"Your project sounds cool, but I'm not sure this is VC fundable".

Silence. Blank stares.

"What the heck did he just say?"

If you're raising funds, you may have heard of VC fundability. It is a simple but important concept that you need to understand before you start raising.

Here's a simple explainer.

Table of Contents

1. Your model is not scalable or capital efficient

A typical seed investor looks for 100x return within 7 to 10 years.

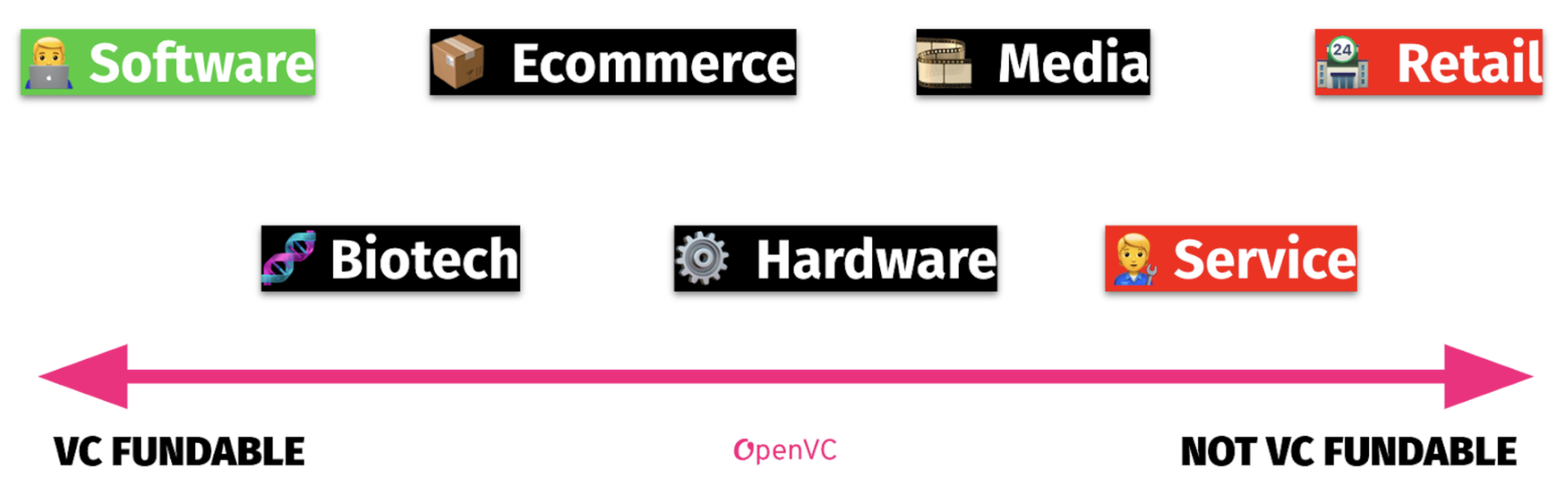

For that reason, VCs love software, which is highly scalable and capital efficient. On the contrary, VCs will usually shy away from retail, service, and less scalable models.

Don't waste your time with VCs if you're starting a gym, restaurant, consulting, farm, mining operation, or real estate business. It's just not what they invest in.

Sorry guys, not VC fundable... Well, not tech VC at least.

In between, you will find product types like biotech, ecommerce, media and hardware, that are not quite as capital efficient as software, but do get funding from specialized VCs.

At the end of the day, the spectrum of fundability models looks like this:

By the way, it doesn't mean that you project is bad. VC firms play a very specific game with very specific rules - and most companies are not just the right fit for that game. Rest assured that you can build a huge, amazing company without VC money.

You just have to take a different funding route.

2. Your market is too small

A typical seed investor wants to turn a $1M check into a $100M return. If they invested at a $10M valuation, your business needs to be worth $1B+ down the road for the math to work.

Now, assuming a typical software company is valued 10x its annual revenue (which is generous in today's market), it means your company needs to make $100M in sales every year.

This is where we get to market sizing:

- If your total market is $50M, there's no way you can make $100M in sales - ever.

- If your total market is $50B, getting 2% of the market amounts to $100M in sales

For reference, $50B is the global market size for CRMs in 2020. Now, you probably only sell to a sub-segment of customers (e.g. SMB or enterprise) and probably only to a specific geography (e.g. US or Western Europe). So your actual market size is actually even smaller than that.

Tweet by Gale Wilkinson. You should follow her.

Now, market size is a controversial measure. For one thing, people are terrible at assessing market size. Some startups are so transformational that they create new consumption habits and create new demand out of thin air. Few would have bet on Airbnb in the early days just by market size.

Nevertheless, it is a criteria for many VCs, hence making you VC fundable or not.

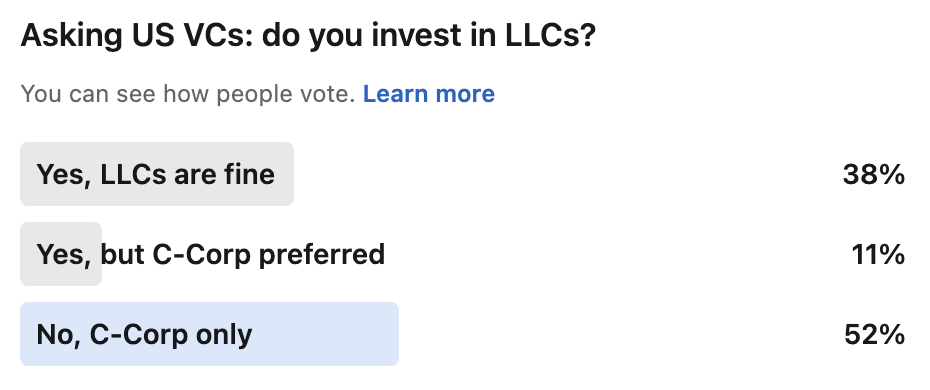

3. You have the wrong type of legal structure

In the US, most VCs want to invest in a Delaware C-Corp. In France, they want to invest in SAS entities.

There are tax and legal reasons for that. Just roll with it.

If you incorporated in the wrong jurisdiction or with the wrong type of legal entity, you will cut yourself from most investors.

Make sure to fix that before starting to raise.

4. You have a broken cap table

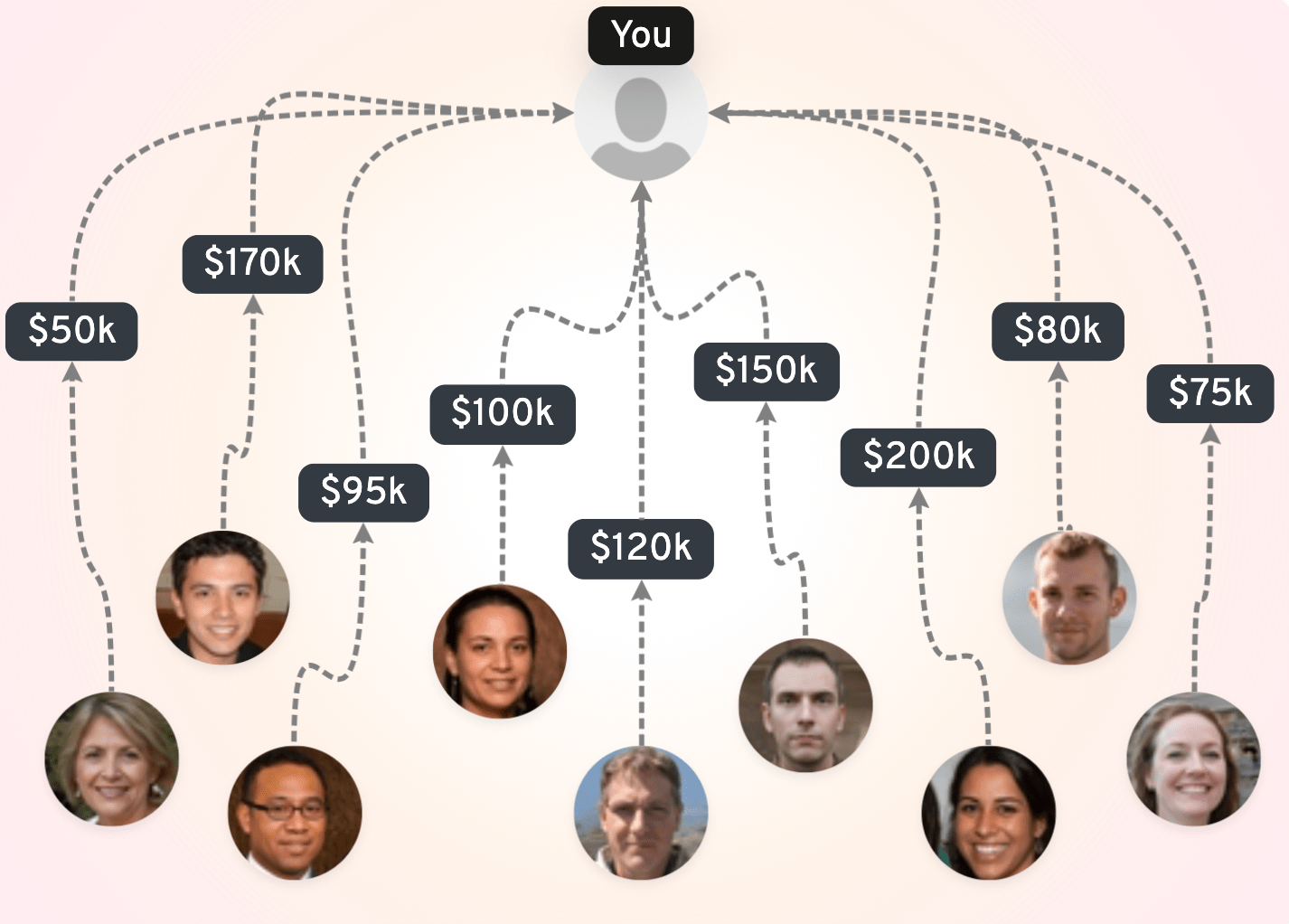

Investors have standards in mind when it comes to what your cap table should look like.

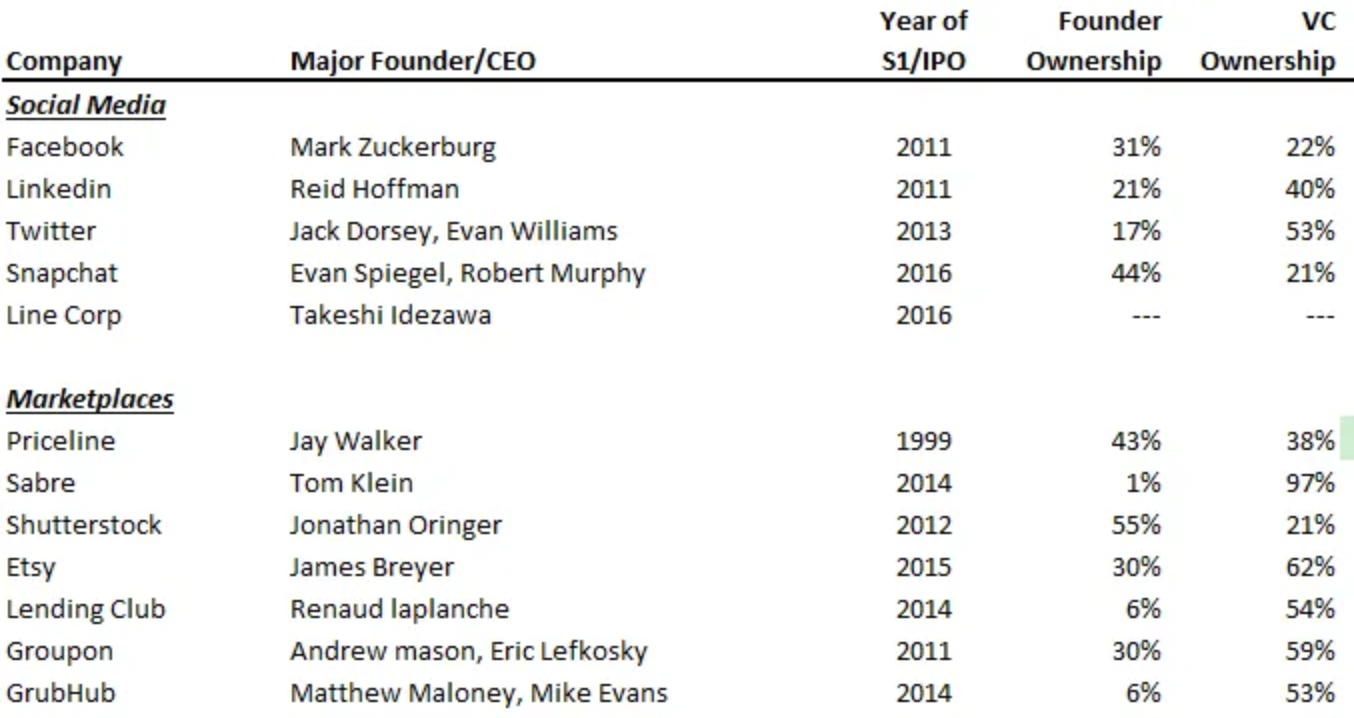

- The founders should collectively own more than 50% of the company after Series A, which roughly translates into collectively owning 70% after seed.

- If the project is a university spin-off, the university should own ~5% of the company, not 20% or more like is sometimes the case.

Your cap table is a resource. If you have enough of it, you can raise more rounds in the future and keep growing the company. Conversely, if you don't own enough of your company, why would you work so hard? There is a financial and psychological reasoning here. VCs understand this.

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now

5. Your company doesn't own its strategic IP

This is mostly for science-based startups e.g. deeptech, biotech, etc. when one co-founder invented the technology and patented it. If that's the case, the patent should be transferred to the company before you raise funds (and the founder can absolutely be compensated for that - be it in cash or equity).

The same goes for technology transfers from university. Strategic IP should be owned by the company itself, not by the university it came from.

Otherwise, this is a deal breaker for VCs.

6. You don't have enough signal (yet)

A typical VC sees 1,000 companies per year and invests in 10. So it takes a lot to get them excited.

To get a VC excited, you need to have "signal". Signal can vary from VC to VC but usually consists in outstanding achievements regarding your team, traction, or funding round.

Here are some examples, take it with a grain of salt.

| Strong signals | Weak signals | Not signal |

|---|---|---|

| • 2x exited founders

• Term sheet secured • MRR growing 30% MoM • Deal closed with big co • FDA approved (medtech) • Backed by tier 1 fund |

• Ex-Uber/Google team

• Soft commit from fund X • 2k active (free) users • Pilot in progress with big co • Patent granted • Stanford/Harvard/MIT team |

• "Motivated team"

• "In talks with fund X" • Waitlist/Mockup but no user • "In talks with big co" • Patent pending • "I'm an inventor" |

The stronger the signal, the more VC fundable you are. I recently came up with this little framework that gives you a rough idea of where you stand.

Most founders fall into the "Typical founder" category. They have a good project in theory: sound idea, large market, balanced team. However, the lack of signal makes their fundraise extremely difficult.

They are VC fundable on paper, but most likely not VC fundable (yet) on the market.

7. You don't want to play the VC game

When you raise VC money, your startup becomes a financial product.

Investors expect you to double or triple revenue every year. To achieve that, you will have to burn cash aggressively and continuously put your company in danger. You will raise funds every 18 months, and if you can't, it's game over.

Your investors want a big exit - an IPO or an acquisition that delivers a 100x return. If you can't or won't deliver, things can get ugly.

Some founders could have had a gorgeous, million-dollar cash machine and be set for life. Instead, the VCs pushed them to the billion-dollar dream. So they worked the hardest 5-10 years of their lives and ended up with NOTHING.

This is the VC game. Some founders are completely fine with that, while others hate it. If that's your case, then you probably shouldn't raise VC money.

Bonus: What if I don't have enough signal yet?

Most founders start as "non-VC fundable" and work their way towards fundability.

Fundability is not a state, it's a process.

The first step consists in measuring your fundability. For that, we built a free Fundability Calculator. Take the test and measure your fundability in 7 minutes at fundability.app.

If your fundability is low, here are the 5 steps I suggest:

- Accept it. You may still raise, just later than you thought. Tons of first-time founders underestimate what it takes to be fundable, so don't beat yourself about it.

- Buy yourself some time. Get to "default alive". You need time to figure things out. This may involve cutting costs, doing consulting on the side, selling LTDs, etc.

- Design a realistic path to fundability. Lower the bar for your MVP, bring in the missing team member, get the first $20k of MRR that will make you fundable.

- Consider bootstrapping. If you put ego aside, bootstrapping is a valid route for many vanilla software startups. Ask Mailchimp how they feel about it.

- If you really need funding to get to fundability, consider raising a smaller round from accelerators, family, friends - not VCs and angels. Btw, $1k checks are great.

Lastly, you can always try to spin a great story and raise on FOMO. Some people excel at that. That's not for everyone, though.

Final thoughts on VC fundability

I believe that the conversation about VC fundability is criminally absent from social media. Experienced founders know this stuff, and they time their fundraise expertly. On the opposite, first-time founders believe they can "just raise", and kill their companies in the process.

There are conditions and a right timing to raise, and you don't get to decide.

As a final thought, I'll leave you with my favorite tweet on the topic by Beata Klein from VC firm Creandum:

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started