British entrepreneur Nick Telson sold his startup Design My Night in 2017. He went on to become a successful tech investors with 50+ checks signed worldwide. Today we discuss his journey in the venture world, from startup to a $30M exit and beyond.

Shaun Gold: Alright. Hello, hello and welcome to our next exit interview, where I have the lovely Nick Telson with me. How are we doing, Nick?

Nick Telson: I'm good. You're alright, Shaun?

Shaun Gold: I'm good. First off, thank you for doing this. The principle behind this interview is simple. We're talking about your entrepreneurial adventure without any fluff. We're not sugarcoating anything. We're going to go from startup to exit. The goal is to go beyond the press releases and the social media and really understand the secret sauce of your success in order to educate and inspire future founders and entrepreneurs. With that being said, are you ready to rock?

Nick Telson: All right.

Shaun Gold: So introduce yourself. Just tell us a little bit about your background and your journey.

Nick Telson: Yeah, sure. I'm actually a language student.

Shaun Gold: I saw that. I don't want to just interrupt you at the first sentence, but I have to ask, you didn't get a degree in business at university, correct?

Nick Telson: Shock, I know. It's probably the best thing I ever did as well. Languages, I think, are great because it gives you confidence, communication skills, and elements of leadership. It's very wide ranging. You obviously don't just learn about the language, you learn about the culture, the history, the literature. I love languages and it's the only thing I'm good at, so I had to do languages. Loved it. Then, that got me onto the graduate scheme over here in London at L'Oreal, the big beauty brand. Back in the day, that was a very popular marketing grad scheme, so I was fortunate to get on that. Worked my way up there for three, four years to marketing manager of one of their brands, which was amazing. Stayed in London, then decided to go at it alone in my mid 20s with my co-founder, who's also my best mate at university, Andrew. We set up a company in the UK called Design My Night, which was, on the one hand, a B2C offering of sort of where to go out in London, and on the other side there were three elements of SaaS - reservation software, ticketing software and vouchering software for pub, bars, and restaurants. We bootstrapped it. We only ever raised half a million pounds from six angel investors. We grew that over seven years. Over 100 people, 15,000 SaaS customers and about 8 million uniques a month on Design My Night. We spread that to 22 cities in the UK, exited in 2017 to a UK software unicorn. We then had a two year earn out with them, which led to the end of 2019. Since then, been angel investing. I've angel invested in over 50 startups across the world. And then recently, Andrew, myself and a third co-founder just started a new business called Trumpet. And a podcast called Pitch Deck, which is like Shark Tank, but real life,

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started

Shaun Gold: Wow. You have a really unique journey. I mean, every founder has a different path to exit and success, but I want to get into the weeds of it. Going back to your degree, here in the States, there's a lot of backlash about the price of university and the actual value of a degree. So if you were to get a degree in languages here, people might laugh at you. Why are you doing that? You should be focusing on something so you can get a good job and get hired. You already said that language was what you were good at, you wanted to do it, it's what you enjoyed. But would you say you wish you had studied more business at university or were you happy with the path that you chose?

Nick Telson: Yeah, definitely not. As in, I wouldn't have done business. I've got friends that did business and they have then gone into the real world and said they haven't learned any of what they learned in their business degree. So for me, it was great to do languages. I know at least in the UK, languages are quite highly thought of in the corporate world, which is where I started out. For me, university was more about finding myself, coming out of my shell a lot more. Obviously, I've made friends for life, but I'm not someone that says you have to go to university to be successful at all. A lot of our hires, especially at Design My Night, never went to university. So I'm also a big advocate for just getting out there. If you want to work from startups or be an entrepreneur, go and work for a startup in an early role there and work your way up, learn the ropes. I don't think there's a right or wrong way for anyone, but you definitely don't have to go and learn business to then succeed in business.

"You don't have to learn business to succeed in business"

Shaun Gold: Understood. So do you think entrepreneurship, even as a part time student, or do you think just the value of a degree in 2023 going into and beyond, especially for startups and entrepreneurship, is just not needed? Is it just kind of a relic of the past?

Nick Telson: I think it really does differ from person to person. I think if you want to get into entrepreneurship or if you want to be a founder or work at a startup and you also have the means and want to go to college or university, then why not do a course in entrepreneurship? But you definitely don't need one to make it big in the startup world. I really, truly believe that.

Shaun Gold: Well, you're living proof you heard it here first. Okay, so very helpful. Now, as a former Nightlife Ninja myself, I'm interested to hear about how Design My Night came about. Was it the result of you trying to find some party to go to and not having a resource and just being annoyed? Or were there other offerings that you thought were terrible? Tell me about it.

Nick Telson: Believe it or not, it came from New York. Andrew and I were on holiday in New York and we were very drunk one night in Benny's Burritos in Greenwich Village. And we came up with the idea that night when we were thinking back to where can you search to go out in London? It sounds crazy. This was when we were ideating in 2009. That was like thinking about Millennials. That was Mobile First. So not that revolutionary if you think about it now, but back in the day, there weren't that many offerings. We were also thinking like the concierge at the hotel when we said "we want to go out tonight", he was like "Where do you want to go out? What music do you like? What areas do you want to go out to?". So I think that started us to think if we could translate a concierge service into a going out website and make it more like Millennial Focus mobile first, you could be onto something. So, yeah, we started Ideating that night and then when we came back to London, we properly dug into the idea.

Shaun Gold: So it was born out of a night of drunken debauchery, is what you're saying?

Nick Telson: Correct.

Shaun Gold: And they say alcohol kills brain cells. All right, nice. So you and your co-founder, you were still working your full time jobs, correct?

Nick Telson: Yes, so we worked our full time jobs for probably about a year when we were building the website. So we met up every evening, every weekend, and it was a proper side hustle. And then after a year, I left my job and then Andrew stayed at his. He worked at Accenture, so he was earning a lot more than me. So we actually split his salary for six months.

Shaun Gold: Oh, wow. That's a good friend.

Nick Telson: Yeah, I was building the business with no salary, so we were like, let's do that. So we did that for six months and then we started to see traction. So then he made the leap as well. But we worked hard that year to save all the money we could. We never went out, we didn't really socialize, we didn't eat out in restaurants, and we just saved as much money as we could for that year, knowing that we would have to make that last when we fully left our jobs.

"I left my job, Andrew stayed at his, and we split his salary for six months."

Shaun Gold: Yes. I'm always interested in seeing how early stage founders do it. Not so much as the runway of the business, but the runway of the rent, the groceries, a social life, if any. So you guys just focused and built. That's what it was. There was no partying, there was no going on trips. It was just that he went to his real job. You worked on the startup, he came home and then joined you on the start up and that's how it was and split the salary. And that's how it was until you both became full time, correct?

Nick Telson: Yes. We were privileged enough that both our jobs were well paying jobs. It's not that easy for everyone to just save for a year to then have enough capital to then go and run a startup. But that worked for us and we knew that if we just hunkered down for a year, we would save enough to keep us going - living very leanly still, but keep us going.

Shaun Gold: Did you live together or did you live in your own flats?

Nick Telson: We lived separately. What we did do was one of our best mates worked at Google in London, so we used to go and visit him like three times a week for free lunch and we stole all the snacks from around his desk and that was our dinner. We did that for quite some time as well. So thanks, Google!

Shaun Gold: And they say offices have no benefits there. So after going full time on your startup, was there a period that you missed, like, the comforts of a day job, as in a structure, a salary, benefits, the safety, essentially. How did you deal with that mentally as you were sitting there building something and hoping it worked out or what were your thoughts?

Nick Telson: I think we were so focused on it being successful that we didn't miss the structure and we were so used to living leanly that we didn't sort of miss the salary as such. And we were just so excited by building Design My Night. Well, I would say over the first three years, I did miss the way that if you work for a job, you can just turn your brain off. So I would think it'd be so nice to not think about some Design My Night in the evenings or go on holiday and think about Design My Night or on the weekends and think about Design My Night. I did miss closing that office door at 05:00, leaving the L'Oreal office and not having to think about L'Oreal until the next day or after my holiday. I think the stress of just the relentlessness of thinking about Design My Night constantly did take its toll. That was the only part that I did miss about the safety of the corporate world.

Shaun Gold: Understood. What did you and your cofounder do to cope mentally? Did you have daily walks? Did you have someone to talk to? Was it exercise? Startups are generally very difficult on the mind because they're one-way trips. There's essentially no guarantee that you will be successful, that you will have an exit. Statistically speaking, one of the hardest things to accomplish is to be a successful startup founder. So my question, I guess: it's Wednesday afternoon, you've been working on this all morning, you know, you've got limited funds, there's no salary, you know, there's no easy way out except going forward. How did you cope mentally?

Nick Telson: I think it wasn't talked about as much back then, so I think there's a lot of information out there now. There's a lot of other founders talking about it, which is good. I think back in those days, there was no sort of secret source to do it. Exercise was definitely one of them. But I think just having each other, I think we were best mates as well, so we knew when to make a joke out of things, when to have fun. We were very good that if one of us was down, the other one would be up and vice versa. Any doubts we had, if one had doubts, the other would pick you up. So, yeah, we didn't meditate, walk every day, eat specifically healthily, all the things that people do now and should do. But it was just leaning on each other as sort of best mates rather than founders to pick each other up when we needed to.

"The stress of thinking about Design My Night constantly did take its toll"

Shaun Gold: Understood. When did you raise your first angel round? How many years into the business was it?

Nick Telson: So about two years, one and a half years in, we raised £250,000 from six angels and then they followed on the following year with another $250,000.

Shaun Gold: And with that money, did you use it for your personal expenses to maybe take yourself out for some food? To say, we're going to reward ourselves because we're tired of eating the snacks from Google for the 10th day in a row. If I eat one more Kind Bar or Cliff Bar, I'm going to lose it. Was it all 100% of the business or was it used for personal expenses, rent, food? Tell me about it.

Nick Telson: It was probably 80% business, so we did pay ourselves, but a small salary.

Shaun Gold: Could you tell us, because I know there's a Ramen salary, which I wrote about, and how much founders pay themselves? The Ramen salary, the broke-is-all-hell flavor, but could you tell us how much it was? Was it something that was laughable? I mean, of course it's laughable compared to an office job, but was it something that just was to cover your food and your expenses, or what was the exact amount or what was it used for?

Nick Telson: At the start, it was probably around 18,000, £20,000 a year each. Back in the day, that would be like a very low entry salary job somewhere. But for us, that was enough to then be able to just live a teeny bit better, at least, and just give us a bit of security. As the business grew, obviously, we then started to pay ourselves more. We never paid ourselves loads, so actually, when we exited and we had over 100 people, Andrew and I were probably in the bottom 60% of earnings for the company. So we never actually paid ourselves low because we were so EBITDA driven and we were like, well, there's no need to pay us a big salary because our big salary is going to come when we exit. We never actually paid ourselves a fortune, but, yeah, having taken that first round, we could pay ourselves a small amount, but the rest was definitely like hiring. Before that, we hired interns, university students that wanted experience, so there's like a very young, inexperienced team that was just there to help out. So for the first time, we could hire a CTO, we could hire a content manager and actually start to build the team to build the business.

Shaun Gold: Did you guys have an office at the time or was it just working out of each other's flats?

Nick Telson: At the start? It was each other's flats. Andrews lived in South London, I lived in North London. So we used to meet in a Starbucks in central London on Regent Street most days because it was huge and they had good internet. And then when we raised the first round, we got a very small crappy office, but we actually stayed there for two years.

Shaun Gold: Then you moved to a nicer, bigger office afterward? Or was it that we work or what? I would like to ask what the next step was. You hired all these people. Do we all just meet at Starbucks or our small, tiny office? Or do we actually get the nice posh office where we have our own snacks?

Nick Telson: Yeah, we could get to that eventually. The way we did offices was always very sort of handmade, so the first office was very small and crappy, but in central London. Then, as we were hiring more people, we actually went upstairs in that same block and had another crappy office that was a bit bigger. And then we would go to Ikea and just, like, deck it out and make it look fun, again for cheap. Then we moved to Shoreditch, which your US listeners might have heard of, but that's sort of like the Silicon Valley of London.

"When we exited, Andrew and I were probably in the bottom 60% of earnings for the company."

Shaun Gold: Is it near the Silicon Roundabout?

Nick Telson: Silicon Roundabout is what it's called because it's a huge roundabout there, so obviously rents are more expensive there. But we actually found, like an old clothing warehouse and the landlord was like, yeah, you can have it, so it's just an empty warehouse. And again, we went to Ikea and just decked it out. Then we took the office next door to that and connected it to ours. And then finally, in that same building, we took the top floor and then decked it out with our acquirers, actually, and had a super cool, fancy office, with a rooftop and everything, but still within this old warehouse. But that was right.

Shaun Gold: Did this happen after the second round of funding was raised?

Nick Telson: So after the second round? Yeah. That's when we moved to our first office in Shoreditch. And then we slowly got bigger and bigger as the years went on. The super fancy office was actually right around our exit.

Shaun Gold: Understood. So you raised capital from a group of six angels, correct? That was your angel investors. And then it was the same group of angels that you raised the next round of capital from. Is that the total amount raised?

Nick Telson: Yes. Half a million.

Shaun Gold: Wow. So half a million from the same people? Did you look for other outside capital?

Nick Telson: No. So our vision was always that half a million built a profitable company. The whole journey was about nine and a half years for us. So it was slower than if we would have probably taken bigger funding. But Andrew and I wanted to always keep a large slice of equity. We knew how much money we wanted to take from the business on exit. So we then just did the math, basically, and we could see what we needed to exit for in, say, five, six years with how much equity we had. So we just worked towards that goal of revenue, EBITDA. When we exited, we were running at 48% EBITDA margin. So we worked really hard to build a really profitable company.

Shaun Gold: It's interesting because it's $500k total for a nine years journey. Correct?

Nick Telson: Yeah.

Shaun Gold: And I see decks all the time. And I'm sure you do. The preseed decks or the seed decks that want 5 million out the gate. What do you say to the founders that truly want to build a business, but they don't know how much money to raise? And they think more is better. And they think, well, if we're going to raise five, we might as well raise ten. What would your advice be to them? Because we see so many different numbers coming in. And again, we all have the same stupid little chart "here's where the use of proceeds are going to go". I want to know your thoughts on that, on someone. Let's say they're pre-seed and they want to raise $4 million. Let's even say they're seed stage. They have some traction. They want to raise $5 million. What are your thoughts on these crazy amounts of money from someone who actually did it with far less than what we see in decks today.

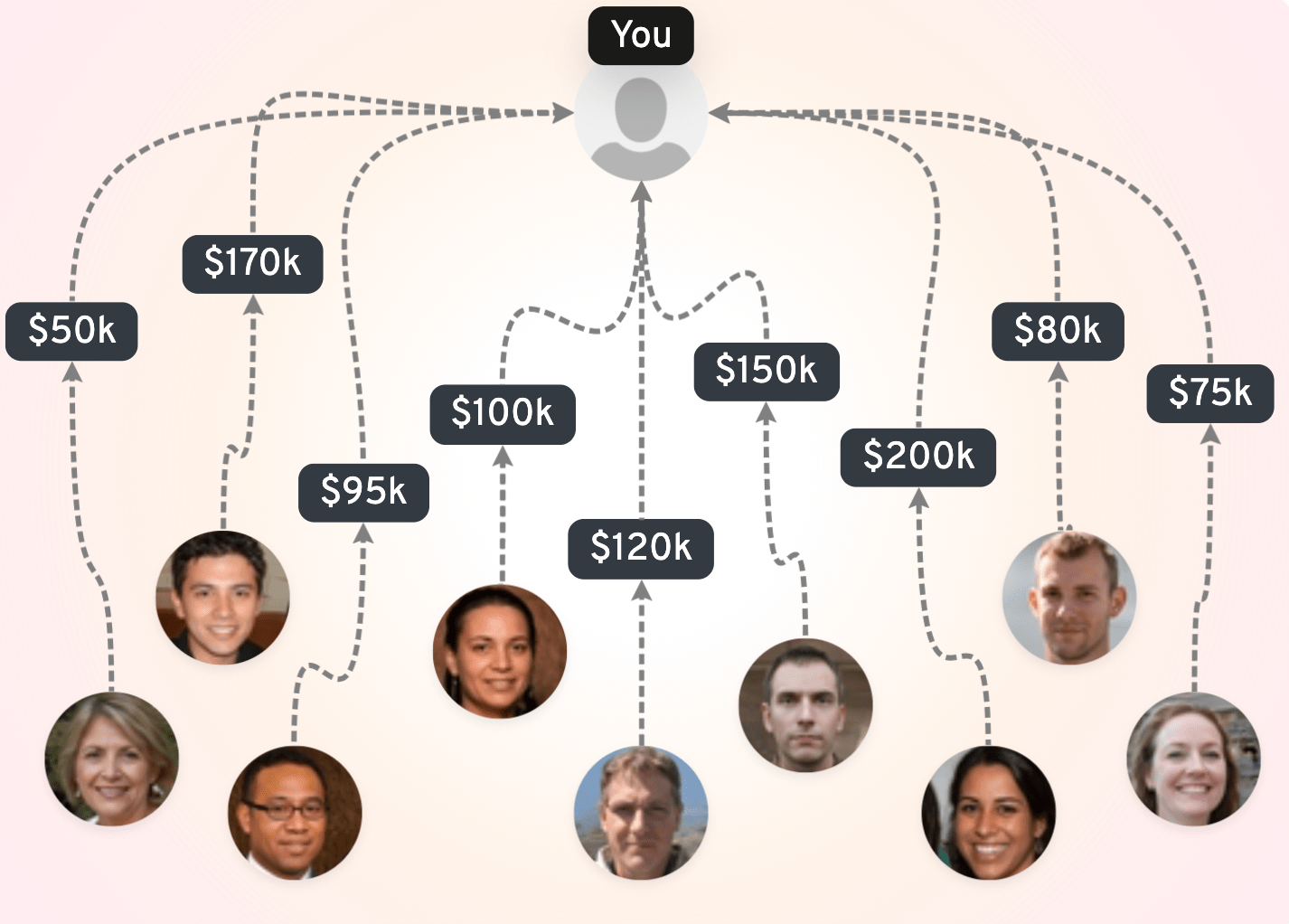

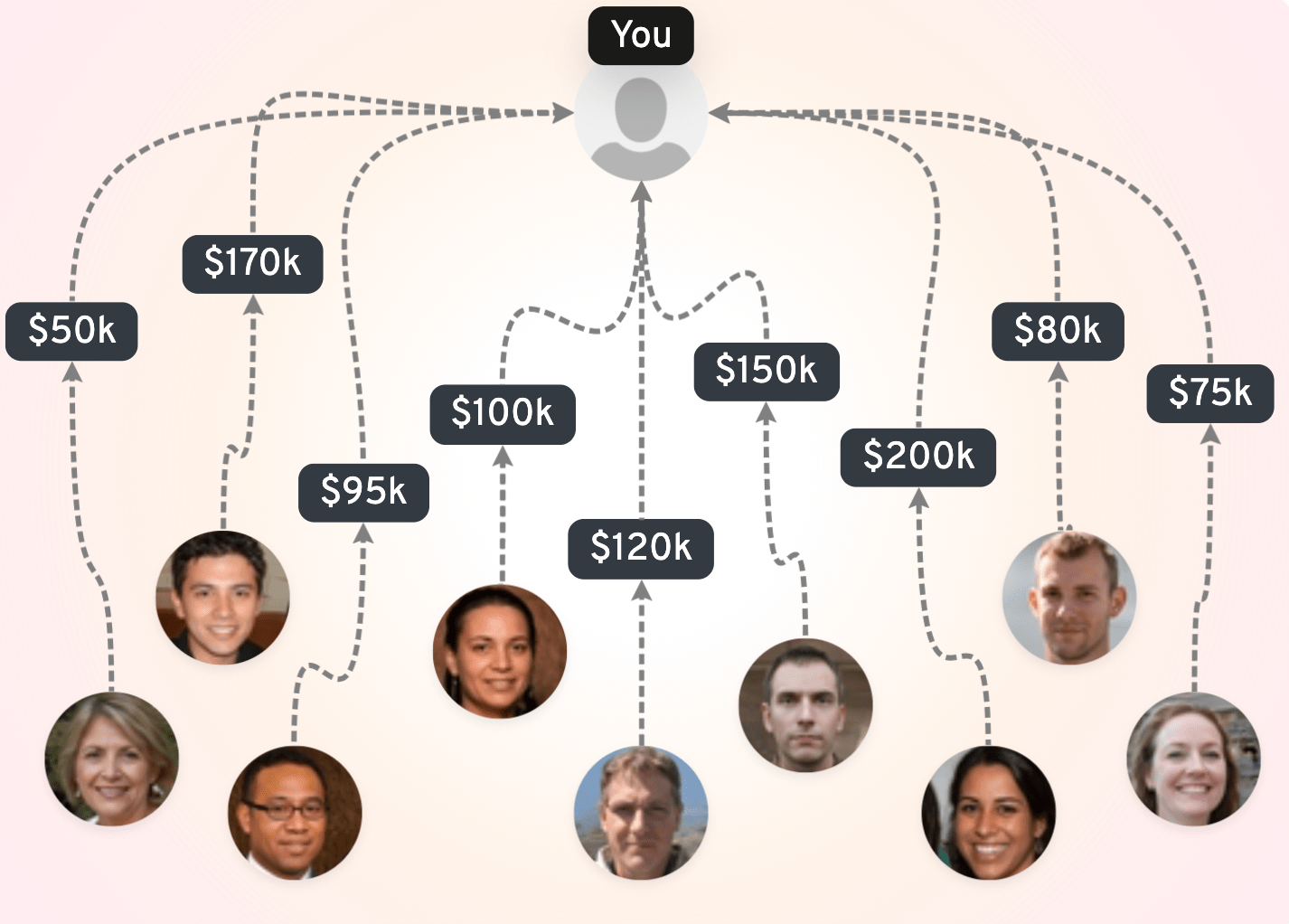

Nick Telson: I mean, it's a really complicated answer, and there's definitely not a right or wrong way. I'm definitely not someone that says you have to bootstrap. Actually Trumpet our latest business, we raised $2 million pre product, pre revenue from VC. So I'm definitely not one to say that you have to do it this way. I think the most important thing to think about before you raise money is what you want out of it as founders. What do you want to achieve with this business? If you take ego out of it. If what you want to achieve is a $500 million business, then, yeah, you're probably going to have to go down the VC funding route and grow a big global business. However, what isn't talked about enough is if you want financial freedom and actually $4 million to you is financial freedom, then actually you might only need to sell your business for $15 million. And actually, you can sell your business for $15 million by just taking angel funding. So depending on what you want from the business, I say you've got to take ego out of it, because I think ego drives people to big rounds and headlines and TechCrunch and stuff. It really depends on the different routes you take. A lot of founders that I meet are pre-seed and that are trying to raise their million dollars without anything. You have to then get quite a big valuation to keep your equity, but you've got nothing to show that you're worth that money and then you're just constantly chasing this false valuation and obviously the market sort of caught up with that now and it's collapsed a bit. So, you know, my advice to founders at the moment is there's so many vehicles to raise money with quickly now that you can do from angels or syndicates or loads of different options. So maybe just raise $150,000 at sensible valuation, get some traction, build an actual product, get some customers, then raise another $200,000 at a bigger valuation but still sensible carry on building and actually get to a level then, where you haven't given away loads of equity, but you've got a product, you've got some traction, and then you can decide, OK, now we're going to go and raise $4 million. Or we don't need to raise $4 million, let's go and raise half a million and then take it to the next level. So I think before you raise, you need to be charting five years ahead on where you want the business to be, how much money or what you personally want out of the business and what different routes you really feel you want to go down. It's definitely not the way just to go and raise a big round because you can.

"If you take ego out of it, you can sell your business for $15M by just taking angel funding."

Shaun Gold: Understood. When you raised your funds, did you have advisors on your team or was it just you and your cofounder?

Nick Telson: For Design My Night? It was just me and Andrew, and it was actually our mentor at the time who became our first angel investor, who was actually a professor at the London Business School, which is a very well known business school in the UK. He was great, he was always on our side. He actually became our chairman as well. He wrote the first check and then introduced us to the five others and then we pitched them individually. Yes, we did a little negotiation, but it was all very friendly and worked out for both of us.

Shaun Gold: Very nice. So you had a sizable exit. What was the number?

Nick Telson: We say it was between 30 and $40 million.

Shaun Gold: Is that pounds or dollars?

Nick Telson: Dollars.

Shaun Gold: Oh, wow. Okay. So, yeah, it's very sizable. Do you have any regret that you didn't stay longer and try to get to that 100 million mark or 200 million mark or were you happy with the 30 to 40 million? I only ask because people want to be billionaires and exit for hundreds of millions. But you're a realistic guy. I'm a realistic guy. I'm sure we have some realistic readers and viewers. As you said earlier "Put your ego aside". Were you happy with that number?

Nick Telson: Yeah, really, really happy. As I said, Andrew and I spoke about what financial freedom meant to us and how much we would need in our back pocket and how much we would be happy with. And that number ended up over what we thought. So in terms of numbers, we're very happy. It's a conversation we had because we didn't have the two-year earn out. If we were going to hit our targets of our two-year earn-out, then actually, if you think to yourself, well, actually, if I would have stayed for those two years without selling, the business would have been worth even more. But I think we got to a stage where at that time, we were seven and a half years in. We pretty much bootstrapped it the whole way. We were knackered. We were mentally exhausted. We weren't the sort of upstart anymore. Our big competitors were starting to round back in on us and they could see what we were doing and starting to copy some of the features we were doing. So that made us a bit uneasy. So we just thought, this is the right time to exit the industry. Tailwinds are telling us to exit now. This is more money than we said we wanted, so let's not get greedy. And look, as it happened, six months after, no, three months after our earn-out, Covid hit. So the timing was very right.

Shaun Gold: Yeah, you hear that sound? That's the bullet going by your head. That's the bullet flying by you. Wow. Yeah, that's very good timing. And of course, no more free snacks. Proper meals. Proper meals. So you exited out. What made you want to become an investor and launch Horseplay Ventures and to even still work after that? I feel like you spend a significant portion of your life bootstrapping and working and you just wanted to get back right into it. Most people would go, I don't know, to Kathmandu and climb a mountain, or not want to look at a computer screen, but you immediately kind of went back into it. Why?

"Three months after our earn-out, Covid hit. So the timing was very right."

Nick Telson: So we started Angel Investing before the earn-out. So when we actually first exited, and that was just because it was a financial strategy, we wanted to make money from angel investing and by that time we've made a lot of angel investor friends and contact, so sort of learnt a lot. We thought we'd enjoy it. So, like, being introduced to all these cool founders, being involved in their businesses, but not actually working for them, so just dropping in and out with advice and thinking for them. So we thought that would be cool as well. So we set up Horseplay. People think it's a fund or a VC, it's not, it's just Andrew and I, angel investing, but we wanted to create a brand around angel investing because obviously angel investors are just loads of different people. There's no brand around angel investing, so we wanted to create a bit of a cool brand that people could relate to. We've got like three startup tools on there as well that people can use to help the community. That's part of my podcast as well. So we just, like, really enjoy the stuff up well. And then in terms of going again with Trumpet, obviously COVID hit, so we were probably going to travel for a year with our loved ones, et cetera, but we couldn't. So you sort of ask yourself, we were mid 30s, so still relatively young, and, you know, you ask yourself, what do I want to do with the rest of my life? I don't want to sit on a beach for the rest of my life. That doesn't fulfill me at all. And you sort of ask yourself the difficult questions that you never normally do, like, what makes me happy? What brings me joy apart from partners and family and friends? I've never really asked myself that because I've gone from university to L'Oreal to Design My Night and just never really stopped. And whether it be sad or not, I think we both agreed, luckily, that we just love building brands, we love the cut and thrust of startups. And obviously with this one, there's less pressure, because our financial life doesn't revolve around Trumpet succeeding, which it did a bit of Design My Night. So we thought, let's do it again. We love it, we love ideating. We had about seven ideas and we landed on Trumpet. And for this one, we've brought in a third founder, a guy called Rory, who we've known for years, who wanted to be a founder. So that has allowed us to sort of focus on the stuff we love. So Rory is the CEO, he manages the team in the office and all of that stuff. And Andrew and I can just focus on brand building, sales, data operations and the stuff we really enjoy, so we're really enjoying it.

Shaun Gold: Right. What's more fun? Being involved in the startup that you're doing or just being an angel investor in other startups?

Nick Telson: 100% doing your own. I think that's another reason why we thought, let's do it, because actually being an angel investor was just not fulfilling at all. You realize, actually, a lot of founders don't really reach out for your help or ask for your advice. So out of the 55 plus investments we've done, we probably only speak really regularly to, like, ten of them, but we make ourselves open to everyone. But just founders, rightly or wrongly, are very heads down, so you feel quite disconnected from a lot of them. You know, you just get your quarterly update and that's it. So we really missed not having an impact.

Shaun Gold: With that being said, what is Trumpet? What does it do? And bonus question: is it personally fulfilling?

Nick Telson: We looked at the whole B2B sales journey, so there's loads of tools for outreach, there's loads of tools for CRM, but then we looked at a whole piece in the middle where you are sending cold outreach. So decks, PowerPoints, PDF, slides, and then you have the back and forth with the customer. FAQ, show me this. Can you send me a use case? Can you send me a case study? And then getting the deal done and then handing them over to customer success for onboarding. It was very old school, so we wanted to unify that whole journey. We unite the buyer experience with one journey from cold outreach all the way to onboarding with personalized microsites. It's like a canva for salespeople. The salesperson can whip up these personalized microsites in minutes without design skills. Personalized to your customer. That helps you get your foot in the door. And then with that pod, as we call it, the microsite, you can just add pages. So if they come back and ask the use cases and video content, you can drop it in the pod. If they have contracts or SLAs, they want to see, you drop it in the pod, and then you hand over that pod to customer success, and they carry on with that same pod onboarding the customer. So, yeah, it's sort of a new space within sales. It's going great. We opened up the beta in June this summer. We had 3,000 on the waitlist. We've now onboarded about one and a half thousand, and it's going really, really well. The ROI is approving themselves, which is great. So, yeah, really excited. And yes, it's very fulfilling.

Shaun Gold: And you raised outside investment for this, correct?

Nick Telson: Yes, we did. A $2 million VC round.

Shaun Gold: Why do the round if you guys can clearly self fund it?

Nick Telson: So we self funded the start, we self funded the bills, the brand. We actually worked on the product for, like, seven months before even talking about it. We sort of ignored the Lean Startup, so when we launched our MVP, people have said it's like a Series A product, and that's because Andrew and I had invested quite a lot of money into the product, into the team, and Rory as well. But then we wanted to bring in outside funding to kick on. So we essentially did like the pre seed round ourselves and then brought in VCs to kick it on.

"Being an angel investor was just not fulfilling at all."

Shaun Gold: Why did you bring in the VCs and not the same group of angels from last time?

Nick Telson: For Trumpet, we wanted to take a bit of a different task. Like, Trumpet is self-serve, it's product-led growth, it's instantly global. For all of those reasons, it can scale really quickly and we wanted VC backing and VC portfolio codes to help us with that. Whereas Design My Night was always quite difficult to scale because of the big content piece around it as well. Andrew and I said to ourselves, if we're going to do another startup, it has to be those things. PLG, self-serve and global and Trumpet is all of those three things. So we put ourselves in the bracket of Slack or Figma or Notion, that type of product. So we felt that VC was the best way to do that.

Shaun Gold: Understood. So we talked about the importance, or lack of importance of a business degree. We talked about bootstrapping, we talked about self-funding. I want to talk about location, because there's a lot of founders in tiny little places around the world, and you guys were right in London. Do you think right now, in this day and age going into 2023, that a founder can be successful outside of a major hub? Could they be successful in Nottingham or do they have to go to London? Could they be successful in Wales? Because one school of thought is, it's remote, it's fine, and the other school of thought is you have to be there, you have to be in Silicon Valley or New York or London. What do you think?

Nick Telson: I think it helps. I don't think you have to be in those city centers for you to be successful. 100% not, but it just helps. Like, a lot of head offices are in London, so, you know, we're doing top down sales for Trumpet with Enterprise at the moment and we can go and meet them in their offices in London. A lot of the capital is in the major cities, so it's much nicer to go and speak to a VC face to face rather than over zoom. I think Covid obviously helped the opposite of what I'm saying. So we raised our Trumpet round actually over Zoom because it's still sort of Covid was happening. It can definitely be done and you definitely don't need to be in a major city to be successful, but I think it just gives you that small little leg up, I'd say, and helps you along your way. If you do want to have a small office, it helps you attract certain bits of talent as well. So it helps, but it's not the be all and end all, I don't think.

Shaun Gold: Do VC offices have snacks and if so, did you partake?

Nick Telson: Not as good as Google. And I normally have to have water, but I did treat myself to sparkling water.

Shaun Gold: Wow. Okay, you heard it here first. Well, there's my last question, because I want to be respectful of your time. What advice would you give a founder right now, in 2023, that is, no two journeys are the same, but is working a fulltime job that's bootstrapping, that wants to go on the journey, whether it's four years or five years or ten years, but really wants to make their company successful. What better advice do you have for them, just from your personal experiences that could benefit them?

Nick Telson: I think that the two best things we did at Design My Night and Trumpet, and it doesn't cost you anything, was getting close to your buyers or even your potential buyers. I think that's the best thing you can do in the early stages. For Design My Night, we spent every weekend walking around bars and pubs and asking to speak to general managers or managers or owners. We would show them what we were up to. We would get their feedback, we would take their email address, take their phone number, and start to build a rapport with them. And then when we did launch, or when we were launching new things, we almost had, like, our own little client list already. And they'd met us. They met in person, they remembered us. We got amazing ideas from that as well. And Trumpet, before we even spent a penny on development, we interviewed over 150 salespeople and founders and said, this is our idea. We would love feedback. We would love to jump on a call, but if you don't have time, here's a Typeform. We would love you to fill it out. It'll take you five minutes. This is the idea. Be as honest as you can. Do you like it? Do you not? If you like it, what things would you like to see in it? If you don't like it, why? What would your intent to buy be of this product? And that has helped us so much shape our products have a user list to go to. When we did launch, it helped us raise money, because when we went to VCs, we were pre-product, pre-revenue. But we could show them all this research we've done, and we still stay incredibly close to our customers. And it's where most of our best ideas come from. So don't shy away from that. Get yourself out there. Get on the phone. It doesn't cost you anything. Don't hide behind your laptop. And I think that's the best solid foundation you can have when starting an early stage business

Shaun Gold: And not be afraid of the feedback.

Nick Telson: And I think what a lot of founders do is they'll block out the negative feedback.

Shaun Gold: Exactly.

Nick Telson: So listen to it. Don't be defensive. They're saying it for a reason. They're not just trying to be rude. You don't obviously have to agree with every bit of feedback and not everyone's right, but digest it, think about it, take it on board. I think that's the most important thing. And when you're ideating so, as I said, we had, like, seven ideas before Trumpet. What I say to founders to do is try and do everything you can to dissuade yourself. It's a good idea. So change your mindset. So when you're going out for feedback, don't go out trying to prove it's a good idea, because you'll ask the wrong questions and your mindset will be wrong. Try and prove to yourself that it's a bad idea. And if you can get through that time and you're like, oh, it could be a good idea, then you could be on to something. So you just gotta flip your mindset. I think the minute someone comes up with a name for their business and starts creating a logo, they're all in and are probably ignoring negative feedback. So forget all of that and really speak to the industry, speak to potential buyers, look at what competitors are doing, listen to podcasts and really understand everything. And just try and prove yourself that it's a bad idea. If you can come through that still thinking it's a good idea, then you might be onto something.

Shaun Gold: Okay, well, that's all for me. I want to thank you for personally being here and being open and sharing your journey and providing all that great feedback and the notion that Google has the best snacks. That's what I got out of it. But it was really great. And we'll have some links, so we can find you at Trumpet, at Horseplay Ventures, at your personal site and your podcast, because people, as you know, we do our roasts, but you are much quicker and I assume much more ruthless. But again, it's all feedback, it's all helpful and it's all useful in the end, so you can't be afraid of that. Nick Telson, thank you for being here.

Nick Telson: Thanks for having me, Shaun.

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started