Investor feedback is rarely valuable because it's rarely true.

When they pass, most investors give a generic, well-rounded reason. "It's not you, it's me" kind of thing. It's nice, low effort, and everyone moves on.

But why is it that way?

Table of Contents

Giving honest feedback is a time suck with zero upside

From the moment an investor decides you're a "pass", you have near zero value to them.

It's not a mean thing to say, it's just a fact.

Therefore, they have little incentive to spend time giving feedback.

And boy does it take time! Writing a deep, detailed feedback email is not done in 1 minute. You need to structure your thoughts, pick your words carefully, back up your opinion with facts, numbers, examples, links. A lot of work for someone you will likely never see again.

Now, let's be honest: would you do that 68 times a week? Probably not.

Looked at 68 companies so far this week.

— Francis Santora🐿️ (@FrancisPSantora) November 10, 2023

Passed on everything.

Investors can't admit they didn't like you

Early-stage investment is not a rational process.

Sure, investors look at market size, competition, etc. But there's definitely a subjective element to it. Do they "get" the founder? Do they "vibe" well?

Very much like dating, investing starts in the heart, then moves to the brain.

Obviously, no investor will ever tell you "I'm passing because I didn't like your vibe".

Hence the generic reply:

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now

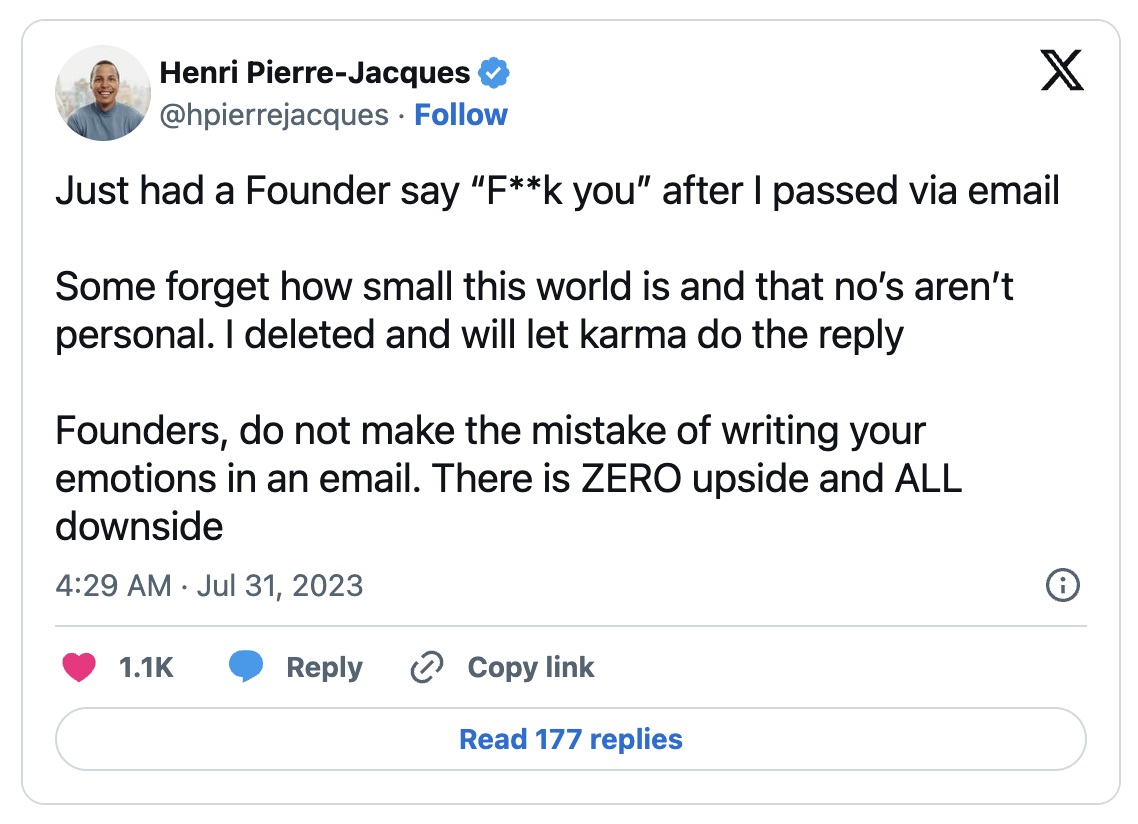

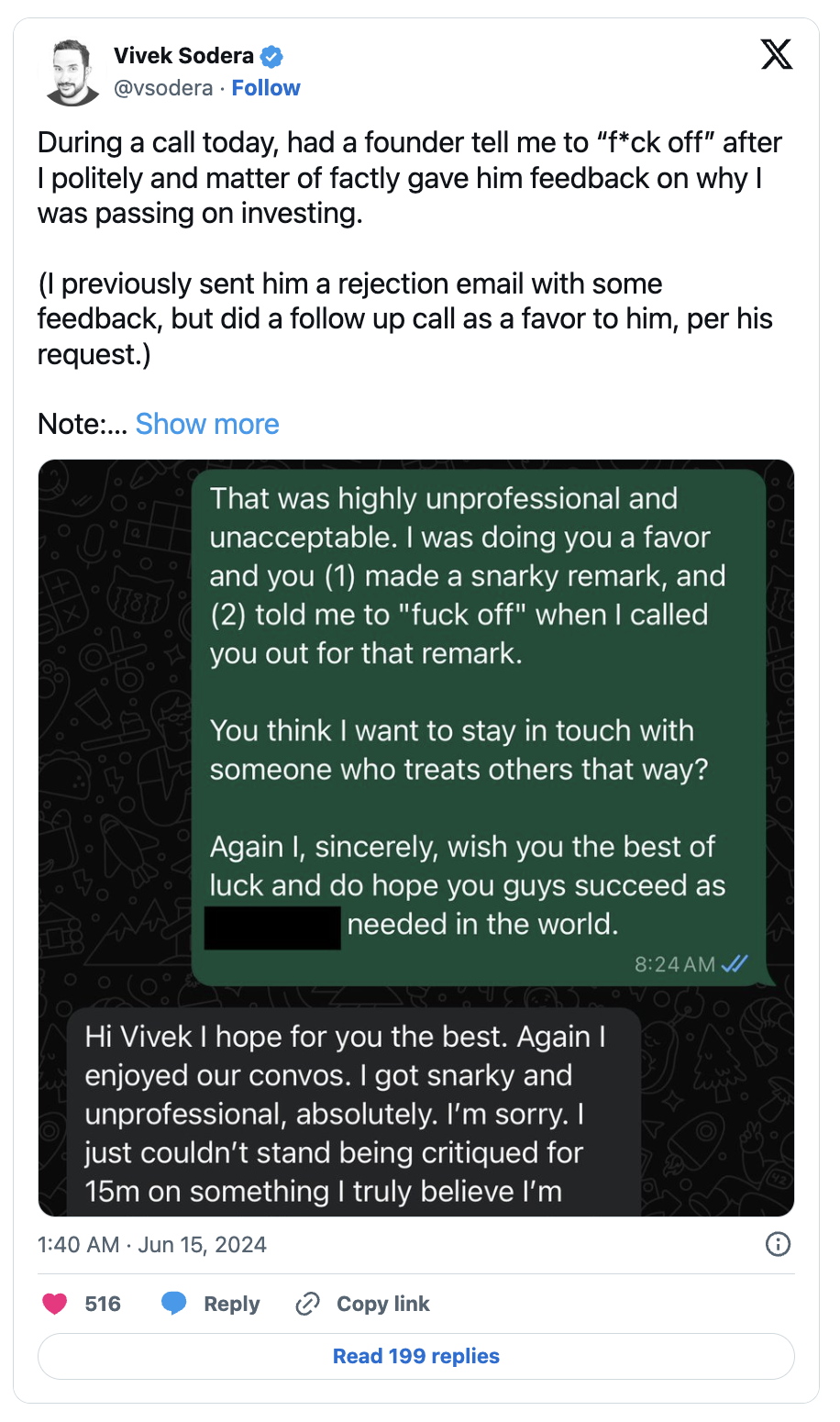

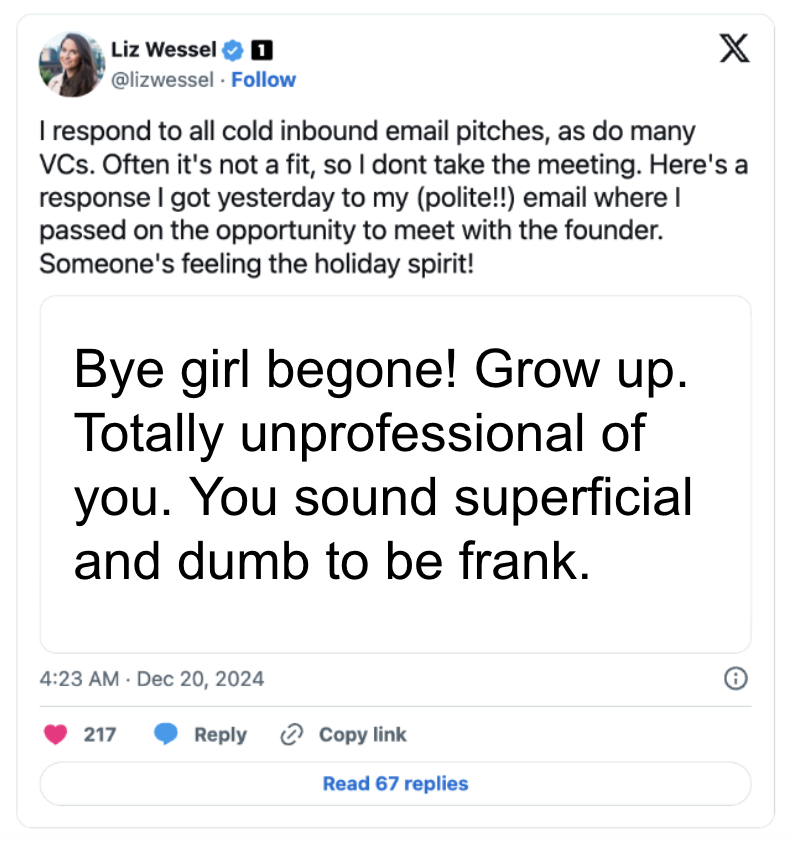

Investors don't want to handle founders' negativity

In my own case, I sometimes give in-depth, detailed feedback and the founder starts arguing back and forth on each point as if trying to prove me wrong. Waste of time, waste of energy. Just take the feedback and do your best with it.

By the way, I'm not the only one in that case:

And here's another one.

And here's another one.

And here's another one:

Of course, this is just 1% of founders. But that's enough to suck.

You can see why investors stop giving honest feedback after a few such experiences.

Investors don't want to burn bridges

Investors are often wrong at early-stage, and they know it.

Maybe another investor will see something they missed and lead your round. Maybe your growth will skyrocket in the next 24 hours. Who knows?

For that reason, investors don't want to burn bridges. They want to stay in your good grace just in case you become the next big thing.

A soft, neutral feedback is the best way to do that.

So what should you do when an investor passes?

First, don't flog a dead horse.

When an investor passes, even in soft-spoken terms, get the message - no means no. If they provide you with feedback, don't restart the conversation with counter arguments. Take it with grace, say thanks, and move on.

Second, take feedback with a big pinch of salt.

Don't expect all feedback to be valuable or even meaningful. As a founder, learn to read between the lines and apply judgment.

Rapahel gets it:

Yup. This is why we stopped asking for feedback.

— Rafael Masters (@rafael_masters) November 10, 2023

Just "Ok cheers for the time, all the best, let us know if you want to be added to the update list".

Move on to the next one, don't look back.

Wanna react to this post? Join the conversation on Twitter or Linkedin.

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now