First-time founders usually lack two things: knowledge and access.

The lack of access is something founders realize very quickly. They don't have the connections to get in front of investors, and start searching anxiously for intros. The lack of knowledge takes longer to realize, but eventually becomes obvious when it's time to design a fundraising strategy, create a data room, or negotiate a term sheet.

That's when the question pops up: "How about paying a pro to raise funds for me?"

This post intends to give you a nuanced answer on a controversial topic.

Here's the truth about investment bankers, fundraising advisors, and what the best option is for first-time founders.

Table of Contents

Option 1: Work with an investment banker

Investment banker raise the bigger rounds

Investment bankers are professionals who help companies raise capital - typically from Series A to pre-IPO.

They take care of everything: preparing the deck, connecting with investors, and even negotiating the term sheets. The founder just shows up for key meetings and relies on the banker's expertise and network to close his round efficiently while he or she focuses on growing the business.

You know the big names: JP Morgan, Rothschild, etc. However, founders often find that smaller, local investment banks are closer to their needs and offer a better experience.

For example, here's a map of the startup-friendly investment banks in France circa 2021 (courtesy of the amazing Augustin de Cambourg, who's working on the 2023 update).

How much to pay an investment banker?

In return for their services, most investment bankers charge a fixed fee every month, plus a success fee if the raise is successful.

Depending on their prestige and the round size, you can expect to pay from $5k to $20k per month as a fixed fee, and a success fee of 3% to 5% of the amount raised.

Some may want exclusivity. Some may want to be paid on the whole round - not just the amount they bring you. These are terms that need to be clarified upfront.

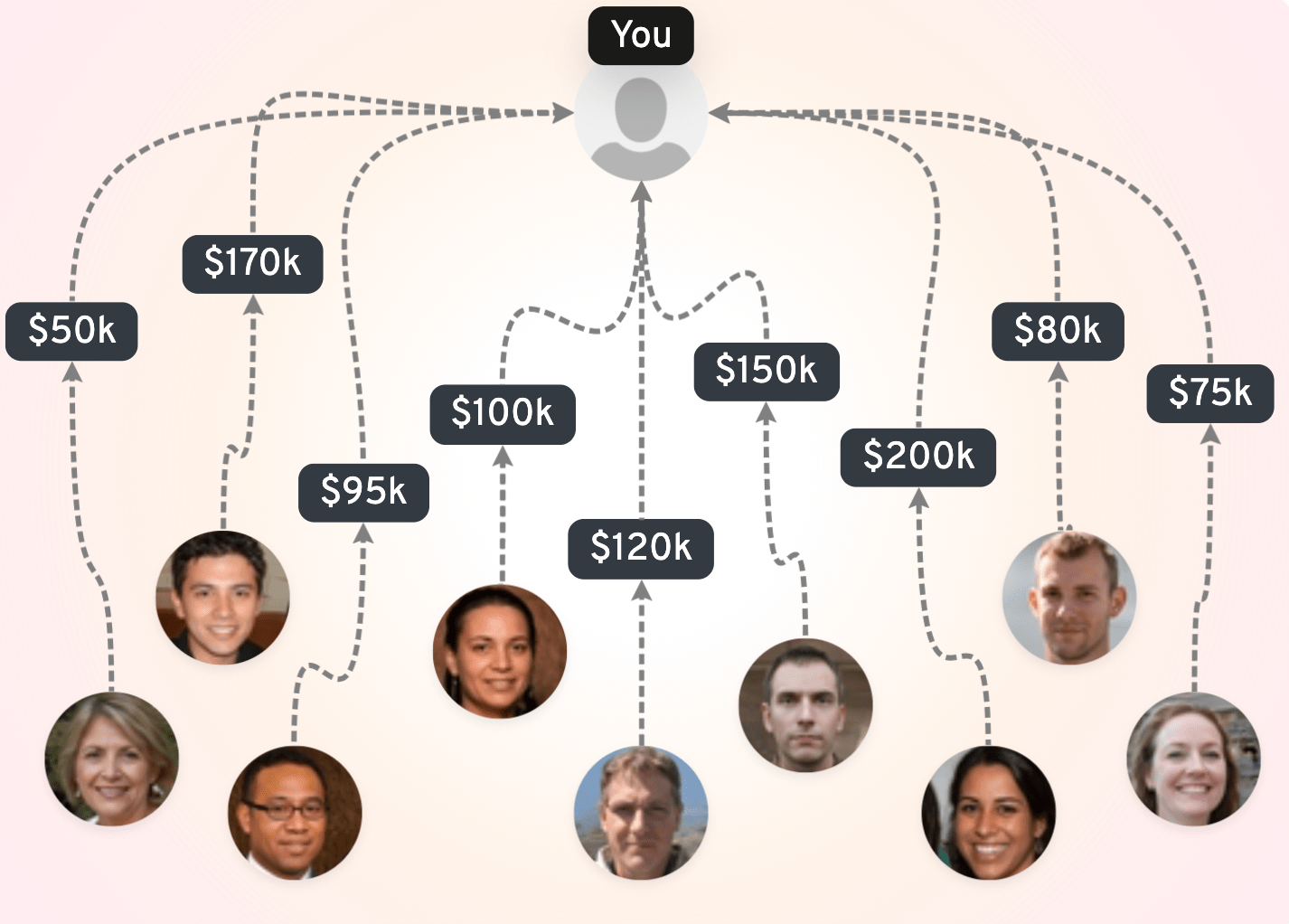

When considering the costs, you should also factor in the time you save and the better terms the banker may negotiate for you. Let's take an extreme example:Is it likely, though? Does that completely offset the banker fees? Maybe, you be the judge.

- On your own, you could spend 6 months full-time raising 5 at 25.

- With a banker, you could raise 5.5 at 30 and only spend 20% of your time on the raise

Can you hire an investment banker to raise your pre-seed?

Probably not.

Investment bankers don't usually do early-stage startups because it's not profitable for them.

Here's the napkin math:

Raising for early-stage founders is a bad deal for investment bankers:

- More work : Pre-seed founders are often inexperienced. Lots of handholding and time spent explaining the basics.

- Less money : Pre-seed rounds have the highest rates of failures - even with intros. And the rounds are mechanically smaller.

Bottom line: it's 10x more attractive for investment bankers to work with A+ rounds. That's where their economic model makes sense.

So how can early-stage founders get some help?

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now

Option 2: Work with a fundraising advisor

Fundraising advisors specialize in early-stage startups

The term Fundraising Advisor ("FA") is not standard in the US nor in Europe. I use it to describe "professionals who help early-stage founders raise funds". Here, we're talking sub-$5M rounds: angel round, pre-seed, seed, and maybe small Series A.

Those FAs offer similar services to investment bankers. They run the whole process with you from start to finish. They are investment bankers in all but name.

You can find them, including their pricing and references, at FundraisingAdvisors.app.

How much does a Fundraising Advisor cost?

That's the problem 🙂

First, let's hear what founders want:

Sorry founders, most FAs charge a fixed fee!

As explained before, this is the most sustainable model for them. Like consultants, FAs charge a fixed price for the service they provide.

But there's another reason: taking a success fee is highly regulated in most common law countries (US, UK, Singapore, etc.). Unless they have the appropriate license, FAs aren't legally allowed to charge a success fee even if they wanted to.

You may still find an occasional Fundraising Advisor who works on a mixed or pure success fee basis, especially in civil law countries (France, Switzerland, etc) where regulations are more relaxed. This is rare, though, and those FAs will be extremely selective. Not an option for most founders.

One last point about equity…

Some FAs may accept payment in the form of equity. To be frank, I'm not super enthusiastic about the idea. Equity is supposed to incentivize and lock in people who continuously add value to the company in the long term e.g. key executives or employees. A FA provides value once (or a few times if several raises), so it probably makes more sense to compensate them in cash for each round and keep a clean cap table.

Accelerators are not fundraising advisors because they usually invest cash in the startup. If an accelerator doesn't invest in you, they're not an accelerator - they are a fundraising advisor!

Botton line - if you want a FA to help with your round, you will have to pay out of pocket. It's a risk that needs to be weighed in carefully.

Is it worth it, though? Let's see what people think.

Debunking the hate around fundraising advisors

Fundraising advisors are sometimes heavily criticized on social media.

Is it justified or just dumb bashing? Here's my take on this.

Criticism #1. Founders should learn how to raise funds themselves

True.

Fundraising is a learning curve every founder has to climb. By outsourcing the raise to a FA, you might miss out on an important part of your education as a CEO.

However, I would argue that working with a professional is a fine way to learn. Make sure that you get involved in every step of the process, and this will be an accelerated fundraising class for you.

Criticism #2. Using a fundraising advisor is bad signal for investors

It all depends on the existing relationships between the FA and the investors.

The FA is supposed to have existing connections with investors. His or her name is supposed to add value to your raise, not the opposite. As long as you get intros to in-network investors who trust the judgment of your FA, it's a plus.

However, if the FA doesn't have a pre-existing relationship with a specific investor, then the outreach should come from you, the CEO, rather than from them. The FA can always help in the background, by reaching out from your email address for instance.

There's also a special case for the US.

— Steph from OpenVC (@StephNass) November 22, 2023

Early-stage US investors are culturally more averse to the use of FAs than any other country.

Take this into account in your decision process. 🧐

Criticism #3. Fundraising advisors will take your money and not raise your round

Maybe.

Fundraising has a high failure rate. Even a good FA may fail to raise, and leave you in a worse situation than when you started. It's a risk you accept when you work with them. There's no 100% guarantee.

However, the high failure rate is also a convenient excuse for scam artists who take advantage of desperate founders, charge them a hefty fee, and don't deliver. Before signing with a FA, compare a few of them, google their names, do a background check (including contacting previous founders who worked with them), and listen to your guts.

The first call with a FA should always be free so you can ask all your questions and assess them. A good FA will roast you just like an investor, and will reject you if they feel they cannot help. A bad FA will accept you without second thought because they are after your money, not your success. Be smart, apply judgement.

To learn how to pick the right FA, read this.

Criticism #4. This should be free!

Some people see fundraising advisors as parasites, "gatekeepers" who monetize access to the investors and by doing so, destroy value in the startup community. I used to think like that, but not anymore. Here's my reasoning.

The prep work (coaching, materials, strategy, etc) is tangible work and deserves to be paid for the time spent. Many founders think they just need intros to succeed. The truth is many are flying blind, unaware of their own shortcomings, and it takes a lot of work to make them investable.

Access to investors is also work. Someone has spent 5 to 10 years building access, maintaining a network of relationships and a "knowledge graph", building a brand and a reputation. You haven't. They are lending you their social capital. That's what you're paying for.

Option 3: Raise funds yourself - but do it the right way

Most founders raise funding on their own. No banker, no advisor.

That doesn't mean they didn't get help or didn't have to learn it first.

Here are some options to maximize your chances if you're going your own way.

Teach yourself the fundraising playbook

Your first enemy is "unknown unknowns".

If you've never raised funds before, there's a lot of stuff you don't know and you need to learn ASAP.

You can do that for free: read blogs, watch Youtube videos, join webinars, etc.

If you prefer a more structured approach, you can pay to join in-person or online bootcamps.

Of course, if you're an OpenVC Premium member, you already have access to our amazing Fundraising Masterclass that covers all the important stuff in a practical way with examples.

Pay for tools & support based on your needs

Even if you raise on your own, you can still get some help on a case-by-case basis.

For example, you can hire a pitch deck designer who will focus exclusively on your pitch deck. Cheaper than a FA, and it will save you some time.

Same with your investor list. Same with your pitch deck template. Same with your financials. There's a whole toolbox at your disposal.

You can even hire freelancers who specialize in investor outreach. They will focus on one thing only: landing your pitch in as many investor inboxes as possible. That way, you focus on getting intros while the cold outreach is taken care of.

And of course, use OpenVC to streamline the whole raise process.

Leverage brokers opportunistically

Some countries are extremely relationship-driven. In China or the Gulf countries, investors are difficult to access. You won't find them on LinkedIn or Twitter. They may not even have a website.

For that reason, being a middleman is completely accepted. Everyone is a broker. Taking a cut by making intros is a normal thing.

These people are pure brokers, though: they won't do any work other than shooting a message or forwarding your deck to the investor (and getting a commission for that).

If that's your fundraising environment, then roll with it.

Conclusion: what's the best option for you

Start with an honest self-assessment: how fast can you learn and be proficient at fundraising? Do you need a little help? A lot of help?

Remember: anybody who guarantees a successful raise is lying. If you choose to work with an investment banker or a fundraising advisor, speak to a few and make sure to vet them fully.

In any case, you will be heavily involved in the raise. A FA will assist you, but never replace you. Don't expect to have it easy because you're paying - it's just not happening.

As a closing thought, it's important to acknowledge that early-stage venture is a cash-poor environment. First-time founders need help the most, yet they are the least likely to be able to afford that help. It's just what it is, and part of the struggle.

At OpenVC, we try to make this journey a little easier.

Wanna react to this post? Join the conversation on Twitter or Linkedin!

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started