Raising funds for your startup is never easy. Despite having interest from investors, you still need to make sure you are legally prepared to raise funds. This is part of our series of posts on how to legally raise funds in the United States.

Table of Contents

What is Regulation D (Reg D)?

Conducting a public offering is a costly and time-consuming process, not to mention that raising capital in reliance on Section 4(a)(2) of the Securities Act of 1933 includes some legal uncertainties (which I summarize in my articles ‘What is an exemption from registration?’ and ‘Raise funds with Section 4(a)(2)’). Due to the somewhat unclear framework afforded by the Section 4(a)(2) statutory private placement exemption, the SEC adopted Regulation D in 1982 (Reg D, if you’re cool). Reg D contains a set of rules that allow companies to issue securities in private offerings as opposed to public offerings and provides three reliable, efficient, and well-known safe harbors for the offer and sale of securities exempt from the registration requirements of the Securities Act: Rule 506(b), Rule 504, and today’s lucky exemption: Rule 506(c).

Who can invest in a Regulation D, Rule 506(c) offering?

Rule 506(c) is a prominent exemption from registration as it allows companies to raise an unlimited amount of money from accredited investors; unlike under Rule 506(b), the securities offered by a company relying on Rule 506(c) may not be sold to any investor that is not accredited.

What defines an accredited investor?

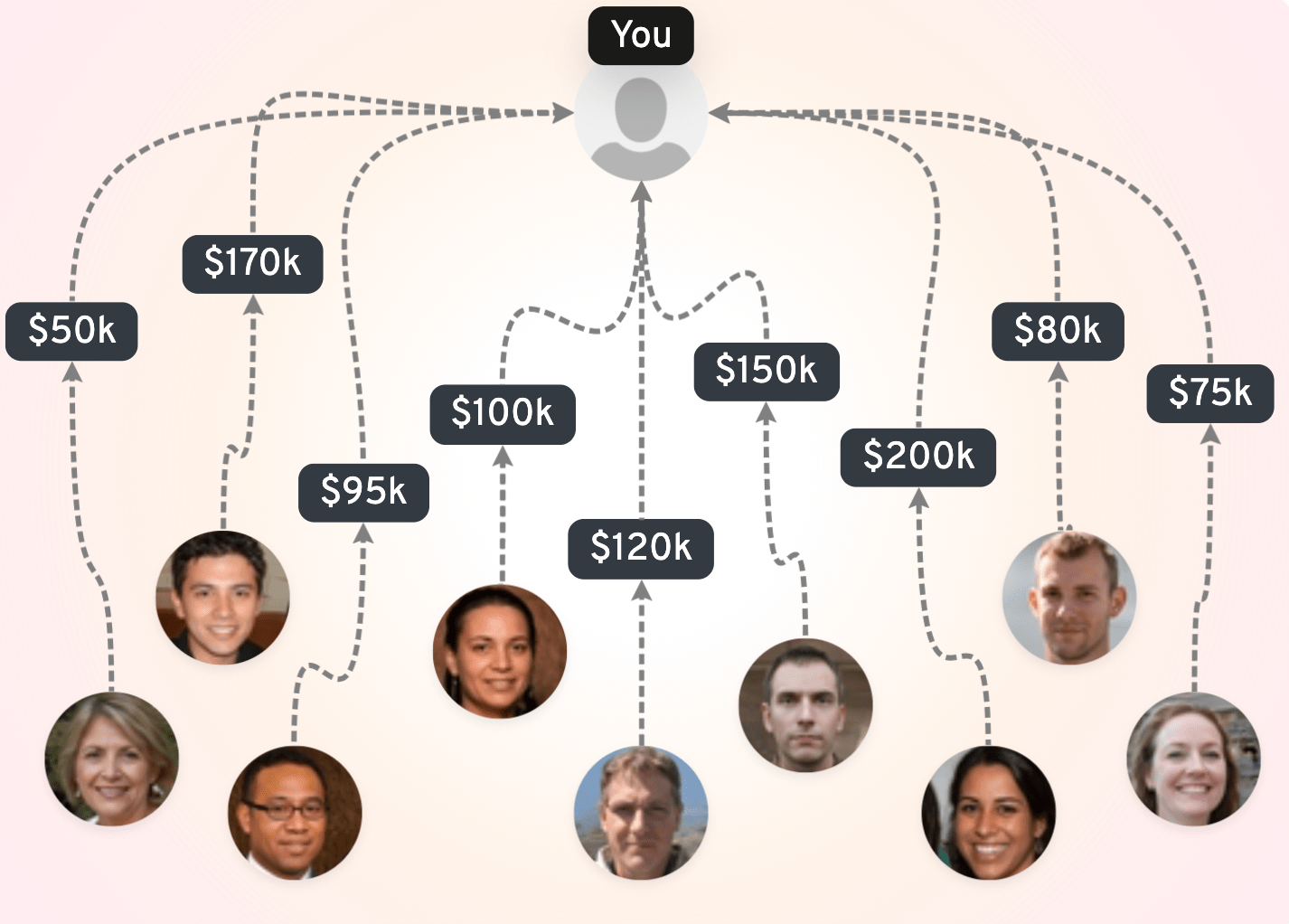

What is an accredited investor? In brief: an individual or an entity with deep pockets! There are great many ways an investor may fall within the definition of an accredited investor as set forth in Rule 501(a) under Regulation D[MN1]. In most cases, an accredited investor is an individual whose income exceeds $200,000 per year (for single persons) or $300,000 per year (for married couples) in each of the two most recent years (with a reasonable expectation of the same income level in the current year) or has a net worth over $1,000,000 excluding such individual’s primary residence. Individuals who hold FINRA’s Series 7, Series 65 or Series 82 designations in good standing also qualify as accredited investors. Most entities holding total investments in excess of $5 million qualify, so long as they were not formed to specifically purchase the securities at issue; alternatively, an entity may also qualify as an accredited investor provided that all such entity’s equity owners are accredited investors themselves. Here is a chart from ArescoTX.com to keep it simple.

How do I know if an investor is accredited?

A company issuing securities under Rule 506(c) is required to take “reasonable steps” to verify that each purchaser in the offering is an accredited investor before allowing them to invest. That means that, unlike under Rule 506(b), the company has to do more than merely relying on a statement made by the prospective investor itself (which could be sufficient under Rule 506(b) unless the company has reasons to believe that the investor is misrepresenting his accreditation status).

To complete these “reasonable steps,” a company conducting a small Rule 506(c) round would typically directly request from each prospective investor certain documents demonstrating said investor’s accreditation status under either the so-called “income test” or “net worth test.” The income test entails an investor granting the company access to review such investor’s applicable IRS forms, whereas the net worth test requires specific financial documents such as bank statements and consumer credit reports dated within the prior three months.

Yes, this is a lot of information for a company to compile, but when conducting a Reg D, Rule 506(c) offering, a company may also rely on a verification letter prepared by a qualified third party. Such accreditation verification letter can be issued by registered broker-dealers, SEC-registered investment advisers, attorneys, and certified public accountants. Not only can relying on a third-party verification letter save company labor (and avoid the risks of an incorrect determination), but it is, likewise, appealing to many investors who are reluctant to provide sensitive financial information.

Can I advertise my Rule 506(c) offering?

Much of Rule 506(c)’s popularity is because the issuer is authorized to use general solicitation and advertising to market the offering, thereby allowing a company to reach out to new investors by promoting the terms of the offering on an unrestricted, publicly available website.

What type of information is required under Rule 506(c)?

When a company relies on Rule 506(c), no specific information is required by law. That being said, Rule 506(c) issuers should follow the best practice of providing truthful and complete information to their prospective investors in a Private Placement Memorandum (or “PPM”) to ensure that investors are able to make an informed, reasonable decision. Preparing a PPM is generally advisable, as most investors will feel more comfortable if the company and its counsel haven taken the time to disclose all relevant information about the company and the offering (not to mention that preparing a complete PPM can reduce liability risk!).

What are the SEC filing requirements of Rule 506(c)?

Rule 506(c) is a federal safe harbor provided by Reg D and, therefore, a Rule 506(c) issuer is required to prepare and file a Form D with the SEC on EDGAR (the Electronic Data Gathering, Analysis, and Retrieval system) to meet compliance on a federal level. To do so, the Company should first obtain its EDGAR codes by filing a completed and notarized Form ID (for free!) on the EDGAR platform. While preparing a Form D does not take much time for an experienced securities attorney, its contents should be carefully drafted -- once filed on the EDGAR platform, the Form D instantly becomes available to the public. Beware, the clock is ticking: the Form D must be filed no later than 15 calendar days after the date on which the first investor is irrevocably contractually committed to invest in the offering made pursuant to Reg D (the SEC refers to this as the date of the first sale). To err on the side of caution, many issuers and their counsels often decide to file the Form D prior to the first sale.

What are the state filing requirements of Rule 506(c)?

Keep in mind that securities are governed on both federal and state level; state securities laws and regulations (“Blue Sky laws”) generally give state regulators the authority to approve or disapprove an offering based on their assessment of its merits. The general mechanics of Blue Sky laws are somewhat similar to the federal registration requirements set out under Section 5 of the Securities Act, so they may also include exemptions from their registration requirements. Securities offered and sold in reliance on Rule 506 qualify as “covered securities,” meaning state Blue Sky registration requirements are preempted; however, most states still require that an issuer offering securities in a particular state make a notice filing in that state, provide consent to service of process, and pay the applicable filing fee with respect to the covered securities. These state requirements vary and so do the applicable state filing deadlines (double, triple check your dates!). Companies relying on Rule 506(c) should always consider the applicable securities laws of the state(s) in which their investors reside. The good news is that a number of states have opted to participate in the Electronic Filing Depository system, a multi-state electronic filing platform which allows issuers to easily file their state Blue Sky notices and pay the applicable Blue Sky fees. Finale (very important) note: do not be late filing your Blue Sky notices, as you would be subject to state fines, investor lawsuits, and action by state securities agencies (so double, triple, quadruple check your dates!).

About the author

- Attorney Advertising -

Côme Laffay, Esq. is a corporate and securities attorney. He is Counsel at KBL Roche, a transatlantic full-service boutique law firm with offices in New York, Paris, and Munich. Côme's practice focuses on capital raising activities in both the private placement and the crowdfunding spaces, with the goal of supporting entrepreneurs and financial intermediaries.

KBL Roche

1115 Broadway, STE 1011 New York, NY 10010

[email protected]

(646) 801-6171

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started