Thinking about joining an accelerator? Then this post is for you!

In the next 10 minutes, you'll learn which accelerators are actually worth it (if any) and what you should expect from them.

Also, make sure to check out our 36 Accelerator benchmark if you haven't!

Table of Contents

I. How accelerators make money: the 3 business models

An accelerator is a program that takes early-stage startups, provides them with support for a few weeks, and gets them to the next stage, especially to the next funding stage.

That's the big picture.

In reality, there are 3 types of accelerators:

- Venture accelerators invest cash in your company in exchange for equity, for example $150k for 5%. This is the model made popular by Y Combinator. Those accelerators are VC funds at the core - they have to generate alpha for their LPs and only really make money when a portfolio company goes liquid.

- Free accelerators are funded by government agencies or large corporations. They don't invest in your startup, but they don't charge anything either. So it's basically free support.

- Paid accelerators are consultants that sell fundraising support in the form of an acceleration program. This is a different dynamic from the other models: you're a client, not a portfolio company, and you're paying in cash, equity, and/or tokens. Don't compare them to accelerators but rather to fundraising advisors.

Each model has its incentives and biases, but they often get similar blame: bad deal and low impact.

Is it a fair criticism? Let's take an honest look.

(that was my first job - can you spot me?)

II. Accelerators promise to kickstart your venture journey

That first check to get things off the ground

Many founders join venture accelerators for the funding alone.

When you're just getting started, $200k can get you far. Actually, it can be the difference between getting a product live and being stuck at the idea stage.

Even better - unlike VCs and angels, accelerators are open to all with a clear application process. That's a huge appeal to all founders, especially those who are less connected.

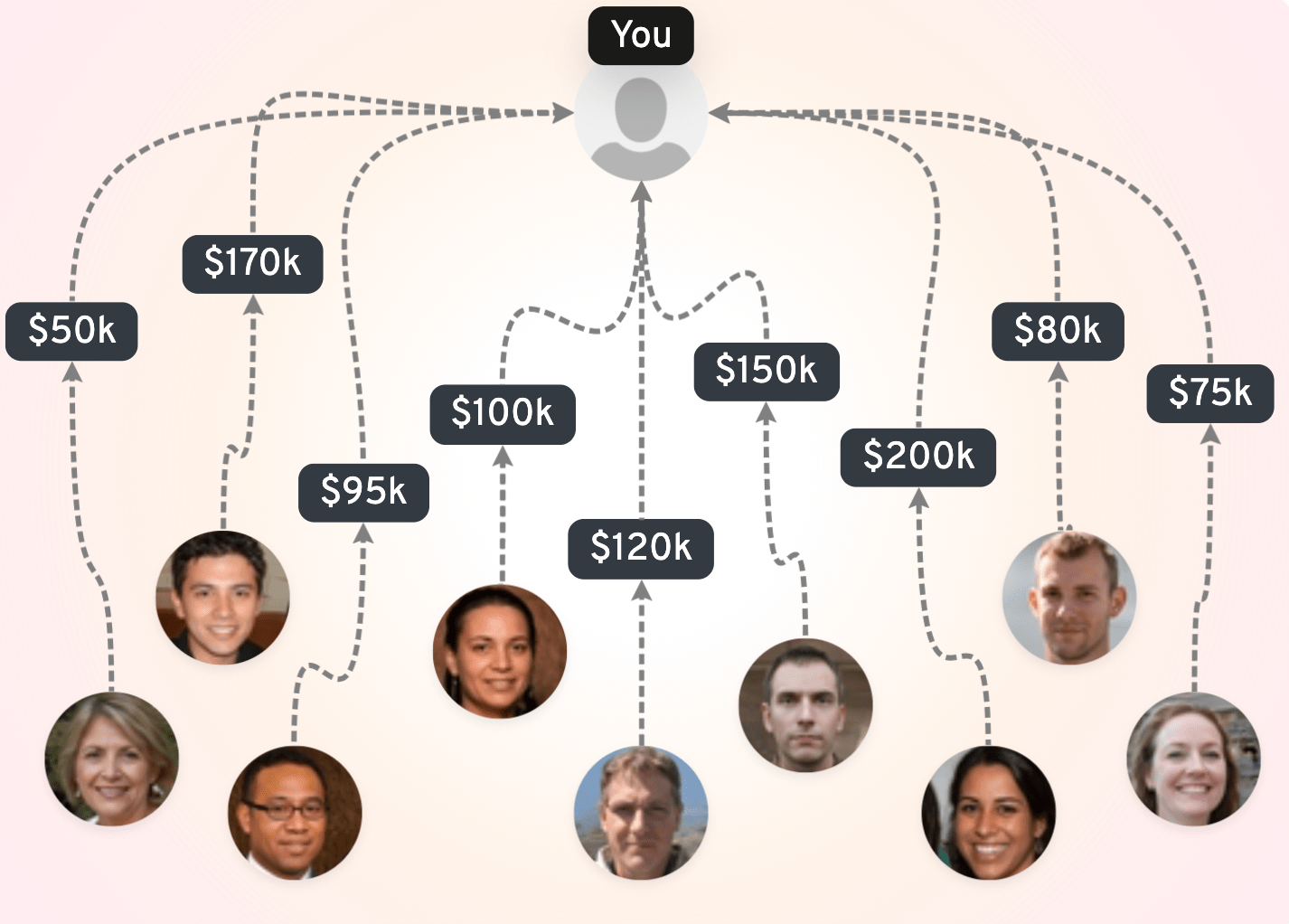

The graph below gives you an overview of how much funding you can get from 30 accelerators. There are 3 categories - under $200k, $200k to $400k, and above $400k.

Click the filters and the squares, it's all interactive!

A built-in network of investors, clients, partners, and peers

"Your network is your net worth". You probably heard that before.

Accelerators, for all intents and purposes, are a built-in network. When you join them, you instantly join a network of hundreds or thousands of stakeholders.

Think of an accelerator as a marketplace. For a short period of time, you're at the center of it all.

Positive signal for strategic stakeholders

Joining a reputable accelerator boosts your credibility.

Whether you're looking for investors, clients, or hires, being part of a big brand accelerator will help. This phenomenon is well known with VCs, and is true with accelerators, too.

The positive signal also acts as a valuation boost. For example, startups graduating from YC raise at a higher valuation than similar non-YC startups.

NB: Not all accelerators can claim that feat. A few have global prestige, some have national or regional fame, most have none. Apply judgment here.

A founder MBA on steroids

Most founders are doing it for the first time.

For that reason, accelerators often provide a curriculum to help you "learn the job". Classes, workshops, guest speakers… Fundraising is front and center, but many accelerators cover adjacent topics, such as product, growth, or legal.

Within a few weeks, you should be able to discuss valuation and term sheets with an investor, avoid the beginner's mistakes, and overall maximize your chances of success.

Perks that extend your runway

Most accelerators offer perks.

Some of these perks have become fairly standard, such as software discounts on Airtable, Stripe, Azure, etc.

(Pro tip: you can get the exact same Perks without joining an accelerator, for just $99 with OpenVC Premium 😉)

However, some accelerators offer truly exclusive perks.

Some of the coolest I've seen were in Shanghai, Suzhou, and Singapore. There, deeptech and biotech accelerators provide their startups with state-of-the-art research facilities and scientific tooling worth millions of dollars.

Pretty sweet if you ask me!

A kick in the ass i.e. hyperdrive mode

Accelerators are about… well, accelerating. 🙂

Being part of a tight-knit community, surrounded with other ambitious founders, you are being put under pressure with a clear milestone in sight: the Demo Day.

This environment acts as a catalyst. You and your co-founders live, breath and sleep for your startup. Your project moves faster than ever before, fueled by the right resources and insights.

For many teams, the acceleration is the pivotal moment when they go full-time on the project.

Hard to quantify the value, but many founders will tell you this had a decisive impact on them.

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now

III. So why do people hate on accelerators so much?

On paper, the value prop is unbeatable. Yet, accelerators get a lot of hate online. Sometimes with reason.

"An innovation zoo that wasted my time with incompetence and rigidity"

This is how a founder described his accelerator experience.

Just like with fundraising advisors, the profession is riddled with bad actors.

Not all accelerators are bad, but bad behaviors should be called out. For example:

- Many accelerator staff are fairly junior with little investor/operator experience, so their contribution is minimal. They rely on external experts to bring in expertise.

- Many of those "external experts" are consultants speaking for free as a pre-sales effort. It doesn't mean they won't do a decent job, but their goal is to sell their services…

- The quality of the mentors is a Russian roulette. Some will love you and go to bat for you, others will ignore you or may even provide bad advice.

- The curriculum is generic and doesn't necessarily match your business needs. Who needs yet another workshop on the Business Model canvas when you're trying to close your 5th enterprise client?

As one EquityLift puts it:

The hidden costs of an accelerator

Joining an accelerator has 2 hidden costs that many fail to take into account

- Program fee : Some accelerators charge a "program fee" or "tuition fee" when you join. For example, Antler charges $50k while 500Global charges $37k. This is not necessarily a scam, rather a way for accelerators to give you a slightly better valuation and themselves a slightly better deal. Just subtract the program fee from the initial funding to know exactly how much you're getting.

- Costs of living: Most accelerators are in-person programs. You may have to move to a high-cost of living area for the duration of the program. Flight tickets, rent, dining out… Count $30k for 2 co-founders spending 4 months in the Bay Area.

You may receive $150k in accelerator funding, but after hidden costs, how much is there left to grow the company?

A bad deal that leads to excessive dilution

Ideally, the founders should collectively own 50%+ of the company after Series A

Now, if you're going to give away 10% to an accelerator, 20% at seed and 20% at Series A, there's little room left for angel investors, strategic advisors, or your early employees.

Suddenly, this $150k accelerator check looks pretty expensive!

And that's if you can even raise.

For all the reasons listed above, some investors have grown wary of accelerators, to such an extent that they perceive them as a negative signal.

So much for that valuation bump!

IV. How to assess the actual value of an accelerator

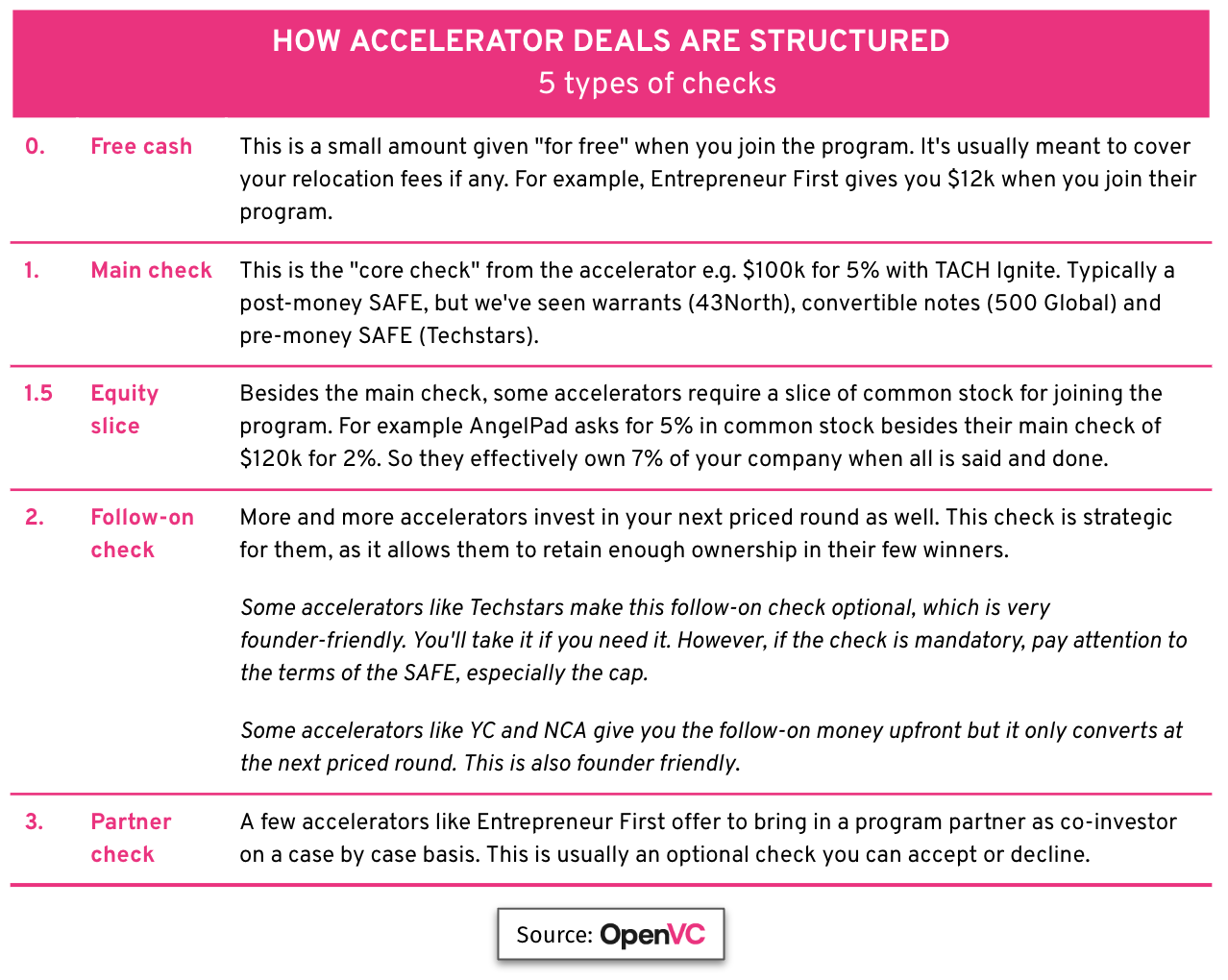

Let's break down the structure of an accelerator deal

Accelerator deals have grown in complexity.

It went from "We invest $150,000 for 5% of your company" to "Companies receive an investment of $150,000 for around 6% of their company (subject to dilution at the time of conversion of our convertible security). The convertible security has certain special rights, including the right to make a follow-on investment of an additional $500,000 or 20% of your next priced round of $1,000,000 or more, whichever is lower, which expires after the conversion of our convertible security. Oh, and there's a $37.500 program fee."

Not necessarily a bad thing, but it's hard to understand for founders.

So let's break it down together.

An accelerator deal typically combines any of the 5 checks below:

There's only one way to understand those deals: simulate how much the accelerator will own after your first priced round.

Assess an accelerator with these 6 questions

OK, enough with the math. Are accelerators worthless?

Well… it depends.

If you're an exited founder going into your next venture, you would probably only consider top-tier accelerators (if any).

On the other hand, 99% of founders are cash-strapped first-time entrepreneurs and would greatly benefit from their friendly neighborhood accelerator.

So it's a spectrum, and you need to look at both your needs and their offer.

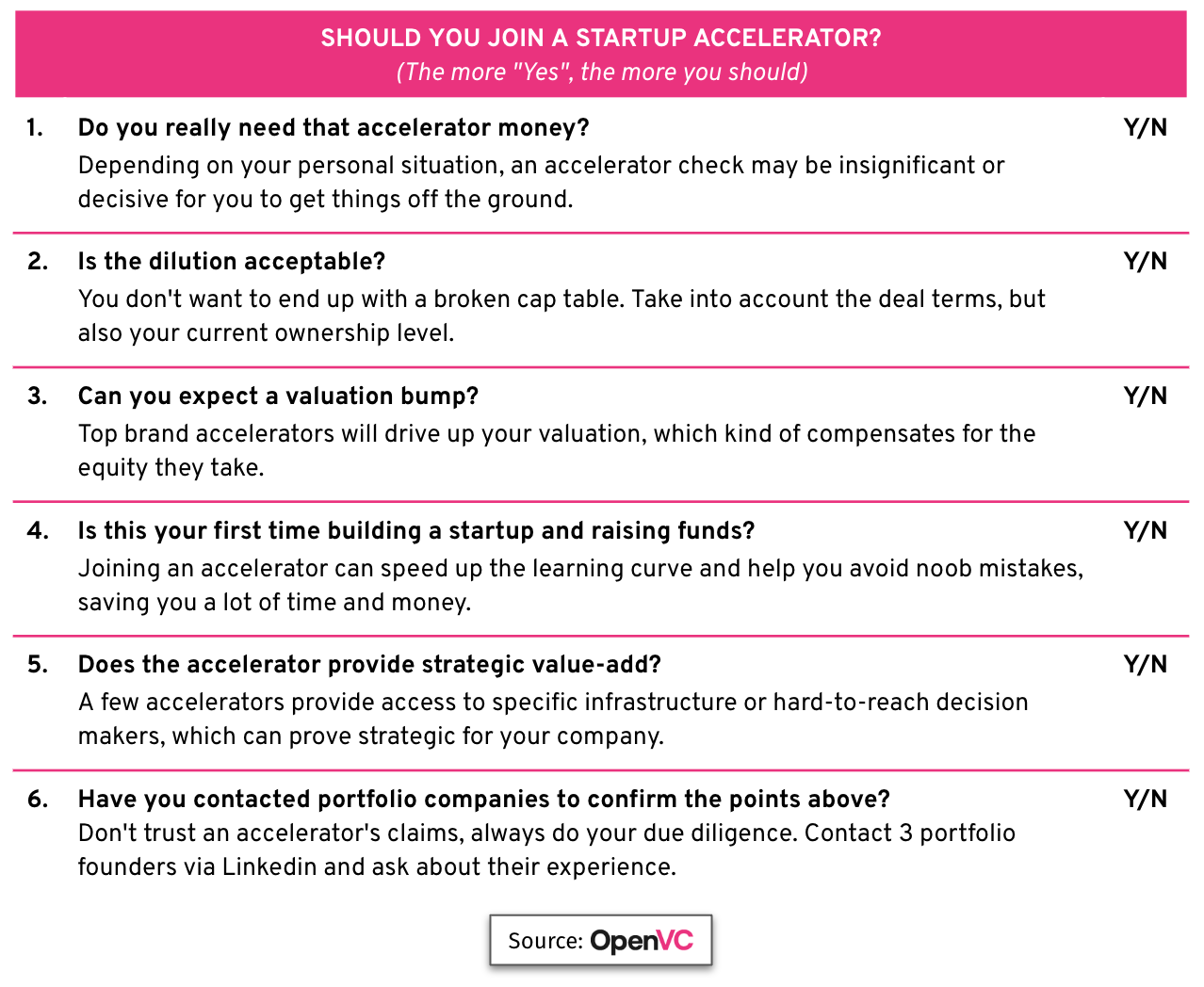

Here are the 6 questions you should ask yourself before joining an accelerator:

Go through this checklist for each accelerator you're considering joining.

This will give you clarity in your decision-making process.

Accelerator for me, not for thee.

You get the point: an accelerator may be right for one founder and wrong for another.

Let me give you two real-life examples:

Berkeley SkyDeck is an accelerator that brings startups from the world to the US, invests $200k for 7.5% of the company, and plugs them into the Silicon Valley startup scene, the best in the world. Imagine your startup being pulled from a tier 3 ecosystem to the San Francisco Bay Area overnight? Massive value creation here. (Disclaimer: SkyDeck funded a startup via OpenVC in 2024.)

Ulric Musset was the co-founder of Vauban, an incredibly successful startup that was acquired by Carta in 2021. With tremendous experience, connections, and capital at his disposal, you would think Ulric couldn't care less for accelerators. Yet, he chose to join Y Combinator with his new startup, Marblism.

If it's good enough for him, it's probably good enough for many of us.

Conclusion

Don't drink the accelerator kool-aid, but don't blindly hate either.

Accelerators play a valuable role in the ecosystem. Not everyone needs an accelerator, but many founders would have done better had they joined one... And sure, there are bad actors who will prey on founders' ignorance.

So get informed, assess your needs versus what's offered, and make the decision that is right for you.

Wanna share your opinion? You can react to this post on Twitter or Linkedin!

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started