprepared. Running a tight process with a clear schedule, good investor prioritization, momentum, and access strategy will increase your chances of success and save you a lot of time and stress.

Here's how to design a winning fundraising strategy for your early-stage startup.

Table of Contents

1. Prepare: fundability, terms, instrument, investor list

Before designing your fundraising strategy, make sure to complete the following points:

In other words, you know whether your company is fundable, how much you want to raise and at what valuation, what financial instrument you will use, and who you will raise from.

Ready? Then move on to the next step.

2. Schedule: Plan for 6 months, plus seasonality

Some rounds close in 3 weeks, others in 9 months.

Hard to predict because it depends on so many factors: how much existing network the founders have, how hot the deal is, and also… sheer luck.

As a rule of thumb, prepare for a 6-month journey.

(Side note: This means you should have enough cash in the bank to last AT LEAST 6 months. And more is better! VCs smell desperation. You don't want to be raising from a position of weakness.)

On top of that, you should factor in seasonality. Indeed, some times of the year are better than others to get a term sheet.

Basically, July and August are dead months. Same with Christmas/New Year. May is slow, too - Labor Day, Memorial Day. Finally, early November is Thanksgiving time in the US, so not a great time for a term sheet either.

Should you optimize for seasonality, though? Yes and no.

On the one hand, you should expect a slower pace on the yellow and red weeks. Not only are VCs out of the office, but so are their lawyers (for paperwork), experts (for due diligence), and fellow VCs (for co-investment). Behind the curtains, getting a term sheet is teamwork.

On the other hand, if you're a hot, competitive deal, VCs will figure out a way to make it work - even if it means taking a call from Burning Man or Aspen.

Lastly, seasonality is true for bigger VC firms, not so much for smaller investors. An emerging VC is hungry to build his/her track record, and will move faster. The same goes with angel investors - they might actually be more available on evenings, weekends, and/or holidays.

Bottom line: build relationships all year-round, but don't expect to close in August or December.

3. Prioritization: Define your first + last waves of investors

Don't activate your whole investor list at once. Instead, work in batches/waves/cohorts.

In the first wave , include the investors that are most likely to say yes - those who already know you, trust you and/or love you. This is key: the sooner you get a term sheet, the faster your raise accelerates. Same if you're raising with SAFE - get that first big check in ASAP.

The last wave includes the investors you want the most, typically the ones with the biggest names, and also the hardest to reach. Think Sequoia, A16Z, or a very high-profile HNWI. We leave them last because by that time (a) you will be much better at pitching, and (b) you will have most of your round secured, which will make you more attractive.

In between, you can add 2-4 more waves. Don't be too specific, things move in surprising and unexpected directions anyways.

⚡️ Pro tip: In OpenVC, move investors from Shortlist to the CRM "To be contacted" to build your first wave.

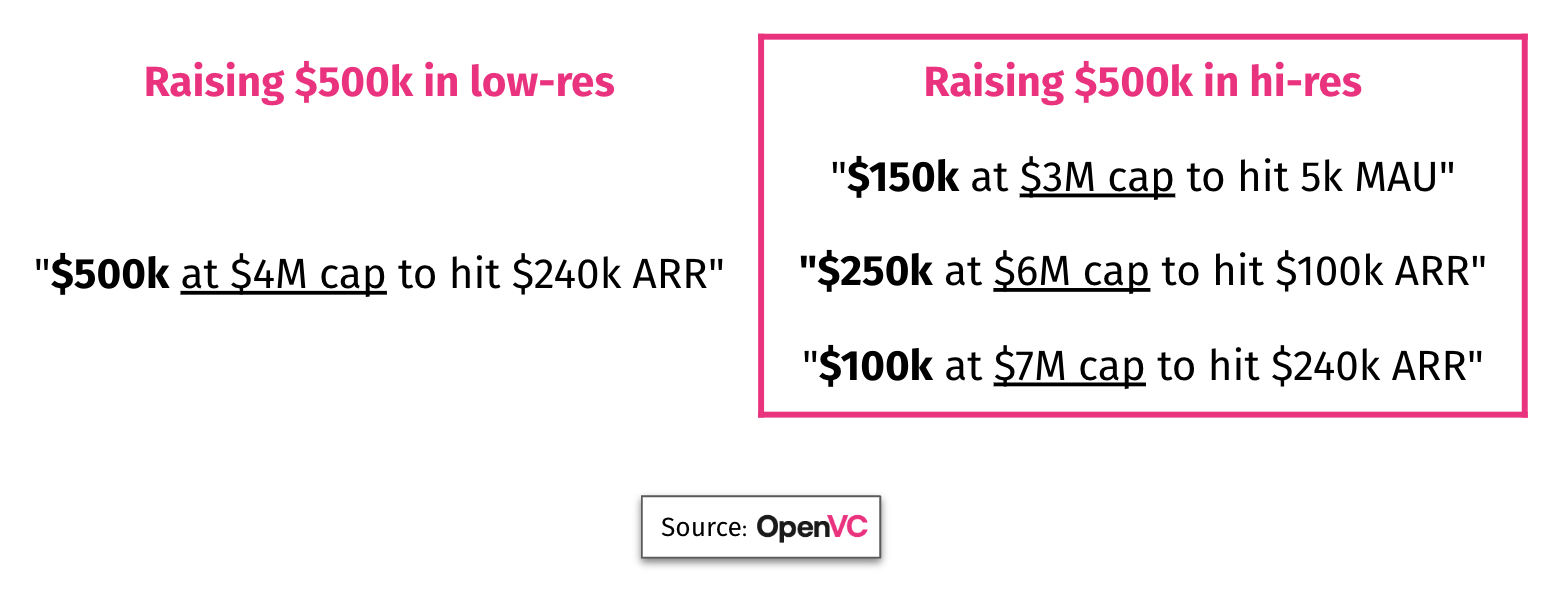

4. Momentum: Use hi-res fundraising to hook in the first checks

If you're raising with SAFE, you can use "high-resolution fundraising" to gain extra momentum.

Initially described by Paul Graham, "hi-res" consists in slicing your SAFE round into smaller tranches, whose terms gradually increase as you hit bigger objectives.

For example, let's say you plan to raise $500k at a $4M cap to get to $1M ARR.

Instead, you could do a tranche of $150k at $3M cap, then another tranche of $250k at $6M cap, and finally a last tranche of 100k at $7M cap. For each tranche, the goals would increase accordingly.

This doesn't cost you more equity and gives you an extra hook to reel in the first checks.

Because the first few checks are critical, high-resolution fundraising can be a great way to kickstart your raise. Just make sure you understand how SAFE convert (read here).

5. Access: Determine the optimal approach for each investor

Now, grab your investor list.

There are 4 ways to access investors: direct, intro, inbound, and outreach (more on that later). For every investor on the list, determine the best approach:

- If they are in your existing network, mark them as "Direct".

- Else, if you know someone who can make a solid intro, "Intro".

- Else, if they are active on social media, "Inbound".

- Otherwise, "Outreach"

Write it all down in your CRM. This will lay the groundwork for the next step.

6. Process: Set the Fundraising Wheel in motion

The Fundraising Wheel is the core framework that describes the basic dynamics of a raise.

Here's how it works (see image below):

- Secure the first checks from your existing network. This is family, friends, your professional network, but also the people who could make intros for you. Don't be afraid to accept small checks - this will help with the next step.

- Ask every person who invests to introduce you to their network. The most credible intros come from people who invest in you. That's why accepting small checks is strategic: every new check opens up new intro paths.

- Occasionally, you may receive inbound interest from an investor. Same process - take the check, then ask for intros.

- Rinse & repeat. Every "spin of the wheel" expands your network a bit further and allows you to reach bigger investors who were previously out of network. Think of it as a ladder: you're building the steps as you climb it.

- Go cold at the end. Secure as much funding as possible before going cold. That way, you can open your cold email with "50% committed" or "Lead investor secured". This will dramatically improve your success rate. So, go cold at the end.

It's a simple process. But simple things work best :)

Conclusion: Time to kick off that raise!

Put together preparation, schedule, prioritization, momentum, access, and you have yourslef a nice fundraising strategy. Congratulations!

Now, you must be wondering: how EXACTLY do I execute on this Fundraising Wheel?

Can I even raise from my lower-middle class family and friends? How do I get intros when I have no network? How do I send a cold email that get replies? And what even is inbound fundraising?

This will be the topic of our next 4 posts:

See you there!