Accelerators have become an essential part in the process of scaling up and reaching funds for startups. These programs provide a range of resources, including mentorship, networking opportunities, and funding, to help early-stage companies succeed.

While accelerators have been around for many years, they have gained significant traction in recent years, particularly in emerging regions. This essay will explore the importance of accelerators in emerging regions and how they are helping to drive innovation, economic growth, and job creation.

Table of Contents

Struggles in the Region

One of the biggest challenges, especially in Latin America, during the early stages of a startup is gaining education about startups and accessing resources.

Many startups fail because they lack the knowledge or skills required to build global businesses, not just local companies. While Latin America's startups are now solving global problems around the world, the region is still in its early stages due to a lack of opportunities to access capital, fierce local and international competition, founders' poor playbooks or formalities, and the inability to achieve product-market fit or build something people want. These struggles, although not uncommon among startups, are magnified in a region where there is a lack of access to proper preparation or community, leaving luck out of the equation. Fortunately, accelerators across the region are helping founders avoid these common pitfalls.

Here are the top 5 challenges startups face to survive and grow in emerging regions, especially in Latin America:

- Access to funding: According to Statista’s research department in 2022, 488 deals received funding in LatAm, with an approximate of 14.000 startups in LatAm according to startup Genome’s study that would mean roughly 3.5% get funding. [1]

- Limited access to mentorship and resources: Many startups in emerging regions suffer from a lack of mentorship opportunities that could help them avoid common pitfalls. According to a survey by Startup Genome, only 10% of startups in emerging regions have access to strong mentorship networks. [2]

-

High competition: Startups in emerging regions often face stiff competition from established businesses and other startups.

-

Regulatory barriers: Startups in emerging regions often face regulatory barriers that can make it difficult to operate and grow. According to a report by the World Bank, Latin America and the Caribbean have the most complex regulatory environment for starting and running a business. [3]

-

Difficulty in finding talent: Finding and retaining talent is a major challenge for startups in emerging regions. Competitive salaries in other regions make it difficult to compete as remote work popularizes and gives access to more opportunities abroad, according to the international talent organization, remote work has increased tenfold in LatAm. [4]

Although talent is difficult to find in the region, the new wave of layoff will allow for talent mobility and relocation to younger startups and help ease the need for top tier talents in early stage companies.

Building a startup is incredibly hard: Many studies have shown that up to 90% of startups fail in the first two years, this means that out of 10 companies you invest in, 9 are going to fail. This makes it a very volatile and hard-to-predict asset, that many investors perceive as not good enough to invest in.

Accelerators can help startups overcome some of these challenges by providing access to funding, mentorship, resources, and networking opportunities.

Find ideal VCs for your startup today 🚀

Share pitch decks, track engagement, and get replies from investors - all within your FREE Fundraising CRM.

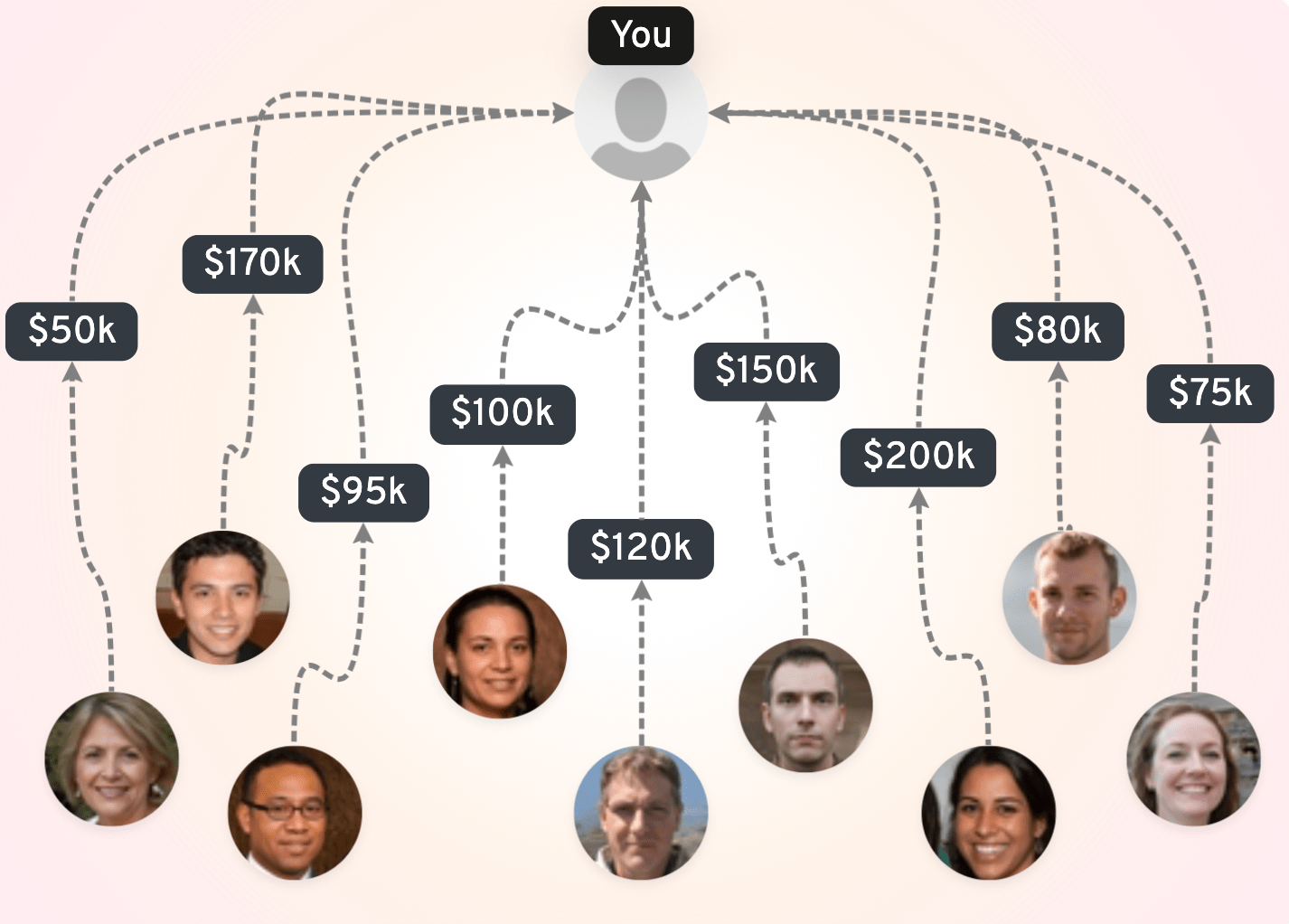

Much needed runway

One big issue for many companies is the lack of resources, which many accelerators give to founders. Access to capital is another significant challenge that founders often face due to limited networks and lack of understanding from investors. This is especially true in emerging regions like Latin America, where the low number of past exits results in fewer angel investors, and in turn, less funding for the very early-stage. See below the number of exits in 2016-2018 per region of the world.

Accelerators provide startups with access to a network of investors who are interested in supporting emerging markets. They also help startups develop a strong pitch and business plan, making them more attractive to potential investors. Through this support, accelerators enable startups to secure the funding they need to grow and succeed.

Accelerators in the region

Pygma: We realized with our guidance, mentors, demo day and overall community we can raise 100K in average for the startups that go through our program in the span of 3 months. We also believe in taking a very small equity participation, in order to let the startup grow, attend other programs and raise capital without perceiving the acceleration as a captable burden. This is why we only take 1% equity in the startups we receive in the program.

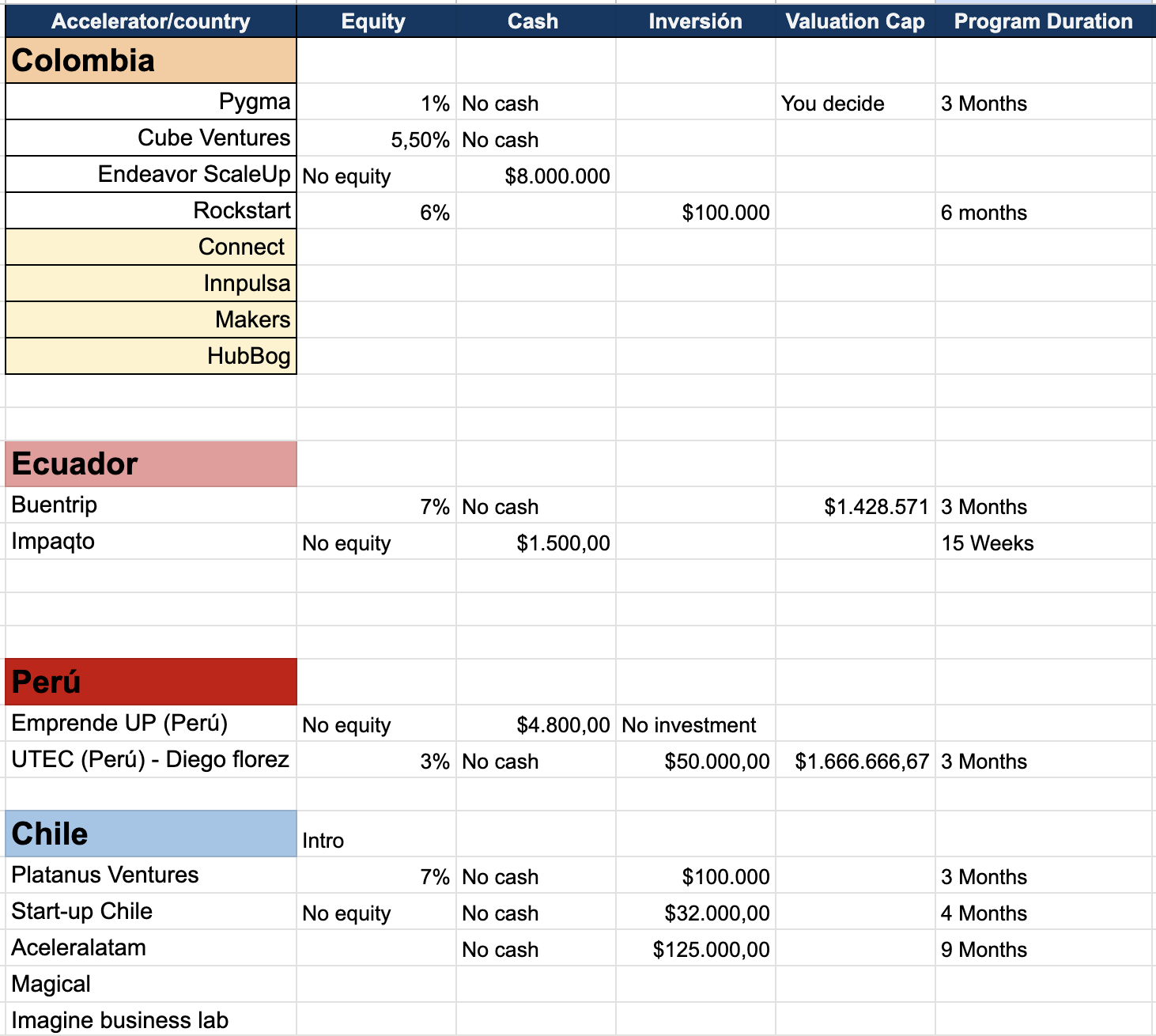

We also outlined the whole list of accelerators and their unique deals in the following document, where you can see great alternatives like Rockstart, Platanus Ventures, 500 and many more!

Community prevails

Despite the growing popularity of the term "entrepreneurial ecosystem," it remains unclear whether emerging markets in LatAm have a true ecosystem or simply communities that live in silos. A genuine ecosystem requires a diverse range of players working together to support the growth and development of startups. Accelerators can play a crucial role in bringing these players together by providing a space for founders, investors, and other stakeholders to connect and collaborate.

In addition to this, accelerators also serve as community builders in emerging markets. By creating a space where like-minded entrepreneurs can connect and share experiences, accelerators offer valuable support, advice, and mentorship throughout the startup journey. This community enables startups to build resilience and develop the necessary skills to overcome challenges and succeed in the long term.

Positive signaling and momentum

In an illiquid, slow and rigid market, something that can truly help a startup is gaining momentum. This allows to create speed in the fundraising market, specially in an emerging region where many angels need positive affirmation before pulling the trigger.

Having the recognition, community and advisors that are present in accelerators can be of great help towards a fundraising round and send positive messages to funds that the startup has a strong support network and has been examined before.

Learning and Global Practices

Entrepreneurs in emerging markets face a challenge: the lack of a distinct mentality and way of doing things. Often, they try to copy the American startup ecosystem without taking into account the unique cultural and economic factors at play in their own countries. This can lead to failure when attempting to replicate the venture capital world in emerging markets. Accelerators can help by providing a framework for building a distinct startup culture that takes into account the unique characteristics of each market.

Lastly, accelerators must have a constantly updated curriculum. One of the most significant benefits of accelerators in emerging markets is their ability to foster innovation. By bringing together a diverse group of entrepreneurs, investors, mentors, and experts, accelerators create a collaborative environment that encourages the exchange of ideas and drives innovation. This unique environment also leads to a compounded talent pool, which can be harnessed for the benefit of the startups and the local ecosystem.

Beware of…

Unfortunately, there are bad practices from relevant players such as accelerators, investors, and public and private organizations. These practices can include deals that are not friendly to founders or a lack of innovation culture. Accelerators can help combat these issues by promoting ethical and transparent practices and encouraging innovation and creativity.

Conclusions

- Accelerators are crucial for the success of startups in emerging regions by providing access to funding, mentorship, resources, and networking opportunities.

- They can help build a distinct startup culture that takes into account the unique characteristics of each market, leading to innovation and a compounded talent pool.

- They serve as community builders in emerging markets by creating a space for like-minded entrepreneurs to connect and share experiences, offering valuable support, advice, and mentorship throughout the startup journey.

- Accelerators can combat bad practices by promoting ethical and transparent deals.

- They are a motor towards encouraging innovation and creativity helping founders go from Point A to Point B faster.

About the Authors

Daniel Ospina is the Co-founder & CIO at Pygma, a pre-seed focused accelerator helping startups in emerging regions. Previously owned Scala a Micro VC fund, invested in several startups and worked in the selection team at Endeavor.

Follow Daniel on Linkedin or Twitter.

Andrés Cano is the Co-founder & CEO at Pygma a pre-seed focused accelerator helping startups in emerging regions. A two time accelerator founder, angel investor, and VC innovator with +180 startups accelerated in his career.

Follow Andrés on Linkedin or Twitter.

About Pygma

Pygma is a pre-seed accelerator focused on the next-gen of founders seeking to create industry defying businesses with an opportunity to scale globally through technology! Our program is remote, 3 months long with an IRL summit to build deep connections.

To join Pygma, apply here: application.pygma.co.

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started