Which geographies should you invest in? This is a core question that any investor needs to obsess about, yet one massively overlooked by most venture capitalists.

In many ways, that question is complex. It’s hard enough to understand the economy of a single diversified economy like the US, how do you continuously evaluate ones that are in a different stage of development and with unique social and historical elements at play? The answer is that you apply the same principles and account for the additional risk (and ideally the additional upside).

But before you do that, you should step back and think about your portfolio holistically - where each investment complements the others and serves a particular purpose.

Table of Contents

I. Why Does A Diversified Portfolio Matter?

The science of portfolio construction is complicated but has some clear tenets. For one, 10% of your net worth should not be restricted to one investment - the risk calculus is brutal. Another is that you ought to diversify across investment types and geographies.

I grew up in managed futures shops (a type of hedge fund) and was taught to think beyond pure plays and to think holistically about my portfolio, trade entry/exit points, and diversification. This meant that the risks (and rewards) need to balance one another and perform at the right time. Perhaps the most renowned example of this investing methodology is Bridgewater’s All Weather (chart below). It recognizes that concentration risk is perhaps the single most dangerous risk (think Lehman and subprime mortgages, or FX shops and the British Pound on Black Wednesday, or any number of asset managers and the dotcom bubble). Spreading risk across a variety of factors and time horizons helps balance the possible outcomes.

Now, the vast majority of investors show a bias towards their own country’s investing options (mainly publicly traded equities). This is not out of patriotism, but familiarity. And in this Magnificent 7 era, it’s a tough argument not to concentrate investments in a handful of American companies/sectors; but I reckon the investors in Enron said the same. Moreover, investors today tend to focus on stocks, bonds, and crypto; often because they are not accredited investors and cannot expand into venture capital or private equity (but if you are one, it’s well worth a look).

Another contributing factor is that investors are fearful of investing spaces they don’t quite understand; and they certainly should be. And finally, investors can often pass judgment on the economy of an entire country based off of a negative headline they saw (e.g. cartels in Mexico, corruption in India, and so forth). But to those investors I’d say don’t only judge a country based on a headline you see. Even developed markets won’t look terribly fantastic if we’re basing our view of them purely on headlines (political violence in the US, constant protests in France, and much more). It’s always worth diving deeper, and if you can’t, find a guide (e.g. a professional emerging markets investor) to help you do so.

But what are emerging markets? Sure, they are complicated and multifaceted and varied. But more specifically, they cover such a range of countries from India to South Africa and from Colombia to Indonesia. In fact, one could easily argue that 80% of the countries of the world fall into the developing / emerging category. So, how do we differentiate between them? What makes them similar and what sets the ones that are most likely to produce outsized returns apart? Well, to understand that, we first have to look at what makes a market “developed.”

II. What Makes A Market “Developed?”

It’s broadly agreed that the US’ fixed income and equities markets fall into the (relatively) low risk bucket of one’s portfolio as against emerging markets, commodities futures, other developed markets, and nearly all FX. But why? What makes the US special?

Beyond just producing consistent outsized returns, the US currently has a dominance in innovative companies and people, a (reasonable amount of) faith in government institutions, a high standard of living for most, a system of law that has standardized repercussions and is relatively swift, significant hard and soft power (the influence of movies and music), leadership in multilateral institutions and more. But here's the thing. Just as the market is dynamic, so is the dominance of any one group of economies.

Only ~100 years ago the British Empire was unrivaled in its industrial capacity, trade dominance, and so much more. Britain is not even a shadow of that today. The same is largely true for France, Spain, Italy, and more. These are economies that are massive and more or less steady but hardly at the cusp of an accelerated breakout. The US has its share of challenges and is perhaps only 10 years away from experiencing something of a lost decade or two like Japan has had so many of now. As it is, the US’ share of global GDP has declined significantly over the decades, already (graphic below)! Moreover, what percentage of the capital in the US stock market is from foreign sovereign wealth or its proxies? Therefore, isn’t it worth considering where else to invest?

And so, let’s double back and ask again, what makes a market “developed?” Consider the following well-accepted factors:

- A high standard of living and high per capita income as against GDP

- High levels of economic stability, infrastructure, and industrialization

- High quality healthcare and education systems

- A high degree of trust and confidence in that country’s institutions

- Liquid, mature, and well-regulated capital markets

Undoubtedly there’s a range amongst them, but all of the above is true with the US, France, and even Spain (on a relative basis). It becomes somewhat and precariously true when considering China or Russia. And becomes incredibly untrue, unfortunately, if we consider Somalia.

All the same, developed markets are also developed markets because of their generational and compounding wealth and ability to manage through a variety of economic cycles over the years. Whether it's inflation, interest rates, trade balancing, or offshoring manufacturing to improve margins of their companies, developed markets have established the ability to rebound unlike some emerging markets such as Argentina. And furthermore, consider that developed markets also remain at the top because of perceived trust and faith in institutions amongst investors (separate from citizens). Take for example that Japan and China are the largest holders of US Government debt though their relationships with the US are complex. Or how about that the largest reserve currencies (e.g. used for trade payment) are the US dollar and the Euro but that quite a bit is held by countries like Saudi Arabia and India as a means of balancing their own.

And so, having briefly looked at what makes a developed market so, let’s consider the state of emerging markets and which ones are poised to grow exponentially. (By the way, if you’re interested in learning more about how developed markets came to be, I recommend Dr. Ha-Joon Chang’s work in “ Kicking Away the Ladder. ”)

III. What’s The Potential For Emerging Markets?

As discussed, emerging markets is a term that covers countries ranging from Kenya to Malaysia and Costa Rica to Egypt. What makes an emerging market so? Well, it’s effectively that the 5 points listed in the developed markets section are only partially or hardly at all true (e.g. a country has a low standard of living for most of its population).

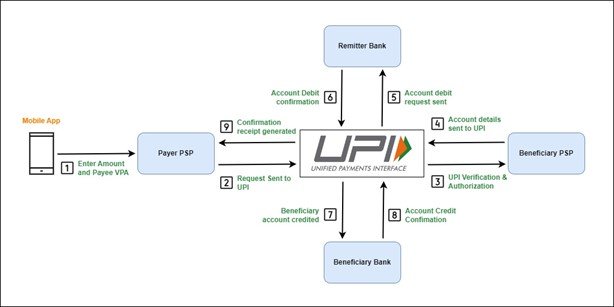

What’s especially fascinating about the past 5-10 years is that leapfrogging has been enabled by the global knowledge sharing through the internet and the breakneck pace of consumer technology. Take for example that in the US ecommerce grew steadily and step by step from Amazon as a desktop-based bookseller in the late 1990s to the mobile-first shopping experiences of Instagram or Temu today. For many emerging markets, they have skipped the first step and that particular infrastructure buildout and are now executing with a far greater rapidity and a lower capital outlay. But, it’s not just an importing of Western markets’ technology that has enabled this leapfrogging, some emerging markets themselves have become incredibly innovative ( UPI and digital payment infrastructure in India is a fantastic case study and is arguably superior to what’s in nearly all developed markets.)

To focus on the investing opportunity further, select emerging countries have also significantly improved their markets, political institutions, regulation, logistics, and infrastructure in recent years.

They have young and well-educated workforces who have been leveraged to fill the massive labor gaps (in fact not because they’re “cheap labor”) for developed market multinational corporations like Google and Toyota. In turn, this has produced massive middle classes - take India with its middle class of over 400 million people or Indonesia and Nigeria with middle classes of 50 million each! The opportunity for investors is tremendous.

Consider and imagine the needs of those consumers, from bank accounts, to home goods, to cars. In fact, consider the comparative consumerism below of India, China, and the US and what that could translate to in dollar terms for companies and investors if India were to catch up!

IV. Why Is Now The Time For Emerging Markets?

So, why now? Why not 5 years from now? It’s simple, emerging markets and developed markets have reached an inflection point like never before. And they’re heading in opposite directions.

I’ve already highlighted the stagnation and political uncertainty facing so many developed markets; this presents an opportunity for emerging markets to act not only as an investment hedge but to produce alpha in their own right (India’s Nifty stock index has tripled in 4 short years and Mexico’s IPC is on its way to doubling). Moreover, most developed markets’ multinational companies are betting their growth strategies predominantly on emerging markets. Apple isn’t just manufacturing iPhones in India, in its first year it sold 10 million of them there. The same mindset is true for Amazon, Starbucks, Toyota, Citibank and beyond.

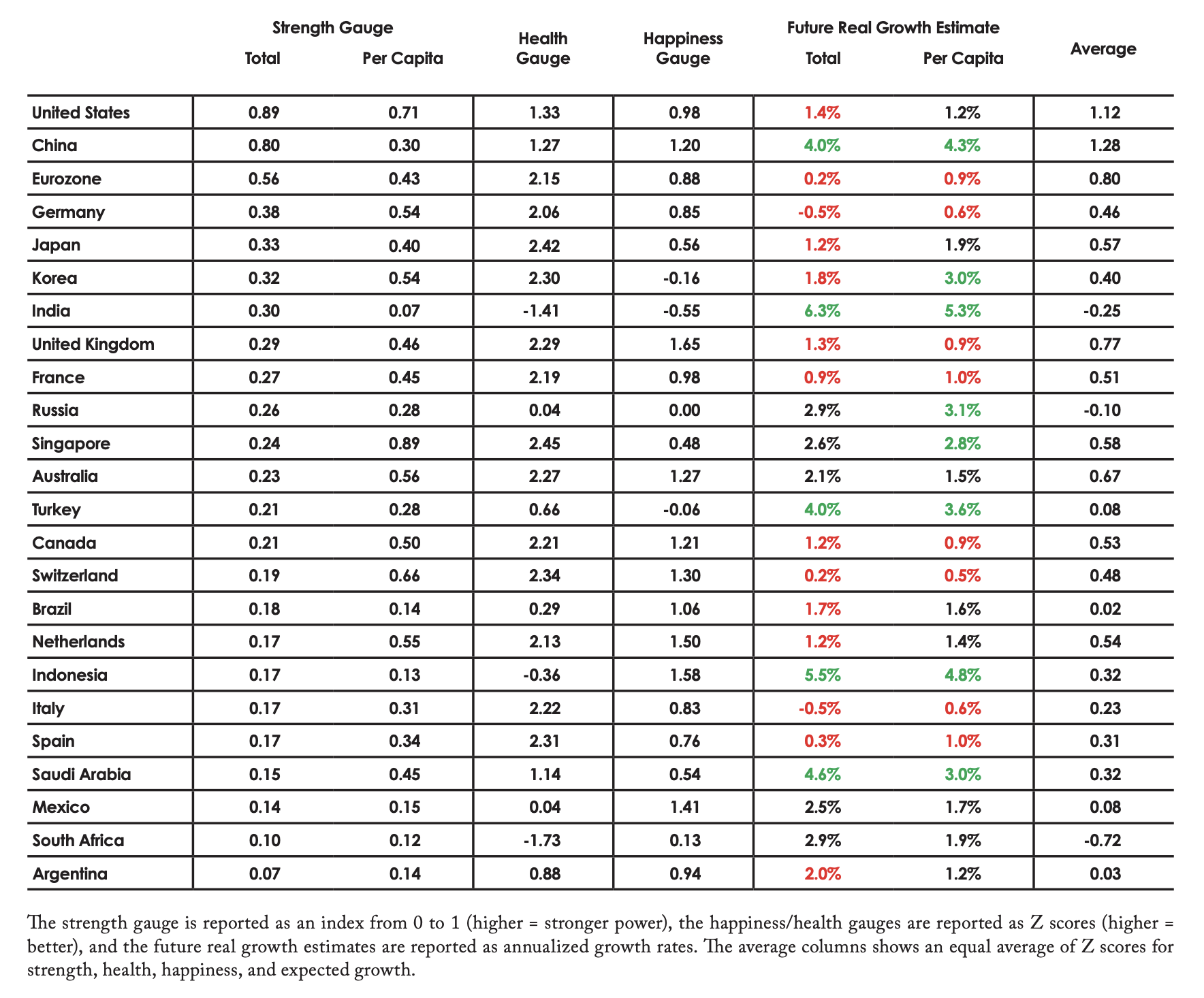

And what about the national debt? Debt can be a useful tool for accelerating growth, but it’s not a coincidence that many developing countries (including India, South Africa, and Indonesia) have stronger debt scores (i.e. a form of fiscal discipline) than their developed market counterparts, per Ray Dalio’s calculus.

Next, to focus on venture investing, there is an argument that the American venture ecosystem has started to become saturated and zero sum in many sectors (i.e. startups keep disrupting each other rather than legacy businesses and sectors). Don’t believe me? How many hundreds of HR SaaS platforms are there? How about CRMs and accounting software? What about the same vanilla investing platforms? Effectively, this means cannibalization of market share that is likely not accelerating the speed and growth of clients. Now compare that to emerging markets which are a blue ocean in so many sectors and where legacy businesses can be disrupted, if at all they exist. And remember, disrupting a large legacy business often means a far greater revenue opportunity than just eating market share from a mid-size startup.

Also consider the economic levers with the recent central bank rate cuts and steadying inflation making it more likely that American and European multinational companies will be able to take on additional debt to accelerate their growth plans abroad. These rate cuts also potentially mean that established companies and startups in emerging markets will be able to find cheaper capital solutions to expedite their own growth. And finally, it has also become less costly for emerging markets to take loans from wealthier nations in order to enhance their physical and social infrastructure. We’re at the cusp of a potentially greater number of rate cuts that set off the roaring ‘20’s in even more emerging markets.

Furthermore, as we look ahead, the Dollar and Euro strength may not hold in the coming 10-15 years. With increasing use of the Renminbi globally and the immense likelihood of a BRICS currency, investing in the ecosystems of select emerging markets is an option to help manage the currency risk and hedge fx rates.

It’s also important to remember that many standard facilities or apps in developed markets, such as access to consumer or small business credit have a long way to go in all emerging markets as of right now - this presents a tremendous opportunity to invest quickly, but intelligently, in these spaces. Some of the sectoral opportunities that remain deep-opportunity emerging markets such as Mexico and Indonesia include Saas, Infrastructure / Logistics, and more. Take my own expertise in financial services. It’s a complex sector (spanning embedded finance, financial infrastructure, insurance, and more) that requires that expansive knowledge, and someone who takes their fiduciary duties to their investors seriously, to navigate it well.

And finally, in just a few short years, the size and breadth of select emerging markets will have taken off. By 2030, the list of the largest economies (GDP by PPP) in the world will be dominated by emerging markets, highlighted below:

And so, consider this: if you could have invested in companies in Silicon Valley 40 years ago, when it was truly starting to take off, wouldn’t you have? That’s the opportunity investors have in select emerging markets over the next few years before they become too expensive, too saturated, and the possible returns become much less exponential.

V. How We Invest In Emerging Markets At Katha VC

We take a high conviction approach to investing in early stage fintech in select emerging markets. These markets have deeply undervalued ecosystems and where diversified financial products can improve the quality of life of their people and the strength of their businesses.

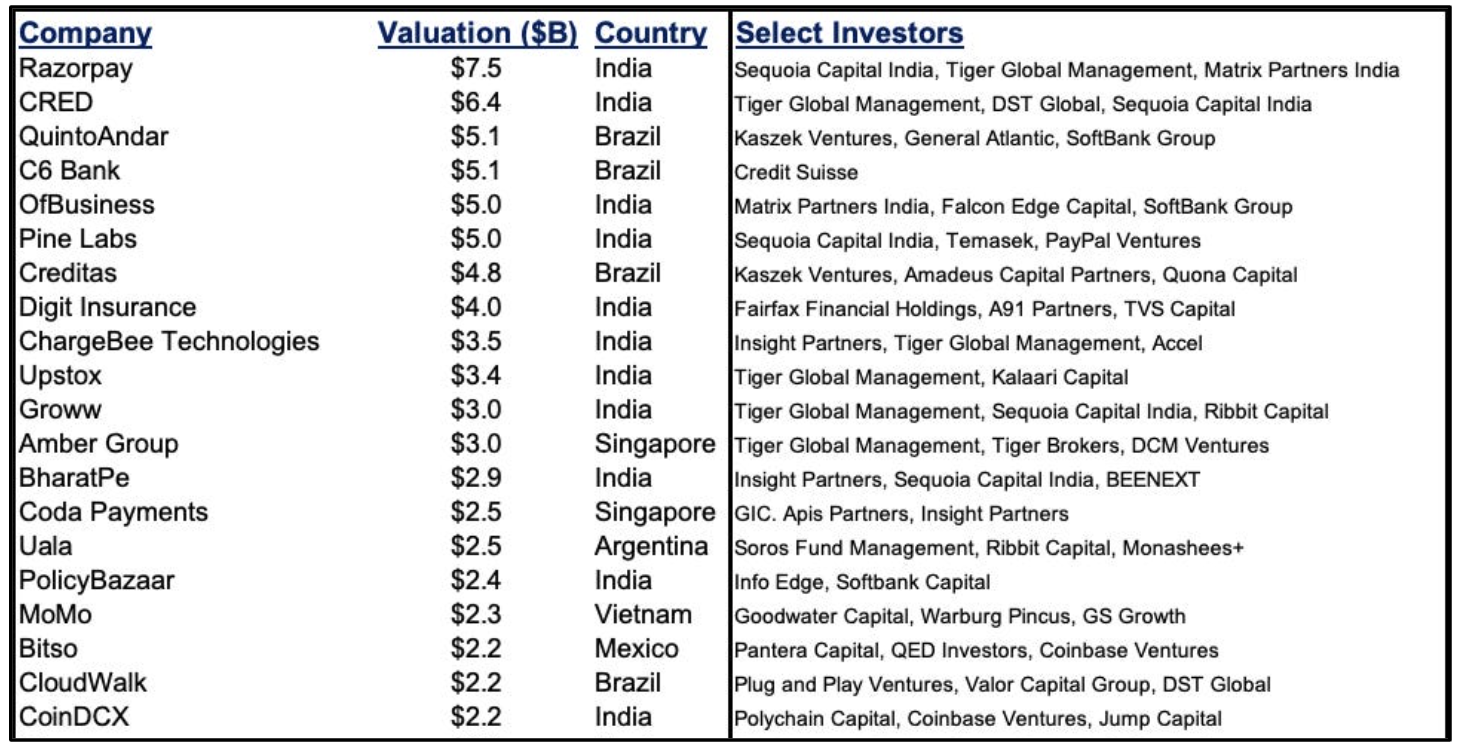

We focus on fintech because it has a high-level of transferability across regions whether it be payments, neo-banks, credit, and beyond. It also has exceptional margins as a sector. Not to mention, the financial sector accounts for 20% of Global GDP. Today, there are already 50 fintech unicorns in emerging markets. And, Asian, Latin American, and African fintechs are expected to reach $1T in revenue by 2030 per BCG.

We run an investment process that is data-driven, disciplined, and repeatable. And given the focus on emerging markets we obsess about risk management, macroeconomic data, regulations, currency movements, and trade. We work with LPs, who are accredited investors, through the Katha VC AngelList Syndicate.

OpenVC is the best way to access deals 🤝

Browse the top 1% of deals and interact directly with founders. Completely free.

About the author

Sahith Aula is GP at Katha VC, a VC focused on investing in the most promising fintechs in select emerging markets. Sahith is a 2x funded fintech founder, has worked in investment law in 6 countries, and led Operations at 3 quantitative hedge funds. Sahith is based in NYC.

Disclaimer

Nothing in this article should be construed as financial advice. Investing involves risks and it's essential to conduct thorough research and understand the dynamic nature of the market before making any decisions. I strongly recommend consulting with qualified professionals, such as financial advisors, tax accountants, and legal experts, to ensure informed choices. Ultimately, you are responsible for your investment decisions and should only invest what you can afford to lose.