Word on the street is that a new startup is doing big things and has even bigger plans.

Their vision aligns with yours and their value proposition is something that you can truly contribute to. You need to be a part of this, you know you can make magic happen.

You reach out and not only get a meeting with the founders, but you wow them. A few days later you receive a lovely email with an offer for you to come on board.

The compensation? Sweat equity.

Huh?

Is this a joke? What is sweat equity? How does it work?

What does it even mean?

This is precisely what this article is going to address.

Table of Contents

What is sweat equity?

Despite its gross name, sweat equity is not liquid. Quite the opposite, actually.

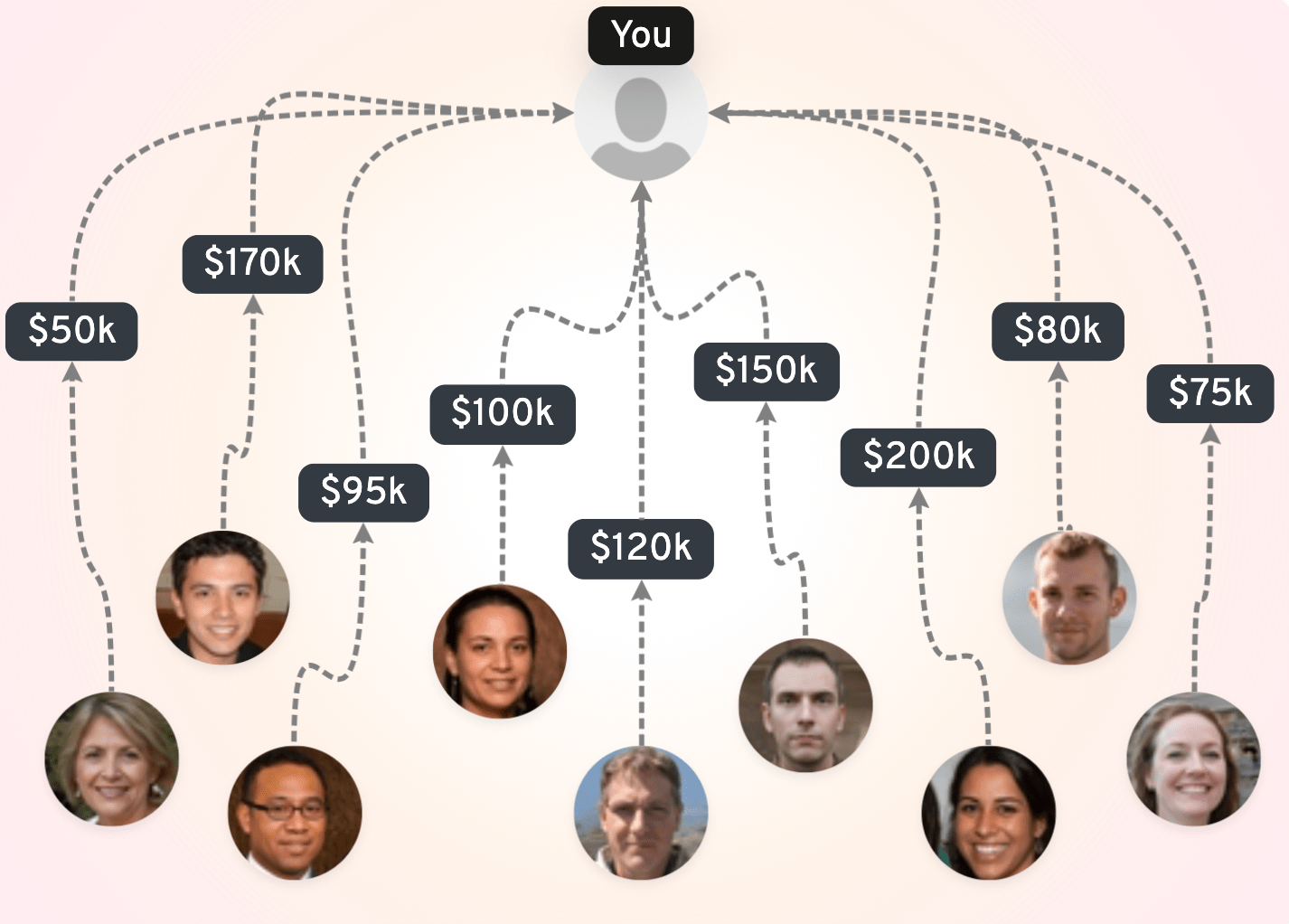

"Sweat equity" is a catch-all term that designates a stake in a company acquired by an employee, a contractor, or an advisor in lieu of cash. So when you hear about "employee stock options" or "advisory shares", they are all a type of sweat equity.

With cash and resources in short supply, founders need to use every means and method that they have to obtain talent and help their startup succeed. Even Shark Tank’s Mark Cuban is a big proponent of sweat equity:

“Sweat equity is the most valuable equity there is. Know your business and industry better than anyone else in the world. Love what you do or don’t do it.”

Sweat equity isn’t just a nasty name, they are actual shares the company uses to compensate stakeholders for their work and time (and are given in place of payment). Talents may be given sweat equity shares in exchange for providing the following:

- Labor

- Connections

- Know-how, knowledge, skills, technical expertise

- Or more generally, any form of value add

This "sweat equity" is used to incentivize and motivate them (especially when they are faced with better offers…i.e. money).

It is hoped that when and if the startup has a liquidity event (acquisition, IPO, or secondaries), these sweat equity shares will really pay off for everyone involved.

Who does what for sweat equity?

First off, founders need to realize that calculating sweat equity for each role can be challenging.

The sum of money and sweat equity invested in a startup is not the market value of the business. Sweat equity work is the result of one’s efforts and contributions to the startup. It is up to the founders or the top members of the company to determine what each person’s actual sweat equity is valued at.

This isn’t a quick and easy task.

A startup needs to carefully assess each person that they plan to offer sweat equity to. They need to understand that individual’s potential contribution to the business as well as their work experience in order to determine their sweat equity. Sure, the potential CMO you want to hire was ex-Uber, but your startup is in the reptile social media space, so the value add may not be as high as they claim. Startups don’t want to overvalue and provide too much equity to a hire as this could cost the startup later on during fundraising.

Startups need to carefully consider the following when providing sweat equity to employees:

- Is this a long-term hire? Will this person be here for the entirety of the journey? Will they stick around through the good and the bad?

- Do they recognize the vision? The mission? Are they able to make the startup’s goals a reality? Will they truly sweat (pun intended) for this endeavor?

- What exactly can they contribute? What kind of skills do they possess? What expertise? How strong is their network? What can they bring to the table? Are they truly able to make a difference or will they just do the bare minimum?

- Are they passionate about the startup? Are they willing to go above and beyond to make sure that the startup reaches its potential and has a proper exit? Their sweat equity is tied to the startup’s success so they should be properly invested.

Understand that there is no accurate or firm dollar amount until a valuation, acquisition, or IPO. Once the startup receives a market value or is sold, the sweat equity is paid via stock options or cash compensation.

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now

The benefits of sweat equity

Sweat equity, if properly utilized by a startup, can provide important benefits:

- It saves the startup capital and allows it to use that capital in other key areas.

- It is a non-cash compensation tool for the startup.

- It attracts employees that the startup otherwise wouldn’t be able to afford.

- It creates incentive as a liquidity event benefits all sweat equity shareholders.

- It aligns objectives for all sweat equity shareholders, as they all work toward a common goal (a liquidity event).

- It can increase a company’s valuation.

- It acts as an incentive for the startup to retain high quality talent.

- It can provide long term wealth creation for all sweat equity shareholders.

Sounds great, right?

Before you draw up the papers and start hydrating yourself, sweat equity also has some drawbacks and limitations.

The limitations of sweat equity

It isn’t all fun and games when it comes to sweat equity. It has significant drawbacks and limitations:

- It takes too long to reap rewards. Employees may lose enthusiasm for a project and move onto something better and more financially rewarding.

- It is risky. Sweat equity is worthless unless the startup is successful and has a liquidity event.

- It doesn’t offer much. Sweat equity shares don’t pay the bills. In fact, other than a catchy title on LinkedIn for your role in the startup, sweat equity offers little immediate reward.

- It can cause delays. Employees compensated with only sweat equity will prioritize other work that pays their bills, causing the startup to miss milestones.

- It can cause internal disputes. Employees may value their contributions and time much higher than the founder does. This could result in nasty internal disputes that could harm the startup.

- Founders may overvalue contributions. There is a risk of overvaluing sweat equity in the early stages of the company. This could result in a share deficit for later-stage investors, especially when the company is growing and scaling up.

- It may actually repel top talent, not attract. Highly skilled people are in high demand. While some may be interested in a sweat equity opportunity, most won’t do anything without proper compensation for the amount of work you want them to do. I wrote about this in detail here. If you don’t have the time to read it, let me just say that the next stranger who approaches me on LinkedIn and offers me sweat equity is going to end up covered in blood, sweat and tears.

Sweat equity agreements

There needs to be clear and concise terms established in a sweat equity agreement. The startup should state their expectations and the hire should be clear and realistic about their contributions. Here is an infographic courtesy of EQVISTA of what should be included in a sweat equity agreement.

Let’s break it down further.

- A vesting period is the time an employee must work for an employer in order to outright own the employee stock options. Each startup has different vesting periods and schedules. This applies to sweat equity, as employees most likely will have to wait years before owning 100% of their shares.

- The type of equity and the terms, which depends on the value they add to the business.

- What exactly are the expectations? How many hours per week? What are the deliverables?

- Sweat agreements need to account for founders who leave the business prematurely. The agreement needs to accommodate the exit of a co-founder and it shouldn’t discount their efforts.

Additionally, these agreements should also contain the maximum equity amount that can be earned, compensation type and amount, as well as an employee separation agreement.

The future of sweat equity

If you think the sweat equity model may seem a bit outdated in today’s world, you aren’t alone. LinkedIn co-founder Reid Hoffman backed Sweat Equity Ventures with $30 million to see if founders would trade equity for value-adding services alone:

"It's a unique channel for equity that's different from the normal cycle of dollar returns."

Sweat Equity Ventures doesn’t write a check. Instead, it provides a team to work inside the startups in their portfolio (everything from writing code to having partners’ names appear on the patents alongside the startup employees). Startups pay Sweat Equity Ventures common stock shares, get paid salaries by the firm and receive part of the carry. SEV staff remain with the startup for as long as they are needed to achieve the strategic goals.

But that isn’t the only change to the sweat equity model. The future of sweat equity is tokenized, at least according to Kevin Monserrat, co-founder at Consilience Ventures. He explains the process in the following steps:

- Startups convert a proportion of their equity into tokens via blockchain.

- Founders can then access a network of curated industry experts across a wide variety of disciplines. Their expertise and services can be paid via the tokens.

- In exchange for their expertise, the experts now control the tokens. As the value of the startup grows, the value of their tokens grows with it.

Monserrat envisions a future where multiple startups use the same token, creating a portfolio of companies. This in turn allows token holders to have a stake in the entire portfolio, which maximizes value and reduces the risk. Additionally, tokenized sweat equity reduces the risk for key hires and experts and increases trust between the founders and experts.

It is hoped that founders can find the right people who can provide the most value and do so without putting cash up front. As the experts will receive compensation through the tokens, it is hoped that they will give the startup their full attention and efforts.

Conclusion

Startups are difficult and having the right team is one of the keys to success. The best way to bring on the best people while not blowing the entire budget is via sweat equity. While sweat equity offers advantages and benefits, it also has limitations and isn’t for everyone. Ultimately, founders must realize when and how to use sweat equity.

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started