A cap table is a document that defines the company's ownership structure; it is where investors are listed, shares are assigned, and ownership percentages are calculated. Preparing and maintaining a cap table is one of the most important parts of your company's operations. Investors will be looking at your cap table in order to make an investment decision. It is essential to have a well-executed cap table before starting the first round of funding. The purpose of this article is to outline the basic structure of a well-maintained cap table.

Table of Contents

What is a cap table, and why do you need one?

A cap table identifies the holders of equity, convertible debt, and options, with details about the amount of stock owned and its price. It is a report that outlines the ownership structure of a company. Preparing a cap table is an essential part of the early stage funding process, as it tracks all existing equity stakeholders in the company. The cap table can be referred to anytime as it summarizes all transactions and provides ready access to relevant details.

Cap tables can be prepared in Excel or through online software. If a cap table is well constructed, it will help the founders get funding, avoid unnecessary legal costs, and prepare for a go-public transaction. Here are a few reasons why you should prepare a cap table:

- Equity distribution offerings and management - The equity of the company is easily managed, with the ownership positions and the vesting schedules clearly defined in the cap table. This is especially useful in the case of secondary offerings of shares where the cap table indicates which founders are selling their shares and their associated vesting schedules. It also helps in the case of early-stage companies, where the significant dilution creates a need to make clear the ownership stakes.

-

Employee stock option management - When employees own stock options, you need to have a cap table that details the status of the underlying shares and their vesting schedule. An employee's ability to exercise their stock options depends on whether they own vested option shares or unvested option shares. The cap table should list all outstanding stock options with details of employee ownership and vesting schedule.

-

Term sheet negotiation - During the term sheet negotiation process, investors will be looking at your cap table to confirm the ownership percentages. A cap table provides the best way to confirm the ownership of the founders, directors, and managers. It is also the best way to indicate to investors the nature of the expected dilution. Overall, a cap table helps to make sure that the ownership percentages and amounts of the round reflect what you have agreed to in your term sheet.

-

Owning breakdown - A cap table tracks all stock issuances, with details about the number of shares issued, price per share, and the number of shares outstanding. It also allows you to track which employees have exercised stock options and when. In this way, you can easily check who owns vested or unvested shares at any time. This is particularly useful for early-stage companies due to the high level of dilution.

-

Successful funding rounds - A well-maintained cap table acts as a reference point for all information about investors, including the price per share and the percentage of ownership. This is particularly useful in terms of investor relations. During funding rounds, it will be possible for investors to check the percentage of ownership and total stock issued, as is reflected in your cap table. As a result, your cap table acts as a practical guide for investors.

About startup funding rounds

Before you prepare your cap table, it is important to understand how funding rounds are performed and how different rounds of funding are structured. From pre-seed funding to series A, B, or C funding rounds, raising money involves various stages. The exact fundraising process will vary depending on the investor, company, and industry.

The basic structure of a funding round involves investors putting in money and receiving equity in return. The company's ownership structure will change depending on which stage the company is at. An early-stage company may have several funding rounds where investors receive an initial amount of shares.

Seed Round - The first round of startup funding

The first round of funding for a new company is usually called the "seed round." The main purpose of raising money in a seed round is to get the company started, build a product and create some traction. Seed rounds also have different stages and phases. In a typical seed round, the average investment is $2.2 million. Seed round investors usually receive an equity stake of between 10% and 20% of the company in exchange for their investment.

It is common for seed round financing to be made up of investors who are already familiar with the founders and their brand. The principle is that these individuals have a long-term investment strategy and will stay involved with the company over many years. As a result, the company is given the opportunity to grow and become profitable.

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now

Consideration startups should follow for seed funding rounds

The seed round is usually used to raise the first investment in a company. It allows them to get a better understanding of their business model and how it can be developed. Basically, the seed round's purpose is to ensure that the company has the capital it needs to remain in business while growing the customer base and looking for additional funding.

To raise a seed round, startups need a clear idea of what they are trying to achieve. Here are a few things that will help startups to get seed funding:

- A proper business model

- Financial projections

- Product roadmap

- Market opportunities

- Pitch deck

The most important thing is to raise enough funds to operate the business and build a solid foundation. Therefore, it is essential to put together a compelling story, attract the right investors and stay in control of the company.

Cap table for startup funding rounds

After a company has successfully raised seed funding, it might go on to raise additional capital in the form of a series A round. Series A investments typically involve larger investments and higher valuations. In this regard, a cap table is an essential tool for both the company and the investors. A startup cap table includes a detailed breakdown of ownership percentages and outstanding shares. This will help the company better understand its current status and the amount of funding they have.

As such, the allocation, budgeting, and capital structure will be easier to track. In order to secure funding, a cap table is a vital tool that helps to align the interests of the founders, investors, and employees. Typically, after every funding round, it is important to update the cap table. This will allow the company to communicate effectively and give investors a good indication of the amount of dilution. In addition, an updated cap table allows founders to make a final evaluation of the round, making sure that all milestones have been achieved.

What information to include in your cap table

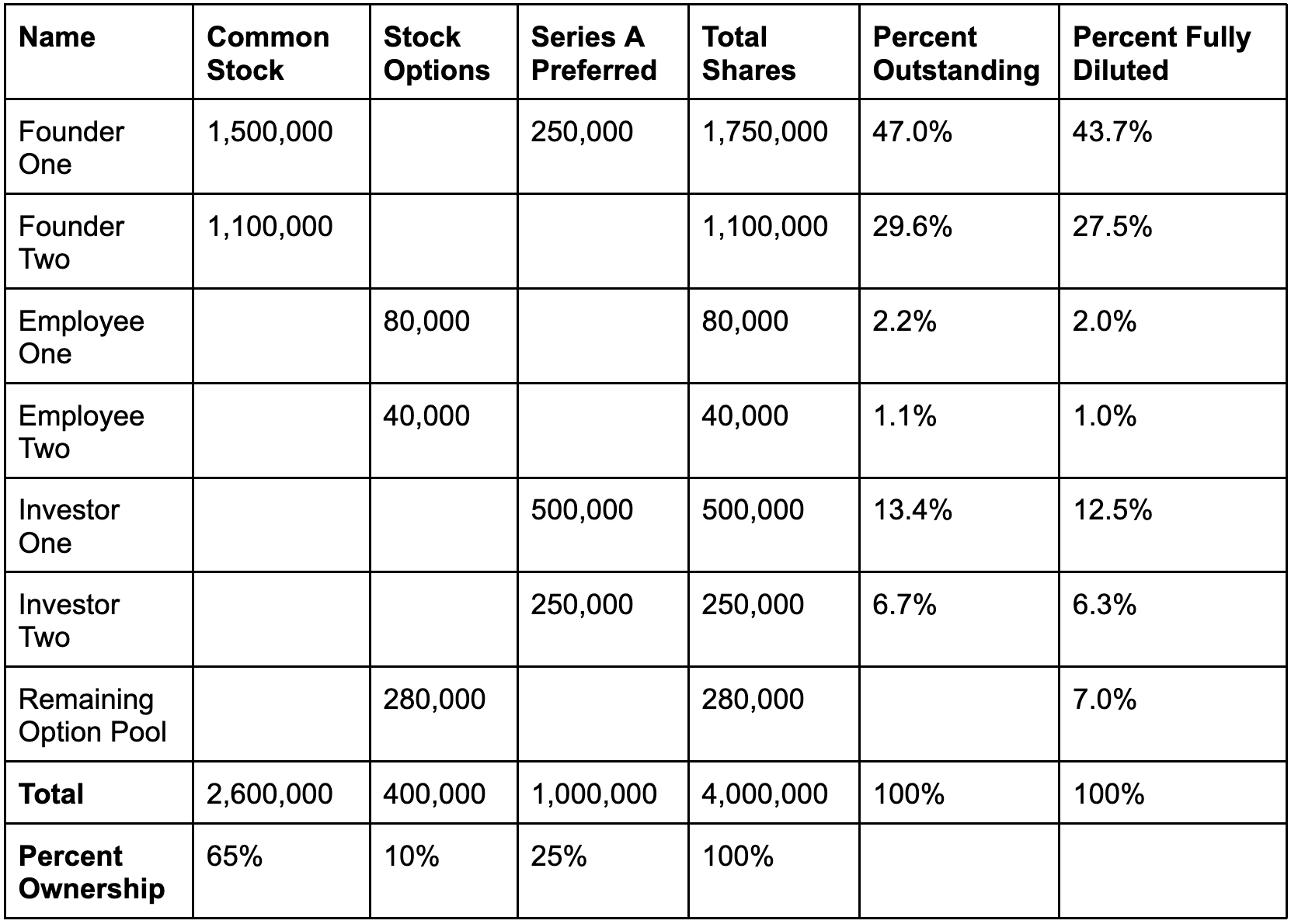

Your investors want the details on their ownership stakes in your company. As a company founder, you need to provide this information to them. A cap table includes the following:

- Name of the investor

- Amount of common stock owned by each investor

- Stock options that have been granted to each employee, investor, or founder

- The series A round of funding that the investor has participated in

- Total shares allocated from each funding round

- The percentage of outstanding shares

- The percentage of fully-diluted shares

- The percentage of ownership from each round

Therefore, when constructing this information, accurate, organized, and easy-to-read data is essential. The format of a cap table varies from company to company, but the basic layout of a cap table is similar. Below is an example of what a cap table would typically look like:

When should startups review their cap table?

The answer to this question depends on a variety of factors, including the type of company and ownership structure and the stage of development. However, the following are the three key events that can trigger a review of the cap table in any startup;

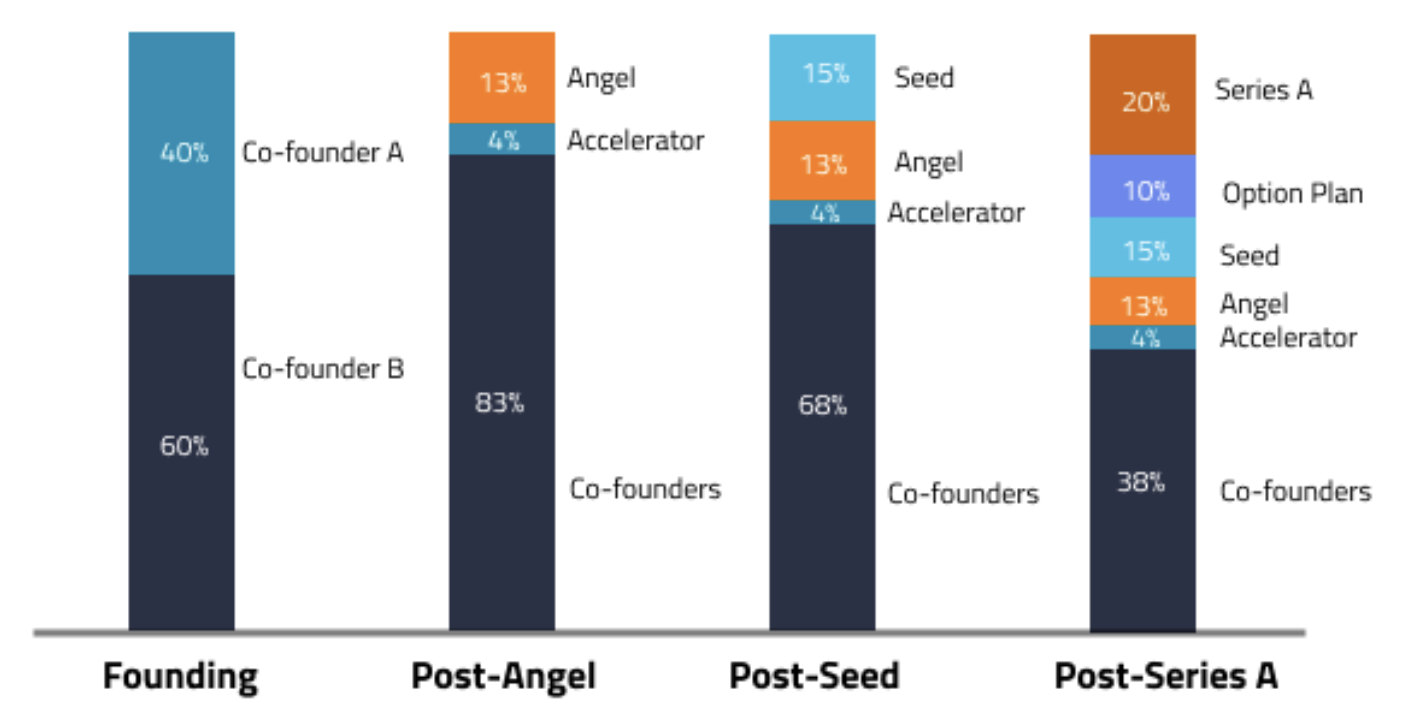

1. Founding - The time when the founders agree on the allocation of equity among themselves. This is one of the most important events in a company's life because the cap table is amended here to reflect this determination. When there is more than one founder, the equity is allocated according to their percentage of ownership. As a result, the allocation of equity should be properly documented to avoid disputes in the future, either among the founders.

2. Angel, Acceleration, Seed Rounds - As the company progresses through different rounds, it will want to ensure that the equity and rights associated with each round are properly allocated in the cap table and fairly reflect the investors' interest in the startup. This will ensure that the cap table is up to date, reflects the investors' equity, and will help avoid disputes later on. For instance, angel investors took 13% of the equity, and accelerator programs took 4%, seed rounds took 15%, and so forth. These numbers should be reflected in the cap table, given that the different types of financing might have different rights attached to the shares.

3. Series A - Series A is the first significant round of funding for the startup. As part of this round, equity will be allocated based on a percentage of the amount raised and the number of investors. The Series A round will be a trigger event for the need to review and amend the cap table. This is because, in this round, the company may have a variety of shareholders, and the dilution triggers the need to adjust the number of shares in the cap table and allocate equity to reflect the new shareholding structure.

The following chart illustrates one possible evolution of a cap table over time.

What happens to your cap table after you raise your funding?

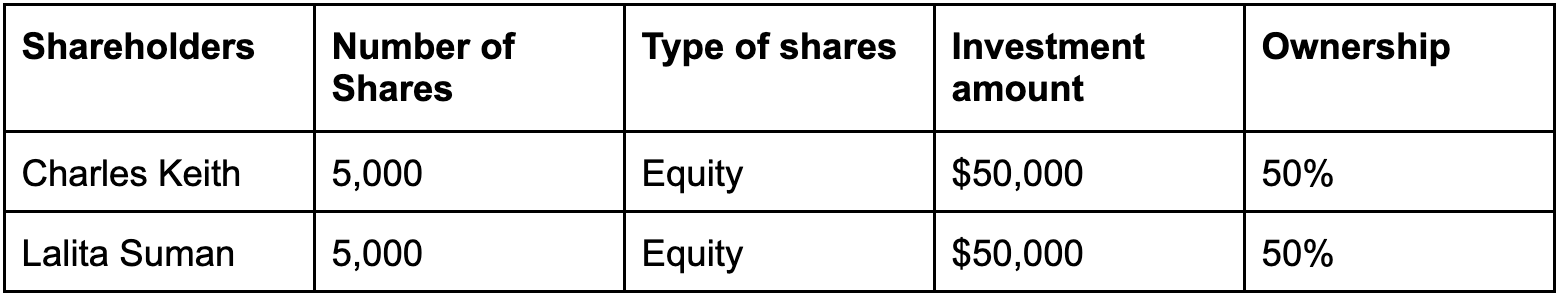

The cap table is one of the most important documents for a company. In it, you’ll find the partners, equity percentages, and other key information about the ownership structure of a company. As your business grows, so does your cap table. But what happens to that table after you raise funding? For example, Charles Keith and Lalita Suman are the founders of a startup named Kroom. They invested $50,000 each with equal ownership of the company, 50% stake each. So, your cap table would simply be created like this:

Cap Table 1

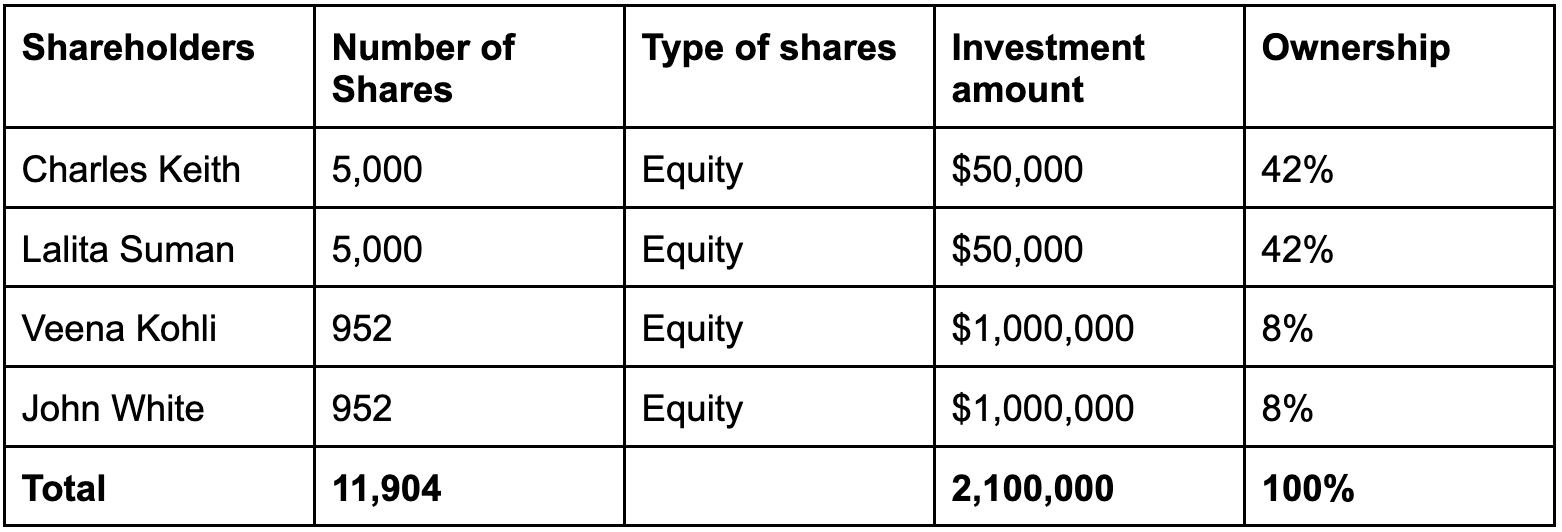

As Kroom grows, they decide to raise $1,000,000 in seed funding from top-tier investors Veena Kohli and John White, at a share price of $1,050.42.

Veena and John are each given 8% of the equity, and the rest is kept for the founders. The formula for determining the number of shares to be granted to the new investors takes into account the dilution percentage and the total number of equity shares prior to the new investment. Thus, this shows how the cap table changes as a startup grows due to dilution.

Cap Table 2

With most investments as preferred stock, they would also have liquidation rights, which means the investor gets back a certain amount before the common stockholders. In most cases this is 1.0x total investment, but can also be 1.5x, 2.0x, or more in case of certain investments (but rare).

So in this case if Veena & John had liquidation rights of 1.0x, if the company is acquired for $2,000,000 or under, the founders Charles & Lalita would not get anything. Once the company reaches a certain threshold where the investors 16% interest is less than $2,000,000 (ie. $2,000,000/ 16%=$12,500,000), would it be better for them to convert their preferred stock to common stock and exit together with the common stockholders.

This type of scenario modeling plays an important part when you are negotiating with investors on their investor/liquidation rights, possible exit values after a few years, and other types of scenarios.

Why a cap table is crucial

A cap table is a very important document because it helps to inform your investors and key stakeholders about equity in your company. It ensures that everyone has a clear understanding of how much they own in the company and how it can be affected by future actions. This is why the cap table should be updated after all funding rounds since investors tend to want to maintain control over the company. Additionally, regularly reviewing this document will help with the overall organization and management of your business. Therefore, it is highly recommended that you review your cap table regularly and keep it up-to-date with all changes.

How to create a cap table

Creating a cap table can be streamlined using several practical tools and resources. Here’s how you can effectively build one:

-

Using Excel or Google Sheets

- Set Up Your Spreadsheet: Depending on your startup's stage and its simplicity, creating a simple spreadsheet in Excel or Google Sheets may get the job done. Create columns for Shareholder Name, Number of Shares, Share Class, Ownership Percentage, and any other relevant details.

- Input Data: Enter the names of shareholders and their corresponding share information. Use formulas to calculate the total shares outstanding and ownership percentages. In just a few minutes, you could have the basics of a cap table.

-

Templates

- Downloadable Templates: There are numerous free and paid cap table CSV templates available online. Websites like Capshare and SeedInvest offer templates tailored to different business needs.

- Use Pre-Built Formulas: Many templates come with built-in formulas that automatically calculate ownership percentages and totals, reducing the chance of errors.

-

SaaS platforms

- Cap Table Management Tools: Consider using dedicated cap table management software such asCarta, Pulley or Cake. These platforms provide a comprehensive solution for tracking equity, including features for managing stock options and generating reports.

- Benefits: SaaS platforms simplify the process by automating calculations and updates. They often include compliance features to help you stay aligned with regulations and can provide insights into your company’s equity structure.

Best practices to keep in mind

- Stay up to date: Regularly update your cap table to reflect changes in equity distribution, such as new funding rounds or stock options exercised.

- Share with Stakeholders: Maintain transparency by sharing the cap table with key stakeholders, including board members and investors, to keep everyone informed of the company’s ownership structure.

- Consult Legal and Financial Advisors: It’s advisable to seek guidance from professionals to ensure your cap table complies with relevant laws and accurately reflects your company’s financial situation.

About the author

Grace Dandan has almost 10 years of experience in media production and content creation. She is currently working at Eqvista as Marketing Content Manager, an equity management software that allows companies, investors and company shareholders to track, manage, and make intelligent decisions about their companies’ equity.

Find ideal VCs for your startup today 🚀